Are you looking for a way to start building wealth and securing your financial future? Real Estate Investment Trusts (REITs) may be the answer you’ve been searching for. As we embark on this journey together, let’s explore what REITs are, how to choose the right ones, and how to build a diversified portfolio to maximize your returns. A long-term dividend snowball with REITs can easily be created.

REITs are companies that own and manage income-generating real estate properties, such as apartments, shopping malls, and office buildings. They offer investors a way to invest in real estate without having to buy and manage properties themselves.

REITs are required by law to distribute at least 90% of their taxable income to shareholders as dividends, making them a great option for investors seeking regular income. There are also studies that show firms with dividends outperform others. But, as with any investment, there are risks and challenges to consider.

That’s why it’s important to have a solid strategy in place before investing in REITs. Let’s dive in and explore how to start a dividend snowball with REITs and secure your financial future.

Key Takeaways

- REITs offer a way to invest in real estate without buying and managing properties

- Equity REITs are considered safer because they are backed by physical assets

- Building a diversified portfolio of different types of real estate investments can maximize returns and minimize risk

- Reinvesting dividends can harness the power of compounding

Understanding Real Estate Investment Trusts

You’ll need to familiarize yourself with the basics of Real Estate Investment Trusts, commonly referred to as REITs, if you want to start building a dividend snowball with this investment strategy.

A REIT is a company that owns and operates income-generating real estate such as shopping malls, apartment buildings, and hotels. REITs allow individual investors to invest in a diversified portfolio of real estate assets without having to buy and manage properties themselves.

REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. This means that investors can earn a steady stream of income from their REIT investments.

Many REITs also offer the potential for capital appreciation as the value of their underlying real estate assets increases over time.

There are two main types of REITs: equity REITs and mortgage REITs. Equity REITs invest in and operate income-generating real estate, while mortgage REITs invest in and manage real estate loans.

Equity REITs are more common and generally considered a safer investment option because they are backed by physical assets. However, mortgage REITs can offer higher yields, but also come with higher risks.

Before investing in REITs, it’s important to do your research and choose the right ones for your investment strategy.

In the next section, we’ll discuss how to evaluate and choose the best REITs for your portfolio.

Choosing the Right REITs

Picking the appropriate REITs can be a challenging task, but it is crucial to ensure that you invest in a profitable option. To help you make an informed decision, let’s look at some factors to consider when choosing the right REITs. First, take a look at the property type. REITs come in different types such as residential, commercial, industrial, and healthcare. Each property type has its own set of risks and rewards, so consider your investment goals and risk tolerance before choosing a property type. For instance, healthcare REITs can be a great option for investors who want to invest in a recession-resistant industry.

Another factor to consider is the REIT’s management team and track record. Look for REITs with experienced and reputable management teams that have a history of making smart investment decisions. You can also check their track record to see if they have consistently generated income and increased their dividends over time. A good way to research this is by looking at their financial statements, annual reports, and news articles.

Additionally, pay attention to the REIT’s dividend yield and payout ratio. A high dividend yield may seem attractive, but it could also indicate that the REIT is taking on too much debt or has an unsustainable dividend policy. On the other hand, a low yield may indicate that the REIT is not generating enough income to pay its investors. It’s important to find a balance between yield and sustainability. You can also look at the payout ratio, which compares the dividends paid to the earnings of the REIT. A low payout ratio indicates that the REIT has room to increase its dividends in the future.

Choosing the right REITs is crucial to building a profitable dividend snowball. Consider the property type, management team, track record, dividend yield, and payout ratio before making an investment decision. By doing so, you can ensure that you invest in a REIT that aligns with your investment goals and risk tolerance. In the next section, we will discuss how to build a diversified portfolio with REITs.

