Are you tired of earning measly dividends on your investments? Look no further than Business Development Companies, or BDCs, for a potentially higher return on your investment. Creating a Dividend Snowball with BDCs can be relatively simple and easy.

Now, I know what you’re thinking, ‘Business Development Companies? That sounds boring.’ But trust us, the potential for increased dividend income is anything but boring.

BDCs are a type of closed-end investment company that primarily invest in small to medium-sized businesses. While they may not be as well-known as other types of investment companies, BDCs offer unique benefits to investors looking to diversify their portfolio and boost their dividend income.

In this article, we’ll break down the basics of BDCs, explore the potential benefits and drawbacks of investing in them, and offer tips on how to select and manage BDC investments.

So, join us as we explore the world of BDCs and potentially snowball your dividend income.

Key Takeaways

- Business Development Companies (BDCs) offer potential for higher returns on investments and high dividend yields, making them a valuable addition to income investors’ portfolios.

- When investing in BDCs, it is important to consider factors such as portfolio alignment, management team, investment strategy, and dividend history, while also being aware of potential risks and challenges.

- Regularly reviewing performance and staying informed is crucial for managing BDC investments, and diversification across different industries and investment strategies can help mitigate risk and maximize returns.

- BDCs invest in small to medium-sized businesses that are considered too small or risky for traditional banks to lend to, which offers exposure to the small business sector and potential for capital appreciation.

What are BDCs and How Do They Work?

So, you might be wondering, what exactly are BDCs and how do they work? And why worry about making a dividend snowball with BDCs?

Well, Business Development Companies (BDCs) are publicly traded investment firms that provide capital to small and mid-sized businesses. They are regulated by the U.S. Securities and Exchange Commission (SEC) and were created by Congress in 1980 to encourage the flow of capital to small businesses. BDCs are required by law to invest at least 70% of their assets in qualifying private or public U.S. companies.

BDCs operate in a similar way to mutual funds, but with a few key differences. First, BDCs are focused on providing debt and equity capital to small businesses, rather than investing in stocks and bonds. Second, BDCs are structured as pass-through entities, which means that they’re not taxed at the corporate level. Instead, they distribute most of their earnings to shareholders in the form of dividends.

Investing in BDCs can be a great way to generate income from your portfolio. BDCs typically offer high dividend yields, with some companies paying out yields in excess of 10%. This is because BDCs are required to distribute at least 90% of their taxable income to shareholders in order to maintain their tax status. This makes them attractive to income investors who’re looking for steady, reliable income streams.

In addition to their high dividend yields, BDCs offer a number of other benefits to investors. For example, they provide exposure to the small business sector, which can be a great source of growth and diversification. They also offer the potential for capital appreciation, as the value of the companies they invest in increases over time.

Overall, BDCs can be a valuable addition to any income investor’s portfolio, providing a reliable source of income and potential for long-term growth. The income is valuable when making a dividend snowball with BDCs.

Example of a Dividend Snowball with BDCs

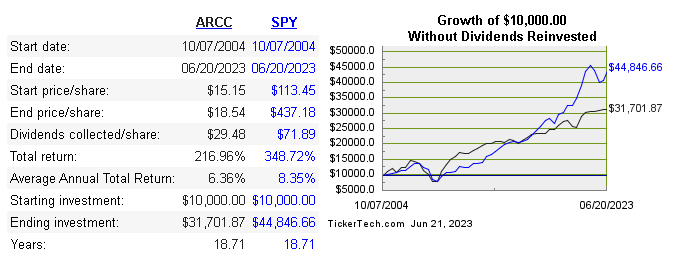

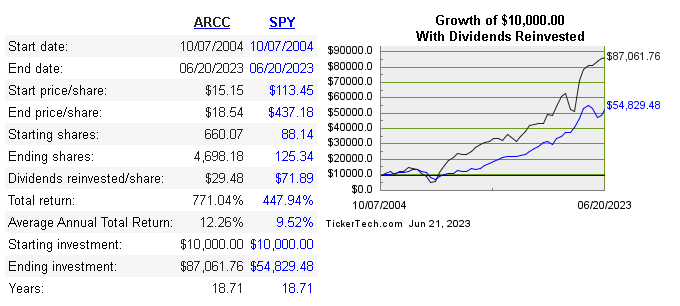

First, let us consider the benefits of creating a dividend snowball with BDCs like Ares Capital (ARCC). By making a $10,000 investment in ARCC when it first started, you can set yourself up for potential long-term gains. Adding to this, including a $10,000 investment in the S&P500 alongside ARCC helps create a diversified portfolio that can further enhance your dividend snowball strategy.

