As an investor, one of the lowest-risk ways to retire rich and stay rich in retirement is simply by investing in world-beating, wide-moat blue-chip companies. ASML, a dominant player in the computer chip market, fits this description perfectly. With a 90% market share and some of the most advanced chip-making technology, ASML has great margins and strong competitive advantages.

Compared to another “sleep well at night” stock, Qualcomm Incorporated, ASML has even bigger upside potential. In this blog post, we will take a closer look at ASML and understand why it is a stock that should be considered for our portfolios.

ASML is a Netherlands-based technology company that specializes in manufacturing lithography machines used to produce microchips. The company has been a key player in the semiconductor industry for several decades, and its innovative solutions have helped to advance chip manufacturing to new heights.

ASML’s lithography machines are essential to producing integrated circuits, which are the building blocks of modern electronics. These machines use light to etch patterns onto silicon wafers, which are then processed to create the various components of a microchip. The company’s latest technology, Extreme Ultraviolet (EUV) lithography, has revolutionized the semiconductor industry by creating smaller, faster, and more power-efficient chips.

EUV lithography uses extremely short wavelengths of light, in the range of 13.5 nanometers, to create the necessary patterns on silicon wafers. This is a significant improvement over traditional lithography methods, which use longer wavelengths of light and are limited in their ability to create smaller features. With EUV lithography, ASML’s machines can produce features as small as 7 nanometers, enabling the production of highly advanced microchips.

One of the key challenges in developing EUV lithography technology has been creating a light source that can produce the necessary wavelengths of light with sufficient power. ASML’s solution to this challenge is a device called an EUV source, which uses a process known as laser-produced plasma to generate the required light. The company has developed a unique, high-powered EUV source that enables its lithography machines to achieve the necessary precision and speed for high-volume chip production.

ASML’s lithography machines are used by some of the world’s largest chip manufacturers, including Intel, Samsung, and TSMC. These companies rely on ASML’s technology to produce advanced chips that power everything from smartphones to supercomputers. With the increasing demand for smaller, faster, and more efficient chips, ASML’s EUV lithography technology is expected to play a critical role in the semiconductor industry’s future.

In addition to its cutting-edge lithography technology, ASML is also committed to sustainability and corporate responsibility. The company has set ambitious goals to reduce its environmental impact, including a commitment to carbon neutrality by 2025. ASML is also committed to fostering diversity and inclusion in its workforce, and has implemented several initiatives to promote these values.

In conclusion, ASML’s EUV lithography technology has revolutionized the semiconductor industry by enabling the production of smaller, faster, and more power-efficient microchips. In addition, the company’s innovative solutions and commitment to sustainability and corporate responsibility have made it a leader in the field of lithography and a key player in the global technology industry.