Building a Diversified Portfolio

To truly maximize your returns, it’s crucial to build a diversified portfolio of different types of real estate investments. This means selecting REITs that specialize in different property types, such as residential, commercial, or industrial properties. It also means choosing REITs that operate in different geographical locations, both domestically and internationally. A diversified portfolio can help mitigate risk by spreading your investment across different types of real estate and markets.

Instant diversification can also be achieved with ETFs witin the portfolio.

Here are four key considerations when building a diversified REIT portfolio:

- Research the different types of REITs: Understanding the different types of REITs available will help you choose a diversified portfolio. Some REITs focus on single-family homes, while others invest in commercial real estate such as office buildings, malls, or hotels.

- Choose REITs with different geographic focuses: Investing in REITs that operate in different regions or countries can help diversify your portfolio and minimize risk. For instance, if one area experiences a downturn, you’ll be less impacted if you’ve invested across different regions.

- Consider the risk profile of each REIT: Some REITs are more aggressive than others, with higher levels of risk and potential for higher returns. Others may be more conservative, offering steady, reliable returns without as much potential for growth. A balanced portfolio will likely include a mix of both types of REITs.

- Monitor and adjust your portfolio over time: As with any investment, it’s important to regularly review your portfolio and make adjustments as needed. This may mean selling underperforming REITs and adding new investments to maintain a diversified portfolio.

By building a diversified REIT portfolio, you can maximize your returns while minimizing risk. In the next section, we’ll explore how to reinvest your dividends to further grow your investments.

Reinvesting for a Dividend Snowball with REITs

When it comes to investing, one of the most powerful tools we have is the power of compounding. That’s why reinvesting your dividends can be a smart strategy.

By reinvesting your dividends, you’ll be able to harness the power of compounding and potentially boost your returns over time.

However, it’s important to be aware of the tax implications of reinvesting your dividends. You should also consider the best strategies for doing so.

The Power of Compounding

As you embark on your journey of building a dividend snowball with REITs, imagine compounding as a magical garden where every seed you plant grows into a beautiful tree, bearing more fruit year after year.

The power of compounding lies in the concept of reinvesting your dividends. When you receive a dividend payout, you have the option to reinvest it back into the same REIT or use it for other investments. By choosing to reinvest your dividends, you allow your investment to grow exponentially over time.

The beauty of compounding is that the longer you stay invested, the greater the impact it has on your returns. With each reinvestment, you are essentially adding more shares to your portfolio, which in turn generate more dividends. This cycle repeats itself, creating a snowball effect that can lead to substantial returns in the long run.

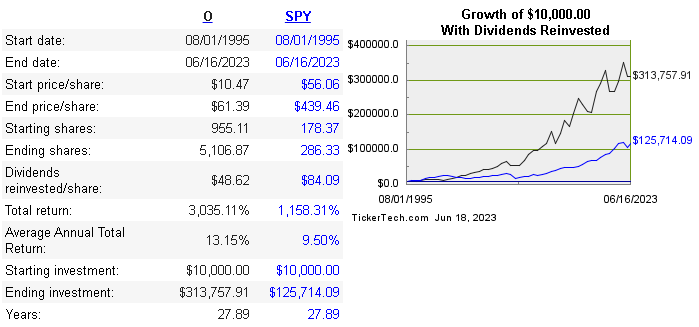

This image is from https://www.dividendchannel.com/symbol/o/forecast/ and shows the impact of taking “O”, one of the largest and best known of the REITs, and investing a fixed sum in 1995 compared to in SPY, then re-investing the dividends. The “O” investment has a 13% annual return compared to the SPY 9.5% over the same period.

As you begin to see the fruits of your labor, you can start to develop strategies for reinvestment that will help you achieve your financial goals.

Strategies for Reinvestment

One way we can maximize our returns with a dividend snowball with REITs and compounding is by developing a strategy for reinvesting our dividends. Rather than taking the cash payout, we can choose to reinvest our dividends and purchase more shares. This allows us to compound our returns, as the more shares we own, the more dividends we receive, and the more shares we can buy with those dividends.

