Are you looking for a reliable investment strategy that can help you build a steady stream of income? Look no further than utility stocks. As a team of financial experts, we have seen firsthand the power of utility companies in generating long-term returns for investors, thereby creating a dividend snowball with utilities. Not only do they offer stable and predictable earnings, but they also provide a valuable service to society by supplying essential commodities like electricity, water, and gas.

In this article, we will explore the ins and outs of investing in utility stocks and how you can use them to build a dividend snowball with utilities. We will discuss the unique characteristics of the utility industry, how to choose the right stocks for your portfolio, and the risks and strategies to consider.

By the end of this article, you will have a better understanding of the potential benefits and pitfalls of investing in utility stocks, and how you can use them to achieve your financial goals and build a dividend snowball with utilities.

Key Takeaways

- Investing in utility stocks can provide a reliable strategy for steady income with stable and predictable earnings from essential commodities, contributing to a dividend snowball with utilities.

- Thorough research and analysis on financial health, regulatory environment, and management team are crucial for successful investing in utility stocks and building a dividend snowball with utilities.

- Diversifying holdings and focusing on companies with stable earnings and dividend growth can mitigate risks and take advantage of new technologies and trends, further boosting your dividend snowball with utilities.

- Compounding returns from reinvesting dividends can lead to significant gains over time, and well-diversified portfolios can help protect against market fluctuations, ultimately contributing to a growing dividend snowball with utilities.

Why Utility Stocks are a Great Investment for Building a Dividend Snowball with Utilities

You’re probably wondering why utility stocks are such a great investment for building a dividend snowball with utilities, but the truth is, they offer a stable and reliable income through their consistent dividend payouts. Utility companies are regulated and required to provide essential services such as electricity, natural gas, and water to the public. This means that they have a steady demand for their services, which translates into steady revenue streams. As a result, utility stocks are known for their low volatility compared to other sectors, making them ideal for building a dividend snowball with utilities.

Another reason why utility stocks are a great investment for building a dividend snowball with utilities is the fact that they have a history of outperforming the broader market during economic downturns. This is because people still need to use essential services like electricity and water even during tough times. Additionally, utility companies have a defensive nature due to their regulated status and the fact that they are often monopolies in their respective markets. This makes them less susceptible to market volatility and economic shocks, therefore contributing to a stable dividend snowball with utilities.

Investing in utility stocks also has the added benefit of being a long-term strategy, which is crucial in building a dividend snowball with utilities. Utility companies often have a long-term outlook on their investments and capital expenditures, which translates into consistent revenue streams and dividend payouts for investors. Furthermore, utility companies often have high barriers to entry due to the high costs associated with building and maintaining infrastructure. This means that they have a competitive advantage over potential new entrants, further solidifying their position as a reliable investment for building a dividend snowball with utilities.

Understanding the Utility Industry for Building a Dividend Snowball with Utilities

To truly comprehend the inner workings of the utility industry and how it contributes to building a dividend snowball with utilities, it’s important to delve into the regulations, infrastructure, and market dynamics that shape the operations of these companies.

The utility industry is heavily regulated, with government entities overseeing everything from pricing to environmental compliance. Utilities must also navigate complex infrastructure systems that require significant capital investments to maintain and expand. These factors play a crucial role in building a dividend snowball with utilities.

These companies operate in a competitive market, where customers can choose from a range of providers, creating a constant pressure to innovate and improve services. One key aspect of the utility industry is that it is primarily focused on providing essential services to consumers. This means that utilities typically have a stable customer base and consistent revenue streams, which can make them attractive investments for building a dividend snowball with utilities. However, it also means that utilities must prioritize reliability and safety above all else, as any disruptions to service can have significant consequences for customers and the broader economy.

Another important consideration when analyzing the utility industry for building a dividend snowball with utilities is the role of technology and innovation. As the world becomes more digital and interconnected, utilities are increasingly turning to smart grid technologies and other innovations to improve efficiency and reliability. These investments can be costly, but they can also provide long-term benefits in terms of improved service quality and reduced costs.

