Hercules Capital (HTGC): A Solid Buy?

The Rationale Behind the Investment

Hercules Capital (HTGC) has been on my radar for a while now, and I am here to give you three reasons why I think it remains a solid buy at these prices. This is a leading Business Development Company (BDC) that pays a high dividend yield.

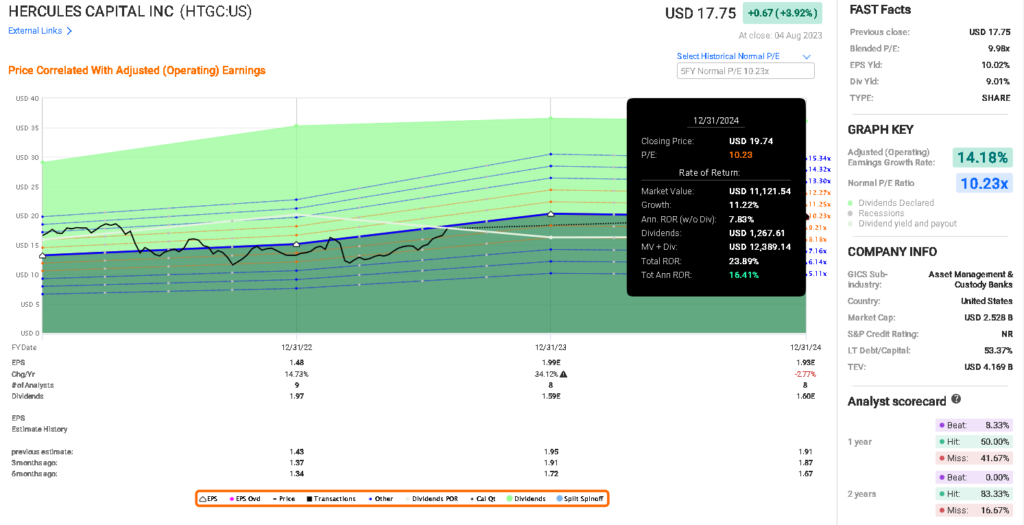

Looking at the historical chart for HTGC Hercules Capital, it’s evident that the company suffered during the global financial crisis and its prices have been volatile. However, if you focus on either the orange or blue line, you’ll see the overall trend has been upwards. The share price, represented in black, has more or less been following the earnings, indicating a positive correlation.

At the start of 2023, the share price was quite a bit lower than the blue line for earnings. Since then, we’ve seen the share price catch up to compensate. Currently, HTGC offers a dividend yield of 9%. Plenty of good results in their Q2 results!

Dividends and Debt

The dividend yield is better than it appears as they often pay supplementary dividends, even this quarter. Their long-term debt to capital ratio stands at 53%, presenting a balanced debt to net asset value ratio, which means they’re not over-leveraged.

Analyst Scorecards

I also like to look at the analyst scorecards. Fast Graphs has done an excellent job pulling in the analyst scorecard and presenting it on the screen for us to examine. The one-year scorecard may look spotty with a 50% hit and 8% beat. However, the two-year score looks much better at 83% hit.

The misses on the one-year earnings have been mainly in the past since 2018. Analysts have done a good job of forecasting, especially for two years forward.

Recent Performance and Investment Opportunity

Now let’s turn our attention to their second quarter financial results for 2023. (Q2 for 2023.)

They’ve reported an increase in total investment income and net investment income, which is up nearly 90% year over year. The dividends per share increased slightly from thirty-nine cents to forty cents. This increase is not common in this sector, so it’s definitely something worth noting.

The net investment income provides 132% coverage on their base distributions. This means that they cover every dollar they pay out in dividends with a dollar of net investment income. This excess cash flow provides them with an opportunity to increase their lending, grow their business and return a supplemental dividend as a one-off when things are going well.

This looks like a possible return of 16% per annum. However, it’s important to note, it is priced to perfection at the moment.