First, consider NOT investing your dividends. In this case, ARCC has a 6.3% average annual total return, compared to the S&P500’s 8.35%.

However, if the dividends are reinvested from ARCC, the average annual total return leaps to 12.26%, outstripping the S&P500’s 9.52% (with dividends reinvested, also!). In this way, the addition of the dividends and the constant reinvestment propels ARCC to be a superior investment.

The dividend snowball strategy focuses on reinvesting dividends received from investments to purchase additional shares. This approach aims to take advantage of compounding returns over time. When applied to BDCs like ARCC, which typically distribute a significant portion of their earnings as dividends, the potential for growth through this strategy becomes even more enticing.

Investing in BDCs offers unique advantages when implementing the dividend snowball strategy. These types of companies focus on providing financing solutions to middle-market businesses across various industries and sectors. By investing in ARCC and other BDCs, you gain exposure to a diverse range of opportunities that can potentially lead to higher returns compared to investments tied solely to one specific sector.

With the dividend snowball strategy and investments in both ARCC and the S&P500, you can harness the power of compounding returns while also spreading your risk across different asset classes. The S&P500 represents a broad index of 500 leading US companies and is often used as a benchmark for overall market performance. Including it in your portfolio alongside ARCC allows you to access growth potential on multiple fronts.

Implementing the dividend snowball strategy with BDCs like ARCC involves regularly reinvesting dividends received from these investments into purchasing additional shares. As your shareholding grows over time, so does your potential for increased dividend payments and capital appreciation.

By utilizing the dividend snowball strategy with BDCs like ARCC and diversifying through investments in the S&P500, you build a strong foundation for long-term wealth creation. However, it’s important to note that past performance is not indicative of future results. While historical data suggests the potential for favorable outcomes with this strategy, market conditions can fluctuate, and it’s crucial to conduct thorough research and consider professional advice before making investment decisions.

In conclusion, the dividend snowball strategy can be a powerful tool when investing in BDCs like Ares Capital (ARCC). By making a $10,000 investment in ARCC when it first started and an additional $10,000 investment in the S&P500, you set yourself up for potential growth through compounding returns and diversification. Remember to stay informed and regularly review your investment strategy to ensure it aligns with your financial goals and risk tolerance.

Benefits of Investing in BDCs

When considering investing to make a dividend snowball with BDCs, there are several benefits to keep in mind. First, BDCs often offer high dividend yields, making them an attractive option for income-seeking investors.

Additionally, there is potential for capital appreciation as BDCs invest in small- and medium-sized businesses that may grow over time.

Last, investing in BDCs can provide diversification to a portfolio, as they offer exposure to a variety of industries and sectors.

High Dividend Yields

With high dividend yields, we can potentially earn substantial passive income from our dividend snowball with BDCs. BDCs are required to distribute at least 90% of their taxable income to shareholders in the form of dividends. This means that investors can receive a steady stream of income, often at a higher yield than other traditional income investments.

Furthermore, BDCs typically invest in middle-market companies that are considered too small or risky for traditional banks to lend to. These companies often have higher borrowing costs, which can translate into higher interest payments to BDCs and, ultimately, higher dividend payouts to investors. In short, high dividend yields from BDCs can provide an attractive source of income for investors seeking to generate passive income and creating a dividend snowball with BDCs. But high yields can also suggest greater risks – so be careful!

Investors should also consider BDCs’ potential for capital appreciation, although this is less common.

Potential for Capital Appreciation from a Dividend Snowball with BDCs

As an investor, you may be excited to learn about the potential for your investments in BDCs to not only provide steady passive income but also grow in value over time. BDCs typically invest in small and medium-sized businesses that have the potential for high growth. An example of a long-term option would be Main Street Capital (MAIN) that has both a high yield and capital appreciation.

As these businesses grow and become more successful, their value increases, which can result in an increase in the value of the BDC’s portfolio. This potential for capital appreciation is a key feature of BDCs that distinguishes them from other high-yielding investment options.