Understanding the complexities of the utility industry can help investors make informed decisions when selecting utility stocks and building a dividend snowball with utilities. By analyzing regulatory environments, infrastructure needs, and market dynamics, investors can identify companies that are well-positioned for long-term growth and stable returns.

How to Choose the Right Utility Stocks for Building a Dividend Snowball with Utilities

When choosing utility stocks for building a dividend snowball with utilities, we need to conduct thorough research and analysis on the companies we’re interested in. We should also consider the dividend yield and payout ratio, as these are important factors in determining the stock’s profitability and stability, and crucial in building a dividend snowball with utilities.

Additionally, it’s essential to keep an eye on industry trends and news, as these can affect the stock’s performance. By taking these factors into account, we can make informed decisions when investing in utility stocks and building a dividend snowball with utilities.

Research and Analysis for Building a Dividend Snowball with Utilities

As we dive deeper into our research and analysis of utility stocks for building a dividend snowball with utilities, we can visualize our dividend snowball growing larger and larger with each passing day. To help us with our analysis, we should consider a few key factors. First, we need to look at the company’s financial health, including its revenue growth and debt levels. Second, we should analyze the utility’s regulatory environment as it can have a significant impact on the company’s profitability. Finally, we should consider the company’s management team and their track record of success.

To give you a better idea of what we mean, take a look at the table below. It compares two different utility companies based on their financial health, regulatory environment, and management team. As you can see, Company A has a higher revenue growth rate and lower debt levels than Company B. Additionally, Company A operates in a favorable regulatory environment while Company B is facing more challenges. Lastly, Company A’s management team has a proven track record of success while Company B’s management team has yet to establish a strong reputation. By analyzing these factors, we can make a more informed decision when choosing utility stocks to add to our dividend snowball with utilities.

Moving forward, we must also consider the dividend yield and payout ratio of the utility stocks we are interested in. By understanding these metrics, we can better predict the sustainability of the company’s dividend payments, ultimately helping us continue to build our dividend snowball with utilities.

Consideration of Dividend Yield and Payout Ratio for Building a Dividend Snowball with Utilities

Get ready to reap the rewards of your investment by exploring how much cash you can pocket with each payout and how sustainable it is for the long haul, contributing to a successful dividend snowball with utilities.

One important factor to consider is the dividend yield, which is the annual dividend payment divided by the stock price. This metric helps investors understand how much they can earn in dividend income each year relative to the price they pay for the stock. However, a high dividend yield may not always be a good thing as it could be a signal that the company is struggling or that the dividend is not sustainable.

Another crucial metric to evaluate is the payout ratio, which is the percentage of earnings that are paid out as dividends. A high payout ratio could suggest that the company is paying out too much of its earnings and may not have enough funds to reinvest in the business or weather any economic downturns. On the other hand, a low payout ratio may indicate that the company is retaining earnings to invest in growth opportunities.

Ultimately, finding a balance between a reasonable dividend yield and a sustainable payout ratio is key to building a dividend snowball with utilities.

By considering both the dividend yield and payout ratio, investors can make informed decisions about which utility stocks to invest in. However, it’s important to also keep an eye on industry trends and news to monitor any changes that could impact the company’s financial performance and ability to pay dividends, ensuring the continued growth of your dividend snowball with utilities.

Monitoring Industry Trends and News for Building a Dividend Snowball with Utilities

To stay on top of industry trends and news for building a dividend snowball with utilities, we should regularly check reliable sources for updates and analysis. This can provide valuable insights into the performance and potential risks of our investments. It is especially important when investing in utility stocks, as the industry can be heavily influenced by factors such as government regulations and changes in energy demand.