Dividend Yield and Analyst Expectations

The current dividend yield is about 9%. At its lowest point, it was about a 7% dividend yield, and during a crisis, it could even reach up to a 10% yield. A good dividend yield for Hercules Capital seems to be anywhere from about eight to ten percent.

Analyst expectations show that the low end of target stock prices has increased quite strongly from about $10.50 to $13.50 since the beginning of 2020. Even though the average and high targets haven’t increased much, this upward trend in the low end is a positive sign for investors.

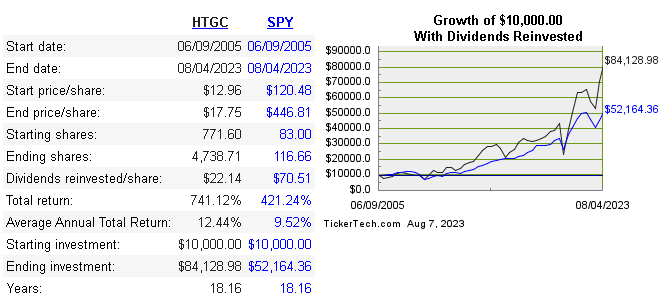

Long-term investors that buy-hold and then re-invest dividends have historically done better than holding the SPY, although with more volatility, capturing a 12.44% annual return compared to the SPY 9.52% return annually.

Future Projections

In terms of future projections, Hercules Capital has traded at about 10.2 times on a price to earnings ratio over the last five years. Currently, it’s trading very close to that at 9.98 times.

For the 2023 financial year, analysts predicted a dollar 70 earnings per share six months ago, which has now been updated to a dollar 99. For the 2024 financial year, the estimate has gone from a dollar 67 six months ago to a dollar 90 in the most recent estimates.

There’s an estimated total annualized rate of return of 16%. Half of this comes from capital appreciation while the other half is from the dividend yield.

Business Development Companies (BDCs) and Why Hercules Capital (HTGC) Stands Out

Business Development Companies (BDCs) are organizations that invest in small and mid-sized businesses. They provide capital to these companies, often in the form of debt or equity investments, and in return, they get a stake in the business or interest payments. BDCs are a unique investment vehicle which allow average investors to invest in private companies that they wouldn’t normally have access to.

The appeal of investing in BDCs includes the potential for high dividend yields and the chance to participate in the growth of emerging companies. BDCs are required by law to distribute at least 90% of their taxable income as dividends to shareholders, resulting in attractive yields. However, with high reward comes high risk. BDCs often invest in less established businesses which can lead to increased credit risk.

In the realm of BDC investing, Hercules Capital (HTGC) stands out due to several reasons.

Solid Track Record

Firstly, HTGC has a solid track record of consistent performance. Despite the volatility observed during the global financial crisis, the overall trend for HTGC has been upwards. This reflects the company’s ability to effectively manage investments and navigate through challenging periods.

Strong Dividend Yield

Secondly, HTGC offers an impressive dividend yield which is currently around 9%. In addition to this, they often pay supplementary dividends when times are good, providing an additional boost to investor returns.

Balanced Debt Profile

Thirdly, HTGC has a balanced debt profile which is evident from their long-term debt to capital ratio of 53%. This suggests that they aren’t over-leveraged and have managed their debt levels prudently.

Positive Analyst Forecasts

Finally, analyst forecasts for HTGC are positive. They have done a good job with their predictions over the past couple of years, especially for two years forward which strengthens investor confidence.

Conclusion

If you’re looking for a nice income play, Hercules Capital might be the right choice for you. The company offers a good 9% dividend yield that’s well covered by their net investment income. With expectations of strong continued growth in earnings, I believe this stock is a good hold for now.

However, remember that prices could go up or down, so it’s crucial to monitor the situation closely. I would recommend starting with a small position and waiting for a pullback to add to that position. There might be other better stocks out there, but HTGC is certainly worth considering.

What are your thoughts on Hercules Capital? Share them in the comments section below!

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.