Are you looking to join the ranks of successful investors who generate regular income through dividends? Building a dividend snowball portfolio may be just what you need, growing wealth with the dividend snowball effect.

As we embark on this step-by-step guide, let’s start by understanding the concept of dividends. Dividends are payments made by companies to their shareholders as a way of distributing profits. Investing in dividend-paying stocks can provide a steady stream of income and help build long-term wealth.

But building a successful dividend portfolio requires more than just randomly selecting high-yield stocks. It involves careful analysis, strategic selection, and ongoing monitoring to ensure that your investments continue to perform well over time.

So, let’s dive into the world of dividend investing and learn how we can build our own snowball portfolio that delivers consistent returns year after year.

Key Takeaways

- Selecting the right stocks is crucial when building a dividend snowball portfolio.

- Regularly monitoring performance is important to identify underperforming stocks or holdings that no longer meet investment criteria.

- Adjustments to the portfolio may be necessary in response to changes in market conditions, dividend cuts, or changes in personal financial goals.

- Maintaining a long-term focus is important for consistent dividend growth and risk management.

Understanding Dividends

If you’re building a dividend snowball portfolio, it’s important to understand dividends – regular payments made by companies to their shareholders that can add up over time. Did you know that from 1972 to 2018, reinvested dividends accounted for approximately 33% of the total return of the S&P 500?

This means that investors who reinvested their dividends would have seen significant growth in their portfolios over the long term. Dividends are usually paid out quarterly or annually and can be in the form of cash or additional shares. They are generally paid out by stable and mature companies with consistent earnings, making them less risky than investing solely in growth stocks.

Dividend-paying stocks also provide a steady stream of income for investors, making them an attractive option for those looking for passive income streams. When choosing dividend-paying stocks for your portfolio, it’s important to consider factors such as yield, payout ratio, and dividend growth rate.

Yield refers to the percentage return on investment based on the annual dividend payment divided by the stock price. Payout ratio is how much of a company’s earnings are being used to pay dividends – a high payout ratio could mean that there is little room for future dividend increases. Dividend growth rate measures how much a company has increased its dividends over time.

Overall, understanding dividends is essential when building a dividend snowball portfolio – they can provide steady income streams and contribute significantly to long-term portfolio growth. By considering factors such as yield, payout ratio, and dividend growth rate when selecting stocks for your portfolio, you can ensure that you’re making informed decisions that will help maximize your returns over time.

Selecting Stocks

Now that you’ve researched your potential stocks, it’s time to make some decisions on which ones are the best fit for your investment strategy.

When selecting stocks for a dividend snowball portfolio, there are several factors to consider. Firstly, look for companies with a history of consistent dividend payments and growth. This signals stability and a commitment to rewarding shareholders over the long term.

Secondly, pay attention to the company’s financial health and growth prospects. A healthy balance sheet and positive earnings trends indicate sustainability of dividend payments.

Another important factor is diversification across sectors and industries. This helps mitigate risks associated with any one sector or industry experiencing downturns or market fluctuations. Additionally, consider the company’s size – large-cap stocks may be more stable but offer lower yields while small-cap stocks may provide higher yields but come with greater risk.

It’s also important to analyze valuation metrics such as price-to-earnings ratio (P/E) and price-to-book ratio (P/B). Look for stocks trading at attractive valuations compared to their peers in the same industry or sector.

Selecting the right stocks is crucial when building a dividend snowball portfolio. Consider factors such as consistent dividends, financial health and growth prospects, diversification across sectors and industries, company size, and valuation metrics before making any investment decisions. We can also use ETFs to gain instant diversification for our dividend snowball portfolio.

By taking a strategic approach to stock selection based on these key principles, you can build a diversified portfolio that generates sustainable income over time while mitigating risks associated with market volatility or economic uncertainty.

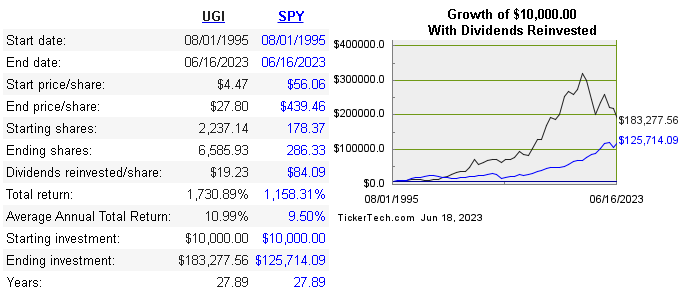

As an example, an investment in the utility sector, in UGI, would have more than out-matched SPY with dividends re-invested. $10,000 invested in 1995 would now be worth $183,000, making it a nice contribution to the dividend snowball portfolio!