By keeping up-to-date with the latest news and developments, we can make informed decisions about our investments and adjust our portfolio accordingly. One way to monitor industry trends is to follow reputable financial publications and news outlets that specialize in the energy sector. These sources often provide in-depth analysis and expert opinions on topics such as renewable energy policies, mergers and acquisitions, and the latest technological advancements in the field.

Additionally, attending industry conferences and events can provide opportunities to network with other investors and gain valuable insights into the market. By staying informed about the latest developments in the utilities industry, we can position ourselves to take advantage of opportunities and avoid potential pitfalls as we work towards building a dividend snowball with utilities.

Building a Dividend Snowball with Utilities: An Investment Strategy

Building a dividend snowball with utilities is a wise investment approach for those seeking stable and consistent income. By continually reinvesting dividends, investors can progressively increase their holdings and generate more income over time.

Utility companies are recognized for their reliable earnings and steady cash flows, making them an excellent choice for long-term investors. One of the main benefits of building a dividend snowball with utilities is the potential for compounding returns. As dividends are reinvested, the investor’s position in the stock grows, resulting in larger dividend payments in the future. This can lead to significant gains over time, particularly when combined with the steady growth of the underlying company.

Another advantage of investing in utility companies is the defensive nature of the sector. Utilities are often considered a safe haven for investors during times of market volatility, as they provide essential services that are less affected by economic downturns. This can help to protect an investor’s portfolio from significant losses in the event of a market downturn.

While building a dividend snowball with utilities can be a smart investment strategy, it is important to consider the risks involved. Utilities can be subject to regulatory changes, which can impact their profitability and dividend payouts. Additionally, rising interest rates can reduce the attractiveness of dividend-paying stocks, as investors may shift their focus to higher-yielding bonds.

By carefully considering these risks and monitoring industry trends, investors can make informed decisions about their utility stock investments. Building a dividend snowball with utilities can be a great way to generate stable and consistent income over the long term. However, it is important to carefully consider the risks involved and stay up-to-date with industry trends to make informed investment decisions.

Risks to Consider when Building a Dividend Snowball with Utilities

Now that we have discussed the benefits of building a dividend snowball with utilities, it is important to consider the risks involved in investing in utility stocks. While utilities are generally considered to be stable and reliable investments, there are still potential risks that investors should be aware of.

One of the main risks associated with utility stocks is regulatory risk. Utilities are heavily regulated by government agencies, and changes in regulations can have a significant impact on their profitability. For example, if a utility is required to invest in expensive upgrades to meet new environmental standards, it could result in higher costs and lower profits.