To develop a strategy for reinvestment, we can consider two approaches. The first is a partial reinvestment strategy, where we reinvest a portion of our dividends and take the remaining cash payout. This allows us to benefit from compounding while also providing some liquidity for our portfolio.

The second approach is a full reinvestment strategy, where we reinvest all of our dividends back into the REIT. This maximizes our compounding returns but also reduces our liquidity. Ultimately, the strategy we choose will depend on our individual investment goals and risk tolerance.

As we consider our reinvestment strategy, it’s important to also keep in mind the tax implications of our investment.

Tax Implications

Don’t let tax implications discourage you from reinvesting your dividends, as there are ways to minimize the impact on your returns.

One of the most effective strategies is to hold your REITs in a tax-advantaged account like an IRA or a 401(k) plan. By doing so, you can defer taxes on your dividends and capital gains until you withdraw the funds in retirement, allowing your investments to grow tax-free in the meantime.

Another way to minimize taxes is to invest in REITs that specialize in tax-efficient real estate, such as healthcare or data centers. These types of REITs tend to have lower taxable income and higher depreciation expenses, which can help reduce the tax burden on your investment returns.

By being strategic in your selection of REITs and the accounts you hold them in, you can make the most of your dividend reinvestment strategy while minimizing the impact of taxes on your returns.

As you implement these strategies, it’s important to monitor your investments regularly to ensure they’re performing as expected and adjust your portfolio as needed.

Monitoring Your Investments

To keep track of your investments, make sure you’re regularly checking their performance and adjusting your strategy accordingly, so you can feel confident in your financial future. This may involve setting up alerts or reminders to check on your portfolio, tracking metrics like dividend yields and price-to-earnings ratios, and staying up-to-date on news and trends in the REIT market.

By monitoring your investments, you can identify potential risks and opportunities, and make informed decisions about where to allocate your resources.

One important aspect of monitoring your REIT investments is maintaining a diversified portfolio. This means investing in a variety of different types of REITs, such as residential, commercial, healthcare, and industrial. Diversification can help spread out your risk and reduce the impact of market fluctuations on your overall returns.

It’s also important to keep an eye on the performance of individual stocks within your portfolio, and make adjustments as needed to ensure that you’re not too heavily invested in any one company or sector. You could also consider the Core Satellite approach to help manage risks.

Another key factor to consider when monitoring your REIT investments is your overall investment strategy. Are you focused on long-term growth, or are you more interested in generating regular income through dividends? Depending on your financial goals, you may need to adjust your portfolio to prioritize certain types of REITs or individual stocks.

It’s also important to keep an eye on external factors like interest rates and economic indicators, which can have a significant impact on the performance of real estate investments.

In the end, monitoring your REIT investments is all about staying informed and strategic in your decision-making. By regularly checking in on your portfolio, diversifying your investments, and adjusting your strategy as needed, you can feel confident in your ability to achieve your financial goals. And as we’ll discuss in the next section, staying focused on your long-term goals is key to weathering any short-term fluctuations in the market.

Staying Focused on Your Long-Term Goals

Stay focused on your long-term goals by regularly reviewing your portfolio and adjusting your strategy based on market trends and your personal financial objectives. It’s important to keep in mind that investing in REITs is a long-term strategy that requires patience and discipline.

It may be tempting to make impulsive decisions based on short-term market fluctuations, but this can be detrimental to your overall investment plan. One way to stay focused on your long-term goals is to set up a schedule for reviewing your portfolio. This could be on a monthly, quarterly, or yearly basis, depending on your personal preference.

During these reviews, you can assess the performance of your REITs and determine if any adjustments need to be made. It can also be helpful to consult with a financial advisor or professional to ensure that your investment strategy aligns with your long-term goals.

Another important factor in staying focused on your long-term goals is to avoid emotional decision-making. It can be easy to get caught up in the excitement or fear of the market, but it’s important to remain objective and stick to your investment plan.

