BUI Review: BlackRock Utilities, Infrastructure and Power Opportunities Fund

If you’re seeking some healthy diversification in your portfolio, laced with an attractive income, the BlackRock Utilities, Infrastructure and Power Opportunities Fund (BUI) might catch your attention. This fund is five-star rated by Morningstar and possesses various positive attributes that could potentially render it a strong contender in the utility space.

Diversification, a fundamental principle of investing, offers the potential to enhance returns and mitigate risk. By holding a broad utility fund like BUI, investors can enjoy the advantages of diversification within the utility sector. Instead of concentrating their capital in individual utility stocks, which comes with a higher risk due to the susceptibility to company-specific events or sector downturns, investors will have exposure to a wide swath of the sector. This results in a more balanced portfolio, reducing the potential for substantial losses if one company underperforms. Thus, diversification through BUI can lead to steadier returns and a more robust investment strategy. Enjoy this BUI review!

A Closer Look at the Portfolio

BlackRock’s BUI portfolio is balanced, predominantly carrying large assets and spreading both value and growth, which is reassuring to observe. Unlike conventional utility funds, which lean towards value and mid-to-large orientation, BUI displays distinct differences that can provide significant advantages.

The fund’s price to earnings aligns fairly with the category average, while the price to book is a bit higher. The price to sales and dividend yield are slightly lower. These are key metrics in the BUI review.

Investing in utilities and infrastructure can offer investors several distinct advantages. For starters, these sectors are known for their stability. Utilities are typically less volatile than the broader market because they provide essential services like water, electricity, and gas. Demand for these services remains relatively constant, regardless of economic conditions, providing a stable flow of revenues and profits. Infrastructure projects, such as roads, bridges, and airports, also generate steady income streams, often backed by long-term contracts or government regulations.

Secondly, utilities and infrastructure often provide attractive income opportunities. Many utility companies and infrastructure projects generate consistent cash flows, which enable them to pay regular dividends. This can make them an appealing choice for income-focused investors, and investigated in the BUI review. Additionally, because these sectors are capital-intensive, they often benefit from high barriers to entry, which can protect profit margins and contribute to their ability to provide regular dividends.

Another benefit of investing in utilities and infrastructure is the potential for inflation protection. These investments often have pricing power due to their monopolistic nature and the essential services they provide. Therefore, they may be able to pass on higher costs to consumers during inflationary periods, which can protect investors’ real returns.

Lastly, investing in utilities and infrastructure can offer diversification benefits. These sectors often have low correlation with other sectors of the economy and can perform well during different market conditions. This characteristic, featured in the BUI Review, can help reduce portfolio risk and increase risk-adjusted returns. Hence, for long-term investors seeking stability, income, inflation protection, and diversification, investments in utilities and infrastructure may be an attractive choice.

Income and Earnings Growth

It’s crucial to understand that the income the fund pays out is not the same as the income they receive from dividends. Interestingly, the investments held by BUI are growing their earnings faster and stronger than the category average. For a long-term investor, this could be an encouraging indicator in this BUI Review.

In addition, BUI exhibits positive cash flow growth and a 4% book value growth which significantly outperforms the category average.

Income and book value growth are crucial aspects of the underlying investments held by a fund, impacting both the returns to investors and the overall health of the fund. Income, often in the form of dividends or interest, provides a steady stream of cash that can be distributed to investors or reinvested back into the fund. A fund with high-income generating assets can offer investors regular payouts, making it an attractive option for income-focused investors or those seeking steady cash flow. Moreover, consistent income generation can indicate the profitability and financial health of the companies within the fund’s portfolio.

Book value growth, on the other hand, reflects the increasing intrinsic value of a company. It can be an indication of a company’s ability to effectively reinvest profits, manage assets, and create shareholder value. A fund that holds companies with growing book values may signal strong management and promising future prospects. These companies could be better positioned to weather economic downturns and provide potential capital appreciation over time. Therefore, both income and book value growth in a fund’s underlying investments are essential considerations for investors seeking balanced financial growth.

Wide Moat Coverage – Key in the BUI Review

An exciting feature of BUI is its 14% wide moat coverage, significantly higher than the negligible wide moat observed in the category. This means that approximately one-seventh of BUI’s portfolio consists of companies with sustainable competitive advantages, potentially leading to superior returns.