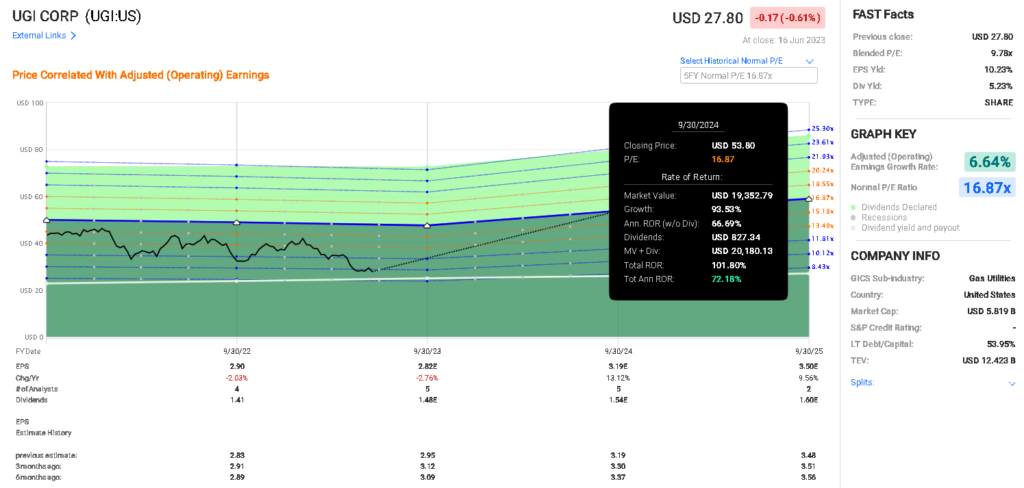

Another risk to consider when building a dividend snowball with utilities is interest rate risk. Utilities are often viewed as bond-like investments, as they typically offer steady dividends and have relatively low volatility. However, if interest rates rise, investors may shift their money out of utility stocks and into higher-yielding bonds, which could lead to a decline in utility stock prices. For example, UGI has high debt and is impacted by interest rates, but remains a good buy at the right prices.

A third risk to be aware of when building a dividend snowball with utilities is operational risk. Utilities are complex businesses that require significant investments in infrastructure and technology. If a utility experiences a major operational issue, such as a power outage or a pipeline leak, it could result in significant costs and damage to the company’s reputation.

To better understand the risks associated with investing in utility stocks, let’s take a closer look at the following table:

| Risk | Description | Example |

|---|---|---|

| Regulatory Risk | Changes in government regulations can impact profitability | Utility required to invest in expensive upgrades to meet new environmental standards |

| Interest Rate Risk | Rising interest rates can lead to a decline in utility stock prices | Investors shift money out of utility stocks and into higher-yielding bonds |

| Operational Risk | Major operational issues can result in significant costs and damage to reputation | Power outage or pipeline leak |

While there are risks involved in building a dividend snowball with utilities, there are also strategies that investors can use to mitigate these risks. In the next section, we will discuss some of these strategies and how they can be used to build a successful dividend snowball with utilities.

Strategies for Mitigating Risks when Building a Dividend Snowball with Utilities

As you navigate the potential risks of investing in the world of utility stocks, it’s important to have a few tools in your belt to weather any storms that may come your way, like a sailor preparing for rough seas ahead. Here are three strategies for mitigating risks when building a dividend snowball with utilities that can help you build and sustain a portfolio of utility stocks.

First, diversify your holdings. While it may be tempting to invest heavily in one or two stocks, doing so can leave you vulnerable to market fluctuations and company-specific risks. Instead, consider investing in a variety of utility stocks across different regions and sectors. This can help protect your portfolio from any one stock’s poor performance while still allowing you to benefit from the industry’s overall stability and dividend payouts when building a dividend snowball with utilities.

Second, pay attention to regulatory changes. Utility stocks are heavily regulated by government bodies, and changes to regulations can have a significant impact on the industry and individual companies within it. Stay up-to-date with any proposed or enacted changes that could affect your holdings, and be prepared to adjust your portfolio accordingly when building a dividend snowball with utilities.

Third, consider the financial health of the companies you’re investing in. Utility companies with high levels of debt, low cash reserves, or poor credit ratings may be more vulnerable to financial difficulties or bankruptcy. Do your research to identify companies with strong financials and a history of stable dividend payouts when building a dividend snowball with utilities.

By implementing these strategies, you can mitigate the risks associated with investing in utility stocks and build a portfolio that is robust and resilient when building a dividend snowball with utilities.

In the next section, we’ll explore tips for success when investing in this industry.

Tips for Success: Building a Dividend Snowball with Utilities

To maximize your returns and build a dividend snowball with utilities, it’s crucial to follow these tips for success. First, focus on companies that have a proven track record of stable earnings and dividend growth. These companies tend to be more reliable and less volatile than their counterparts. Second, look for companies that are well positioned to take advantage of new technologies and trends in the industry. This could mean investing in companies that are investing heavily in renewable energy or that have a strong presence in emerging markets.

Another key tip for successfully creating a dividend snowball with utilities is to diversify your portfolio. This means investing in a variety of different utility companies across different regions and industries. A well-diversified portfolio can help mitigate risks and protect against market fluctuations. To help with this, consider using a utility ETF or mutual fund to gain exposure to a broader range of companies.