However, it’s important to note that this potential for capital appreciation comes with a higher degree of risk. The small and medium-sized businesses that BDCs invest in are often in the early stages of development and may face challenges and setbacks along the way.

As such, it’s important to carefully evaluate the investment opportunities presented by BDCs and assess the potential risks and rewards before making any investment decisions. With that said, diversification can be a key strategy for mitigating risk and maximizing returns, as we’ll discuss in the next section.

Diversification when Forming a Dividend Snowball with BDCs

Diversifying your investment portfolio can help you spread out your risk and potentially increase your returns. It’s important to not put all your eggs in one basket, as the old saying goes. By investing in a variety of different assets, such as stocks, bonds, and real estate, you can reduce your overall risk and protect your investments from the ups and downs of any one market.

One way to diversify your portfolio is by including business development companies (BDCs). BDCs offer exposure to a wide range of small and mid-sized businesses that may not be available through traditional investments. This can help balance out your portfolio and provide potential returns that are not correlated to the broader market.

However, before investing in BDCs, it’s important to understand the potential drawbacks and risks involved.

Drawbacks of Investing in BDCs

Unfortunately, investing in BDCs can come with certain drawbacks that investors should be aware of before jumping in. Here are a few things to keep in mind:

- High Risk: BDCs invest in small and mid-sized companies which are often riskier than larger, established businesses. This means that BDCs have a higher risk of default and bankruptcy, which can lead to a loss of principal investment.

- Fees: BDCs charge management fees and performance fees, which can eat into your returns. These fees can be as high as 2% of assets under management, which can significantly impact your overall returns.

- Limited Liquidity: BDCs are often thinly traded, which can make it difficult to sell your shares when you need to. This lack of liquidity can also lead to wider bid-ask spreads, which can further erode your returns.

- Interest Rate Sensitivity: BDCs invest in debt securities, which means they are sensitive to changes in interest rates. If interest rates rise, the value of BDCs can decline, which can impact your returns.

While these drawbacks may make BDCs seem unattractive, they can still be a valuable addition to a diversified portfolio. When selecting BDCs, it’s important to consider factors such as the quality of the management team, the diversification of the portfolio, and the overall risk profile of the fund. By carefully selecting BDCs that fit your investment objectives and risk tolerance, you can potentially boost your dividend income while minimizing the drawbacks associated with this investment.

Factors to Consider When Selecting Investments for a Dividend Snowball with BDCs

When it comes to selecting BDCs for your portfolio, you’ll want to keep a few key factors in mind. Firstly, it’s important to examine a BDC’s portfolio and see if it aligns with your investment goals. Make sure the BDC invests in industries you understand and believe in, and that the companies it invests in have strong fundamentals.

Additionally, consider the BDC’s investment strategy and whether it’s in line with your risk tolerance. Another factor to consider is the BDC’s management team. Look for a team with a strong track record of success in managing both BDCs and other investment vehicles.

You’ll also want to examine the fees associated with the BDC, including management fees and performance fees. Make sure these fees are reasonable and in line with industry standards. Don’t forget to examine the BDC’s dividend history and payout ratio. Look for a consistent track record of paying dividends, and ensure that the BDC has a sustainable payout ratio.

Keep in mind that a high dividend yield may not always be sustainable if the BDC is paying out more than it can afford. With these factors in mind, selecting the right BDC for your portfolio can be a strategic and informed decision. In the next section, we’ll discuss how to analyze BDCs in more detail to help you make the best decision for your investment goals.

How to Analyze BDCs when Starting a Dividend Snowball with BDCs

To effectively evaluate BDCs for your portfolio, you’ll need to analyze various factors such as their financial performance, management team, investment strategy, and dividend history.

Financial performance analysis includes assessing a BDC’s return on equity, net asset value, and earnings growth. It is important to compare a BDC’s performance to industry benchmarks to determine how well it is performing relative to its peers.

Additionally, analyzing a BDC’s management team involves assessing their experience, track record, and investment philosophy.

Investment strategy analysis is crucial for understanding how a BDC invests its capital. Some BDCs focus on lending to small and medium-sized businesses, while others invest in private equity or real estate. It is important to understand the risks associated with a BDC’s investment strategy and determine whether it aligns with your investment goals and risk tolerance.

