Are you seeking outstanding long-term growth opportunities? Are you interested in a promising investment in real estate with the potential for robust income growth? Look no further, as today, we will explore the incredible prospects of Alexandria Real Estate. We will discuss the company’s background, strengths, and the exciting opportunities it presents for the future. Stay with us until the end to learn more about this promising company.

The Youtube version is here:

Overview of Alexandria Real Estate

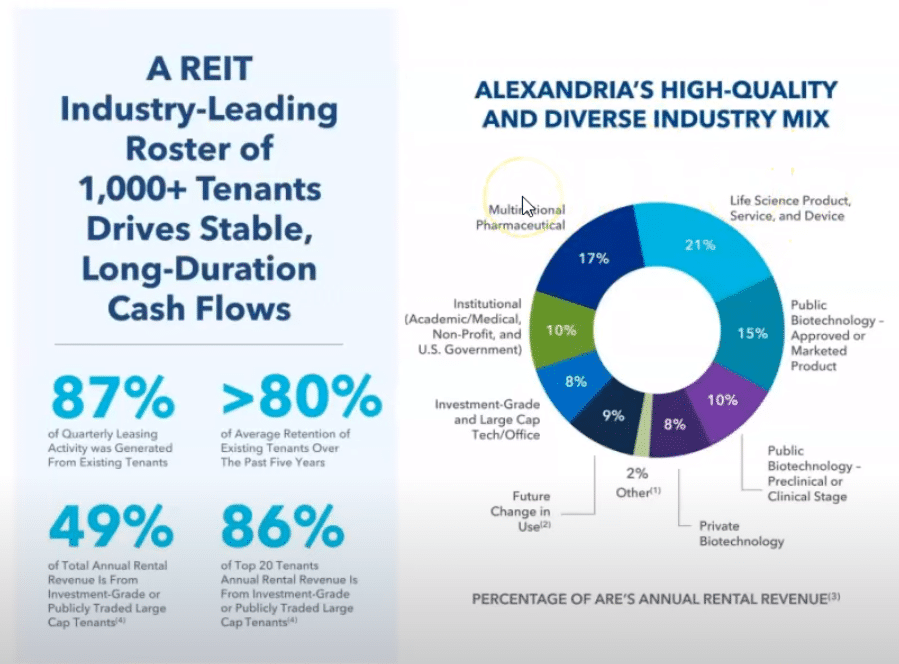

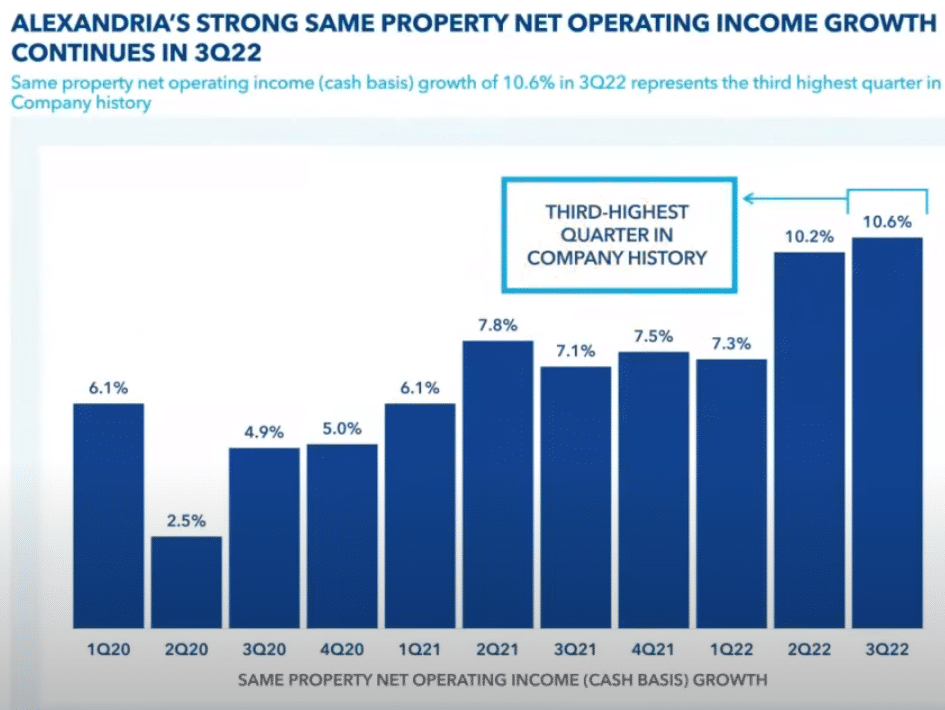

Alexandria boasts an impressive portfolio comprising numerous large tenants from the public biotech, life sciences, and multinational pharmaceutical industries. These tenants offer stability as they are unlikely to face financial difficulties or vanish from the market. Alexandria has demonstrated powerful same-property net operating income growth quarter after quarter. In fact, the third quarter of 2022 marked the third-highest quarter in the company’s history, a truly remarkable achievement.

Focused Strategy

Alexandria has strategically disposed of several non-campus standalone properties, concentrating on the more lucrative campus model. This shift demonstrates a strong sense of focus and direction, making the campus model a more viable option for the company.

Financial Perspective

Despite recent price declines, Alexandria has experienced an average annual dividend per share growth of 6.5% over the last five years. This is an important and promising aspect for potential investors.