Diversification Strategies

To effectively manage risk and maximize returns, diversification is key in any investment strategy. According to a study by Vanguard, a portfolio that consists of 40 to 60 stocks from different sectors and industries can provide optimal diversification benefits. This means that if you are building a dividend snowball portfolio, it is important to ensure that your investments cover various sectors such as healthcare, technology, utility stocks, consumer goods or consumer staples, and finance.

One way of achieving this diversified portfolio is through sector allocation. By investing in different sectors, you reduce the risk of losing too much money if one particular sector takes a hit. For instance, if you have invested all your money in tech stocks and there’s an economic downturn in the tech industry, your entire portfolio will be affected negatively. However, with sector allocation, you spread your investments across various industries which helps mitigate potential losses.

Another important aspect of diversification is market capitalization allocation. Market capitalization refers to the total value of all outstanding shares of a company’s stock. Typically companies are classified into small-cap (market cap under $2 billion), mid-cap (between $2 billion and $10 billion), or large-cap (over $10 billion). By investing in companies across these three categories rather than just focusing on one category alone can help minimize risk while increasing potential returns.

Effective diversification strategies involve allocating investments across various sectors and market caps. The table below highlights some examples of how one could go about implementing these strategies when building their dividend snowball portfolio:

| Sector Allocation | Market Capitalization Allocation |

|---|---|

| Healthcare: 20% | Small-Cap: 20% |

| Technology: 25% | Mid-Cap: 30% |

| Consumer Goods: 15% | Large-Cap: 50% |

| Finance: 40% |

Incorporating these types of strategies into your investment plan will not only help reduce risk but also increase the likelihood of long-term success in building a dividend snowball portfolio.

Reinvesting Dividends

Reinvesting your dividends is crucial to maximizing the growth of your investment portfolio. When you choose to reinvest, you’re essentially buying more shares of stock with the money that was paid out as a dividend. This means that not only are you receiving regular cash payouts from the company, but your overall ownership in the company is increasing as well.

Over time, this can lead to significant growth and increased returns on your investment. One key benefit of reinvesting dividends is the power of compounding. By reinvesting your dividends, you’re essentially earning a return on top of a return in your dividend snowball portfolio. The more frequently you reinvest, the faster this compounding effect will take place. This can help accelerate the growth of your portfolio and potentially lead to much larger returns in the future.

Another advantage of reinvesting dividends is that it allows for automatic diversification within your portfolio. As companies pay out their dividends, you have the opportunity to purchase additional shares across different industries and sectors without having to actively manage individual stocks yourself. This can help spread out risk and protect against market volatility.

In addition to these benefits, many companies offer dividend reinvestment plans (DRIPs) which allow investors to automatically reinvest their dividends without having to pay any brokerage fees or commissions. This can make it even easier for investors to start building their snowball portfolios and taking advantage of all that dividend investing has to offer.

Overall, reinvesting your dividends should be an essential part of any investor’s long-term strategy for building wealth and achieving financial goals.

Monitoring Portfolio Performance

Keeping an eye on your portfolio’s progress is like checking the scoreboard during a game – it helps you make strategic decisions and adjust your moves accordingly. Monitoring your dividend snowball portfolio’s performance is essential in ensuring that it remains on track towards achieving your financial goals. As a dividend investor, tracking the dividends received from each of your holdings is only one aspect of monitoring portfolio performance. It includes evaluating how individual stocks are performing and measuring whether they align with your investment strategy.

To monitor your portfolio effectively, you need to have a system in place that allows for easy tracking of key metrics. A simple table can help you keep track of critical information such as the current stock price, number of shares owned, dividend yield, dividend payout ratio, and annual income generated by each holding. By having all this data readily available in one place, you can quickly identify underperforming stocks or those that no longer meet your investment criteria.

Once you have identified underperforming stocks or holdings no longer aligned with your investment strategy, it’s time to take action. This may involve selling off positions or rebalancing your portfolio to ensure it remains diversified across different sectors, such as utilities. However, before taking any action, evaluate whether these changes align with long-term financial goals and consider consulting with a financial advisor if necessary.

Monitoring the performance of a dividend snowball portfolio requires regular review and analysis of key metrics such as stock prices, dividends yields and payout ratios among others. By keeping track of these factors using a simple table format, investors can quickly identify underperforming investments and adjust their portfolios accordingly to achieve their long-term financial goals. Remember always to remain objective when making decisions about buying or selling securities within the context of specific market conditions and personal financial circumstances.

Adjusting Your Investments

Now that we know how to monitor the performance of our dividend snowball portfolio, it’s time to talk about making adjustments. As with any investment strategy, there may be times when changes need to be made in order to maximize returns and minimize risk.