This may mean resisting the urge to sell during a market downturn or avoiding the temptation to invest in a hot new REIT without thoroughly researching its potential risks and rewards. Staying focused on your long-term goals is crucial when investing in REITs.

By regularly reviewing your portfolio, avoiding emotional decision-making, and consulting with a financial professional, you can ensure that your investment strategy remains aligned with your personal financial objectives. However, it’s important to remember that investing always comes with risks and challenges, which we’ll discuss in the next section.

Risks and Challenges

It’s important to be aware of the potential risks and challenges involved when investing in real estate investment trusts (REITs). One of the biggest risks is the possibility of a decline in property values. This can happen due to a variety of factors such as an economic downturn, oversupply, or changes in regulations. As a result, the value of your REIT shares could decrease, and you could lose money.

Another challenge that investors face is the lack of control over the properties owned by the REIT. Unlike owning a physical property, you have no say in how the property is managed or maintained. This means that if the management of the REIT is poor, it could result in a decline in the value of your investment. Additionally, if the REIT has high levels of debt, it could impact its ability to pay dividends.

Investing in REITs also comes with tax implications. REITs are required to distribute at least 90% of their taxable income to shareholders in the form of dividends. While this provides investors with a reliable stream of income, it also means that investors are required to pay taxes on those dividends. Additionally, if you sell your REIT shares at a profit, you will be subject to capital gains taxes.

Despite these risks and challenges, investing in REITs can be a great way to start a dividend snowball. By doing your due diligence and investing in high-quality REITs, you can mitigate some of the risks involved. Additionally, by diversifying your portfolio with different types of REITs, you can spread your risk and potentially increase your returns over the long-term.

It’s important to remember that investing in REITs should be part of a well-rounded investment strategy that aligns with your long-term goals.

Frequently Asked Questions

What is the minimum investment amount required to start investing in REITs?

‘Looking to invest in REITs? Wondering what the minimum investment amount is? Well, good news – it’s often as low as $500! With this small investment, you can start building your portfolio and gaining passive income.’ ‘Remember to do your research and choose a REIT that aligns with your investment goals and risk tolerance. Some REITs may have higher minimum investment amounts, so make sure to read the prospectus carefully before investing.’

Are REITs taxed differently than other types of investments?

Yes, REITs have a unique tax structure that requires them to distribute at least 90% of their taxable income to shareholders. As a result, investors receive higher yields and potentially lower tax bills.

Can REITs be held in tax-advantaged accounts like IRAs or 401(k)s?

Yes, REITs can be held in tax-advantaged accounts like IRAs or 401(k)s. This makes them a smart investment choice for those looking to grow their retirement savings while enjoying the benefits of real estate ownership.

Are there any restrictions on selling REIT shares, and how quickly can they be sold?

There are no restrictions on selling REIT shares, but it’s important to consider transaction costs and potential tax implications. Generally, REIT shares can be sold quickly, but market conditions may impact the speed of the sale.

How do economic downturns or changes in interest rates affect the performance of REITs?

Economic downturns can negatively affect REITs, as they are tied to the real estate market. However, changes in interest rates can benefit REITs as they can borrow money at lower rates. It’s important to diversify and monitor market conditions.

Conclusion

In conclusion, investing in real estate investment trusts (REITs) is a great way to start a dividend snowball. By understanding the basics of REITs, choosing the right ones, building a diversified portfolio, reinvesting your dividends, and monitoring your investments, you can achieve long-term financial goals.

However, it’s important to stay focused on your long-term goals and be aware of the risks and challenges involved. Did you know that in 2020, REITs outperformed the S&P 500 with a total return of 11.4% compared to the S&P 500’s 9.2%?

This statistic emphasizes the potential for strong returns from REITs and highlights the importance of considering them as a viable investment option. As you continue your investment journey, remember to analyze, strategize, and remain informed to make the best decisions for your financial future.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.