It’s important to pay attention to the regulatory environment when building a dividend snowball with utilities. Changes in regulations can have a significant impact on a company’s earnings and dividend growth. Look for companies that are well positioned to navigate regulatory changes and that have a good track record of working with regulators.

To help illustrate these tips for building a dividend snowball with utilities, here is a table of some top utility stocks, along with their dividend yields and P/E ratios:

| Company | Dividend Yield | P/E Ratio |

|---|---|---|

| Duke Energy | 3.93% | 20.71 |

| NextEra Energy | 2.57% | 37.72 |

| Dominion Energy | 4.93% | 51.49 |

| Southern Company | 4.48% | 16.79 |

| American Electric Power | 3.34% | 21.68 |

As you can see, these companies all have relatively high dividend yields and P/E ratios that are in line with the industry average. By investing in a diversified portfolio of companies like these, you can help mitigate risk and build a strong dividend snowball with utilities over time.

Frequently Asked Questions

What is the history and evolution of the utility industry?

As we researched the utility industry, we found that its history and evolution are intertwined with the growth of electricity and gas consumption. From early power plants to modern grids, utilities have adapted to meet the changing needs of society.

How do regulatory changes impact the utility industry and its stocks?

Regulatory changes have a significant impact on the utility industry and its stocks. We closely monitor regulatory developments to make informed investment decisions. It’s crucial to stay up-to-date on changes that can affect dividends and earnings growth.

What is the difference between regulated and unregulated utilities?

Regulated utilities are subject to government oversight to ensure they provide reliable service at fair rates. Unregulated utilities operate in a competitive market and can adjust prices based on supply and demand. Understanding the difference is important for investing in utility stocks.

Can utility stocks be impacted by environmental concerns and regulations?

Environmental concerns and regulations can impact utility stocks. As investors, we need to consider the potential risks and opportunities related to climate change, including the shift towards renewable energy sources and the potential for increased regulation on carbon emissions.

How do utility stocks compare to other types of dividend-paying investments, such as REITs or high-yield bonds?

Compared to REITs or high-yield bonds, utility stocks provide stable dividends with predictable earnings. Although interest rates and market conditions can affect returns, utilities often outperform in downturns and provide a reliable income stream.

Conclusion

In conclusion, the power of utilities as a source of investment is undeniable. They offer a reliable way to build wealth over time with stable cash flows, regulated prices, and dividend yields. However, there are risks to consider such as regulatory changes, technological disruptions, and environmental concerns.

To mitigate these risks, it’s important to do your research and choose the right utility stocks based on their financial performance, growth prospects, and sustainability practices. Moreover, diversification and a long-term mindset are key to building a dividend snowball that can provide a steady stream of income and capital appreciation.

While some may argue that utility stocks are too boring or too risky, the truth is that they have a place in any well-rounded portfolio. By understanding the fundamentals of the utility industry and following a disciplined investment strategy, you can harness the power of utilities to achieve your financial goals and secure your future.

Conclusion: Harnessing the Power of Utilities to Build a Dividend Snowball

In conclusion, the power of utilities as a source of investment is undeniable. They offer a reliable way to build wealth over time with stable cash flows, regulated prices, and dividend yields. However, there are risks to consider such as regulatory changes, technological disruptions, and environmental concerns when building a dividend snowball with utilities.

To mitigate these risks, it’s important to do your research and choose the right utility stocks based on their financial performance, growth prospects, and sustainability practices. Moreover, diversification and a long-term mindset are key to building a dividend snowball with utilities that can provide a steady stream of income and capital appreciation.

While some may argue that utility stocks are too boring or too risky, the truth is that they have a place in any well-rounded portfolio. By understanding the fundamentals of the utility industry and following a disciplined investment strategy, you can harness the power of utilities to achieve your financial goals, build a dividend snowball with utilities, and secure your future.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.