In this section, we will discuss some key factors to consider when adjusting your investments. First and foremost, it’s important to remember that investing is a long-term game. While short-term fluctuations can be nerve-wracking, it’s crucial not to panic and make rash decisions based on emotion rather than logic.

That being said, there are certain circumstances where adjustments may be necessary. Here are three situations where you might consider making changes:

- Changes in market conditions: If there is a significant shift in the overall market or specific sector that your portfolio focuses on, it may warrant a reevaluation of your holdings.

- Dividend cuts or suspensions: If one of the companies you hold stock in reduces or eliminates their dividend payout altogether, it may no longer meet the criteria for inclusion in your portfolio.

- Changes in personal financial goals: As your financial situation evolves over time (for example, if you become closer to retirement age), you may want to adjust the composition of your portfolio accordingly.

When considering making adjustments to your dividend snowball portfolio, it’s important to do so strategically and with a clear understanding of what you hope to accomplish. Don’t make changes simply for the sake of change – every decision should have a purpose behind it. Additionally, don’t feel like you need to go it alone – consulting with a financial advisor can help ensure that any changes you make align with your overall investment goals.

While monitoring performance is important for tracking progress towards achieving investment goals through dividends paid by stocks held within one’s snowball portfolio; taking action as needed is also critical whether due changing circumstances within markets or personal finances affecting desired outcomes.

Maintaining Long-Term Focus

To ensure our investments continue to grow and provide returns over the long-term, it’s important that we maintain a clear focus on our financial goals and make adjustments as needed. This means staying disciplined and avoiding knee-jerk reactions to market fluctuations or short-term trends.

Instead, we need to regularly review our portfolio performance against our objectives, adjust our asset allocations if necessary, and rebalance periodically.

Maintaining a long-term focus requires patience and discipline. We need to resist the temptation to chase after high-yield stocks or get caught up in short-term market hype. Instead, we should aim for consistent dividend growth over time by investing in stable companies with strong fundamentals. These companies are more likely to weather economic downturns or industry disruptions while continuing to pay out dividends.

Another key aspect of maintaining a long-term focus is diversification. We can reduce risk by spreading our investments across different sectors, industries, and geographies. This helps protect us from any one company or region experiencing significant underperformance that could negatively impact our entire portfolio.

Building a dividend snowball portfolio is not just about selecting the right stocks initially; it’s also about maintaining a long-term perspective over time. By focusing on clear financial goals, staying disciplined in our investment approach, diversifying effectively, and making adjustments when necessary, we can build a portfolio that generates consistent income for years to come while minimizing risk along the way.

Frequently Asked Questions

What are the tax implications of a dividend snowball portfolio?

Taxes can impact your dividend snowball portfolio. We must understand how taxes affect our investments, so we can make strategic decisions and minimize potential losses. It’s crucial to seek professional advice for a tailored approach.

How do I calculate the overall yield of my dividend snowball portfolio?

To calculate the overall yield of our dividend snowball portfolio, we add up the dividends received from all holdings and divide by the total cost basis. This gives us a percentage that reflects our return on investment.

Can I include dividend-paying ETFs in my dividend snowball portfolio?

We investigated whether dividend-paying ETFs can be part of our portfolio. Yes, they can. They offer diversification and convenience. However, we need to consider the expense ratio and ensure they fit our investment strategy before adding them to our portfolio.

How do I determine the appropriate allocation for each stock in my dividend snowball portfolio?

To determine stock allocation in our dividend snowball portfolio, we analyze each company’s financials and historical dividend growth. We aim for diversification across sectors and risk levels, while prioritizing high-quality stocks with sustainable dividends.

What are some common mistakes to avoid when building a dividend snowball portfolio?

When building a dividend snowball portfolio, it’s important to avoid common mistakes such as overconcentration in a single sector or failing to diversify. Symbolically, we must plant multiple seeds for long-term growth.

Conclusion

In conclusion, building a dividend snowball portfolio requires careful consideration of various factors. These include understanding dividends, selecting stocks, diversification strategies, reinvesting dividends, monitoring portfolio performance, adjusting investments, and maintaining a long-term focus.

However, the rewards of investing in such a portfolio can be substantial. For example, let’s consider John, who is planning for his retirement. He starts investing $10,000 in dividend-paying stocks each year for the next 20 years. Assuming an average annual return of 7% and that he reinvests all dividends earned during this period, John would have accumulated over $440,000 by the end of 20 years. This amount could provide him with regular income through dividends to support his retirement needs.

To succeed in building a dividend snowball portfolio requires patience and discipline. You need to develop a deep understanding of your investment goals and risk tolerance levels while staying focused on your long-term objectives. By following the steps outlined in this guide and adapting them to your own unique situation, you can build a portfolio that generates regular income and helps you achieve financial freedom over time.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.