Companies with a wide economic moat within an investment fund like BUI can offer substantial benefits. Firstly, these firms typically have sustainable competitive advantages, such as strong brand recognition, cost advantages, network effects, high switching costs, or intangible assets, which help shield them from competition and enable them to earn high returns on capital for extended periods. Consequently, these companies tend to be more stable and less susceptible to market volatility, significantly contributing to the fund’s overall performance stability.

Secondly, wide-moat companies are often seen as value creators in the long run. Because their competitive advantage allows them to maintain or grow market share over time, they can deliver consistent earnings growth. This translates into reliable and potentially increasing dividends for investors in the fund. Furthermore, the intrinsic value of these companies tends to appreciate over time, providing potential capital appreciation for the fund. Hence, having wide-moat companies in an investment fund like BUI can enhance both income and growth potential for investors.

Long-Term Performance and Income Growth

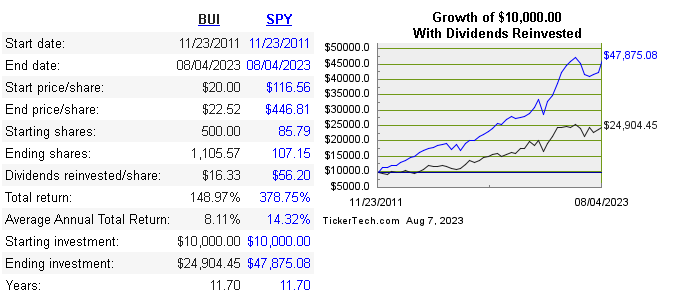

Comparing BUI with the Spider S&P 500 and Spider utility sector ETF reveals interesting insights. BUI has shown a slightly higher standard deviation and a substantially higher max drawdown. However, it’s not as defensively positioned as the utilities sector ETF.

Despite these observations, focusing on income can reveal the real benefits of BUI. When dividends are reinvested, there’s visible growth in income over time. In fact, with a $10,000 investment, you could be looking at a yearly return of $1,500 after just ten years – an appealing proposition for any investor!

Since 2011, the S&P has been on a tear, in a massive bull market and we would expect BUI to underperform, as it did. However, income investors that re-invested their dividends would have seen a 8% annual return, compared to the SPY’s 14% annual return

Generating Income with a Covered Call Strategy

Despite its relatively low dividend yield of 3.25%, BUI uses a covered call strategy to generate a substantial portion of its income. By writing covered calls on their stockholdings, they can augment their income distribution capacity.

This strategy should also theoretically reduce the fund’s downward slide during market downturns, providing a more stable portfolio overall. However, it’s worth noting that during significant market downturns, BUI has been observed to decrease more than the utilities ETF but less than the broader market.

A covered-call based fund offers several benefits to investors. One of the primary advantages is the potential for enhanced income. Covered-call funds generate income through the premiums they receive from selling call options. These premiums can provide an additional source of revenue over and above any dividends or interest the fund might earn from its portfolio of securities. This feature makes covered-call funds particularly attractive in low-interest-rate environments where traditional income-producing investments may not offer satisfactory returns.

Additionally, this strategy offers some degree of downside protection. If the underlying security’s price falls, the income generated from selling call options can help offset some of the losses. This can make covered-call funds less volatile than traditional equity funds, making them an attractive option for conservative investors or those nearing retirement who may be seeking to reduce risk in their portfolio. However, it’s essential to note that while they can mitigate risks associated with market downturns, covered-call funds are not immune to losses.

Final Thoughts in the BUI Review

After this BUI Review, we can say that it might not be the perfect investment for everyone, if you’re looking for diversification and attractive income opportunities, it’s worth considering. As always, make sure to conduct your own research or consult with a financial advisor before making any investment decisions.

An income vehicle like BUI can be an effective tool for investors looking to grow their wealth. BUI, or BlackRock Utility, Infrastructure & Power Opportunities Trust, invests in a portfolio of equity securities, focusing on utility and infrastructure companies. The fund seeks to provide high current income, with a secondary focus on capital appreciation. Investors can reinvest the dividends received from BUI back into the fund, effectively enabling compound growth. Over time, compounding can significantly increase an investor’s total return, which can be a powerful wealth-building mechanism.

Additionally, BUI’s focus on capital appreciation provides another route for wealth growth. The fund invests in sectors like utilities and infrastructure that historically have provided stable and consistent returns. These sectors are often less susceptible to economic downturns, which can lead to steady capital appreciation over time. This balance of income and growth-oriented strategies can offer investors a diversified approach to wealth accumulation, making BUI a potentially valuable component in an investor’s portfolio.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.