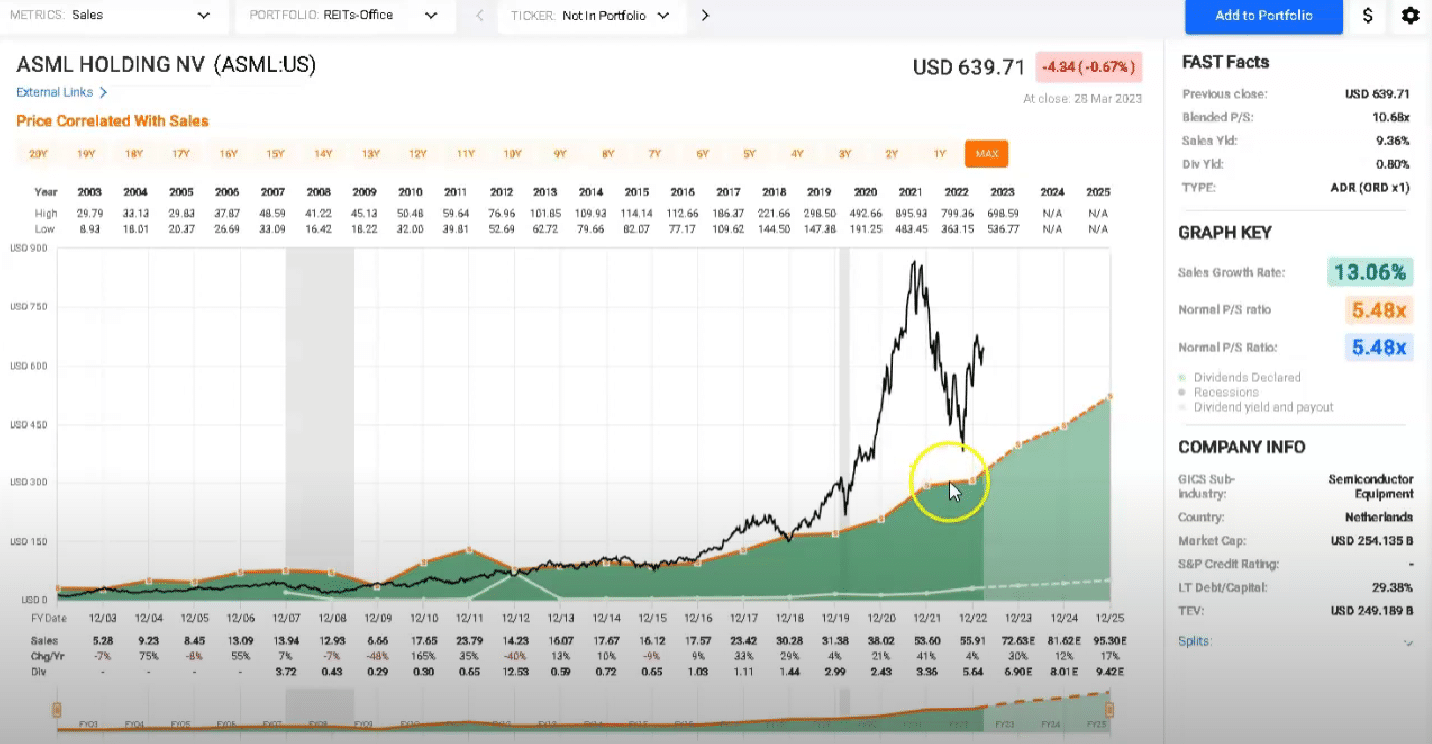

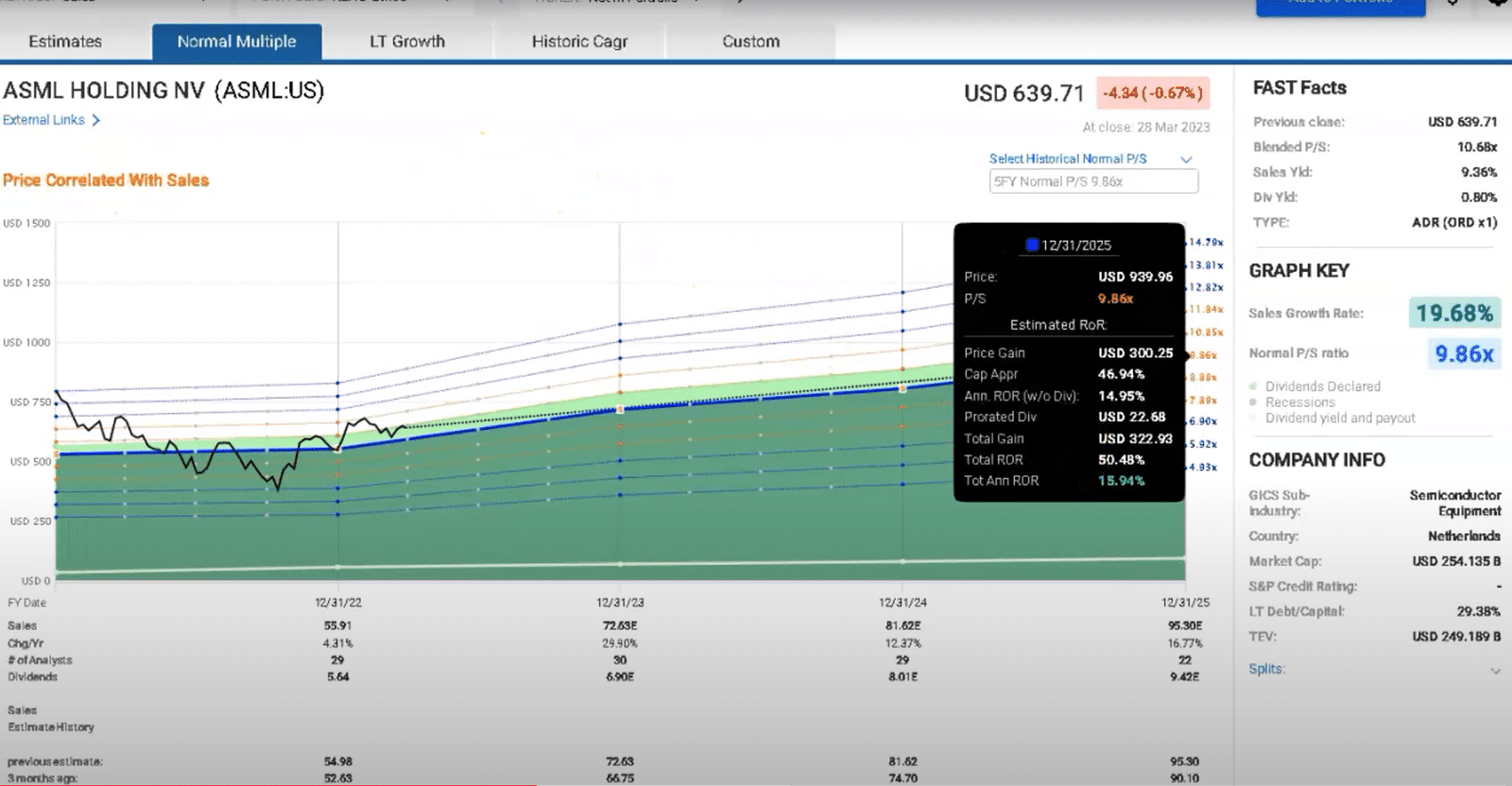

ASML’s price-to-sales ratio has historically been lower, but the stock price has escalated quite rapidly in recent years. Despite the increase, there are some important points to consider. ASML has a favorable nearly 30% debt-to-capital ratio, and though it has a relatively low dividend yield of 0.8%, it offers powerful double-digit long-term returns and strong income growth.

Analysts have estimated an increase in sales of about 30% for 2023, 12% for 2024, and 16% for 2025. If the normal price-to-sales ratio is maintained, we could be looking at annualized returns of about 16% or a total rate of return of around 50% by the end of 2025.

ASML’s dividend growth has been somewhat inconsistent, with substantial increases and cuts. However, recent years have seen impressive dividend increases. As a result, analysts expect the dividend to grow, reaching approximately $9.42 by 2025. This represents a 40% increase for those investing now, making ASML an attractive prospect for dividend growth.

ASML is a growth stock with a strong growing dividend, although its yield is low for dividend investors. However, it can potentially add growth to your portfolio and provide powerful dividend growth rates. Remember that ASML’s share prices have been quite volatile historically, so be prepared to hold through periods of decline.