Lastly, analyzing a BDC’s dividend history is essential for investors who seek income. This includes evaluating their dividend yield, growth, and sustainability.

Analyzing BDCs requires a comprehensive approach that considers multiple factors. It is important to evaluate a BDC’s financial performance, management team, investment strategy, and dividend history to determine if it is a suitable investment for your portfolio.

Next, we’ll discuss tips for managing your BDC investments.

Tips for Managing Your dividend snowball with BDCs

Now that we know how to analyze BDCs, let’s talk about managing our investments in these companies. As with any investment, it’s important to have a strategy in place for managing risk and maximizing returns.

Here are some tips for managing your BDC investments:

- First, diversify your portfolio. Investing in multiple BDCs can help spread out your risk and increase your chances of finding strong performers. Consider investing in BDCs across different industries and with varying investment strategies.

- Second, pay attention to the fees. BDCs typically have higher fees than other investment vehicles, so it’s important to understand what you’re paying for. Look for BDCs with lower fees or consider investing in a BDC index fund to keep costs down.

- Third, stay up-to-date on the performance of your BDC investments. Regularly review financial statements and earnings reports to ensure that the companies you’re invested in are performing well. Consider setting up alerts or notifications to stay on top of any changes in performance.

Managing your BDC investments requires a thoughtful approach. By diversifying your portfolio, understanding the fees, and staying informed on performance, you can increase your chances of success. But, as with any investment, there are potential risks and challenges to consider.

Potential Risks and Challenges When Taking a Dividend Snowball with BDCs Approach

Be aware of the potential risks and challenges you may face when investing in BDCs. One of the biggest risks is exposure to non-diversified portfolios. BDCs typically invest in a limited number of companies, which means that if one of those companies fails, the impact on the BDC’s portfolio can be significant. Another risk is interest rate fluctuations. BDCs often borrow money to fund their investments, and changes in interest rates can affect their profitability.

Credit risk is another challenge to be aware of when investing in a dividend snowball with BDCs BDCs often lend to small and mid-sized companies that may have limited credit histories or poor credit scores. This can increase the risk of default, which can impact the BDC’s ability to pay dividends to shareholders. It’s important to carefully evaluate the credit quality of the companies in which a BDC invests.

BDCs can be a valuable addition to an income-focused investment portfolio as part of a dividend snowball with BDCs. However, it’s important to understand the potential risks and challenges before investing. By carefully evaluating a BDC’s portfolio, credit quality, and fees, investors can make informed decisions and potentially boost their dividend income over time.

Frequently Asked Questions

What is the average return on investment for BDCs?

Investing in BDCs can yield profitable returns, with the average return on investment ranging from 8-10%. This can be compared to other traditional investments and can offer a unique opportunity for diversification in a portfolio.

Can individual investors directly invest in BDCs or do they need to go through a broker?

Yes, individual investors can invest in BDCs directly or through a broker. However, it’s important to research the specific BDC and understand the risks involved, such as potential for high fees and volatility.

How often do BDCs pay out dividends to investors?

BDCs typically pay out dividends quarterly, but some may pay out monthly or annually. As investors, we can benefit from these regular payouts and potentially increase our dividend income through reinvestment and compounding.

Are BDCs subject to the same regulations as other investment companies?

Oh, the joys of regulations! Yes, BDCs are subject to the same regulations as other investment companies. As informed investors, we know that regulations are necessary to protect our investments and promote transparency in the market.

Can investing in BDCs be considered a low-risk investment strategy?

Investing in BDCs is not a low-risk investment strategy. While they offer high dividend yields, they are subject to economic and market fluctuations and are not guaranteed. It’s important to do research and diversify your investments.

Conclusion

In conclusion, a Dividend Snowball with BDCs can be a profitable way to boost your dividend income. However, it’s important to carefully consider the benefits and drawbacks before making any investment decisions.

When selecting stocks for a dividend snowball with BDCs, it’s crucial to analyze various factors such as management quality, portfolio diversification, and financial performance. By conducting thorough research and staying informed about the potential risks and challenges, investors can manage their BDC investments effectively.

Remember to stay patient and persistent in your investment strategy, as a dividend snowball with BDCs requires time and dedication. With proper analysis and management, investing in BDCs can be a valuable addition to your portfolio and contribute to long-term financial success.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.