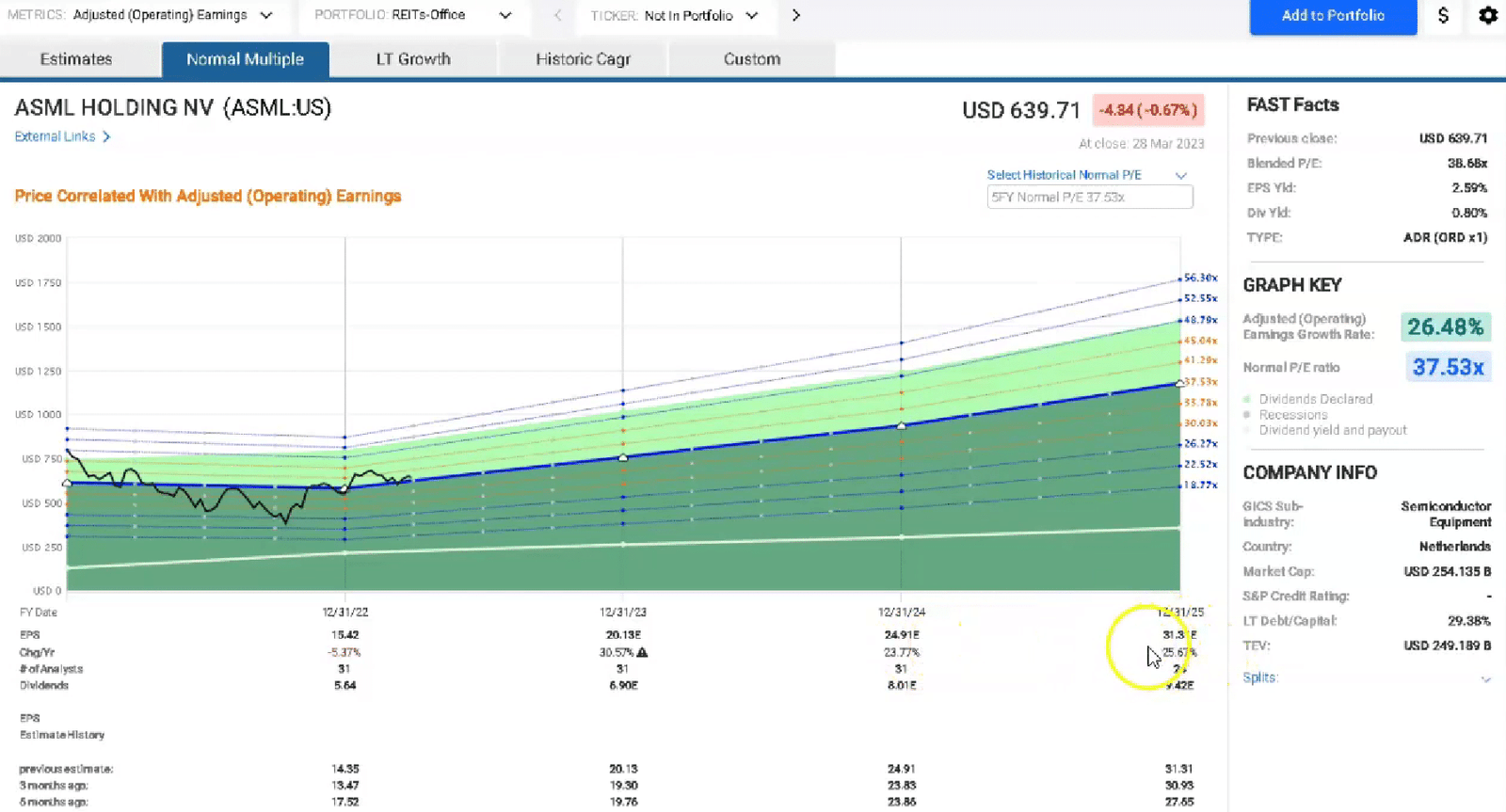

Analysts expect strong gains in earnings, with estimates steadily rising in the last six months. However, be cautious, as the company has missed earnings estimates fairly regularly. On the other hand, sales estimates are more reliable and easier to forecast.

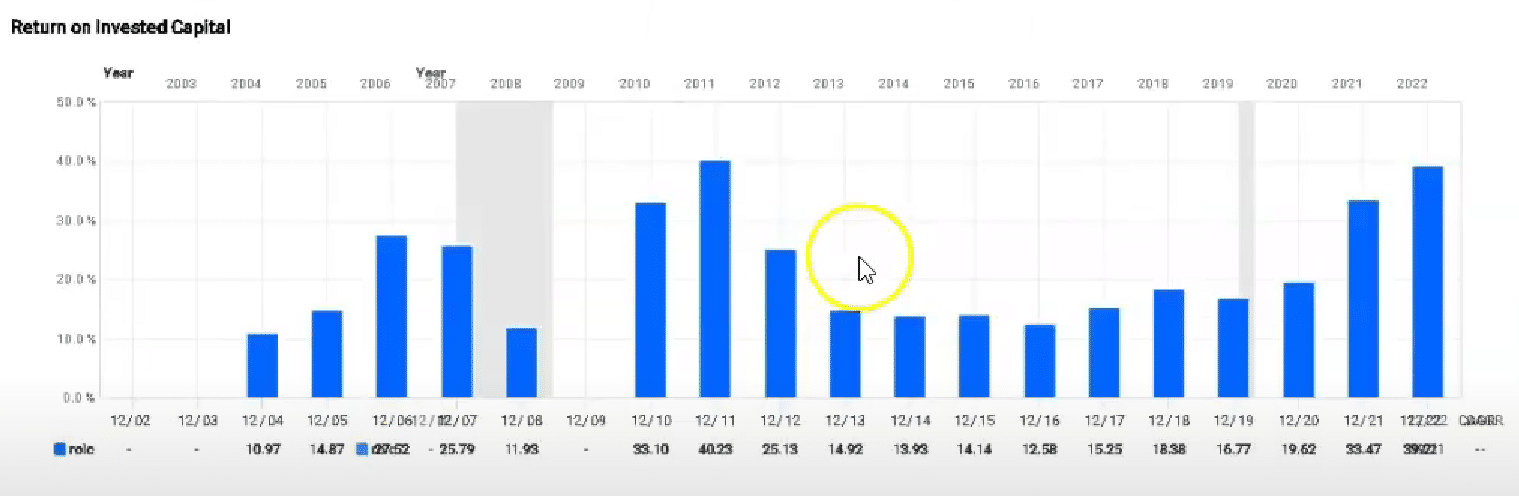

ASML’s financials show strong operating cash flow growth, and its free cash flow per share dwarfs its dividends per share, giving investors confidence that the dividend will be maintained. In addition, the company has strong margins and outperforms the sub-industry average in return on assets, return on equity, and long-term debt-to-capital.

In conclusion, ASML presents a compelling long-term investment opportunity for those looking to drive long-term income growth. Its dominant position in the chip market, strong financials, and potential for powerful dividend growth make it a stock worth considering for your portfolio. Let us know your thoughts in the comments below.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.