Analyzing the Company’s Performance

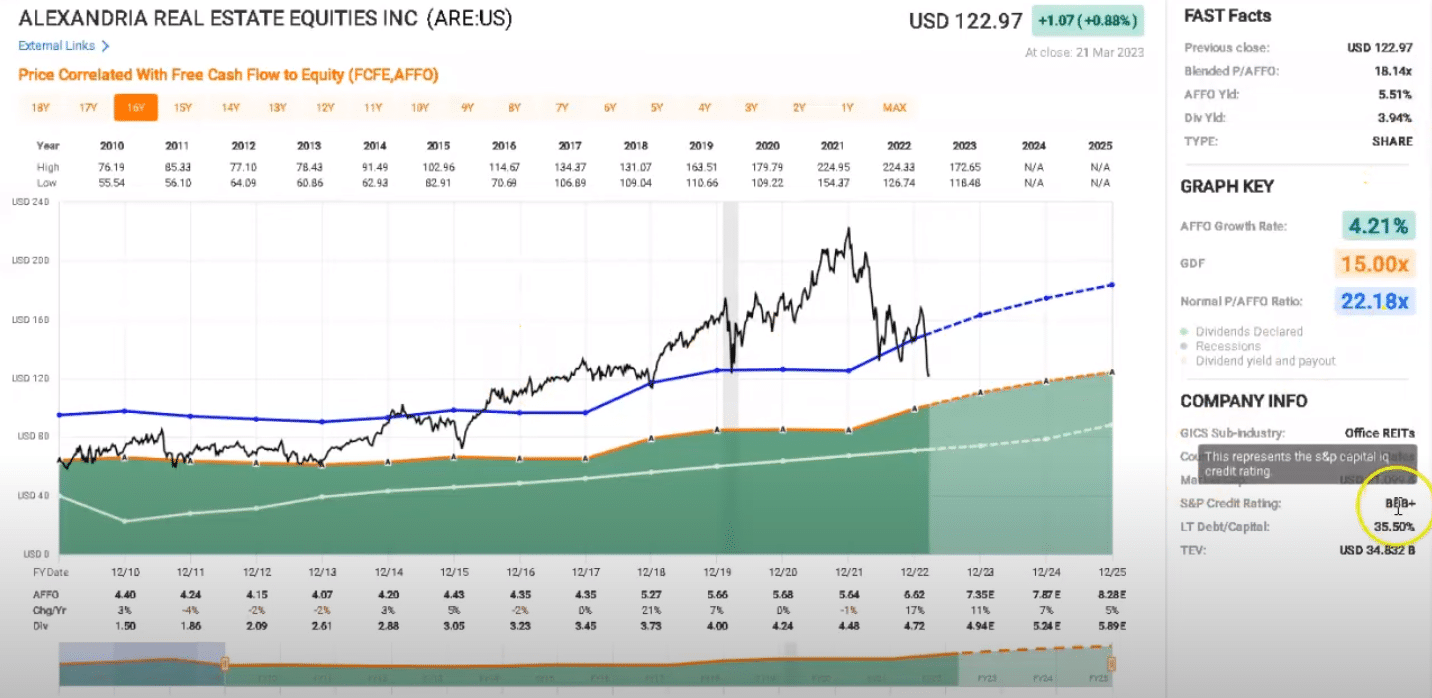

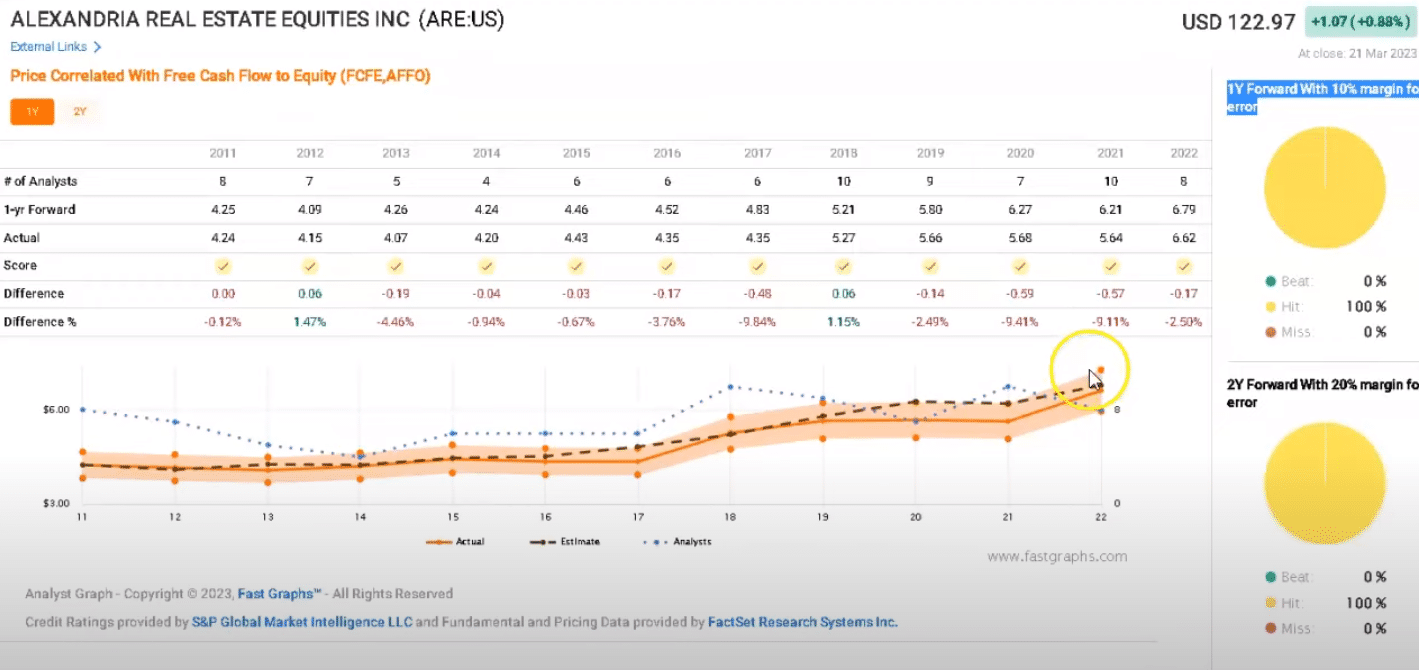

Using FastGraphs, we can easily assess the company’s performance and trends. It is evident that, since 2015-2016, the price has somewhat deviated from the underlying earnings. We can also observe a considerable sell-off in recent months, resulting in a dividend yield of nearly 4%.

Credit Rating and Analyst Scorecard: Alexandria has a strong credit rating of BBB+ (S&P Global), placing it among the top percentile of publicly traded US real estate investment trusts (REITs). This rating is an important indicator of the company’s quality, especially during the market turmoil.

The analyst scorecard, a feature of FastGraphs, reveals the historical performance of analysts’ estimates. The company has consistently provided accurate guidance, indicating a predictable and manageable operating model that appeals to investors.

Forecasting Calculator and Price Targets

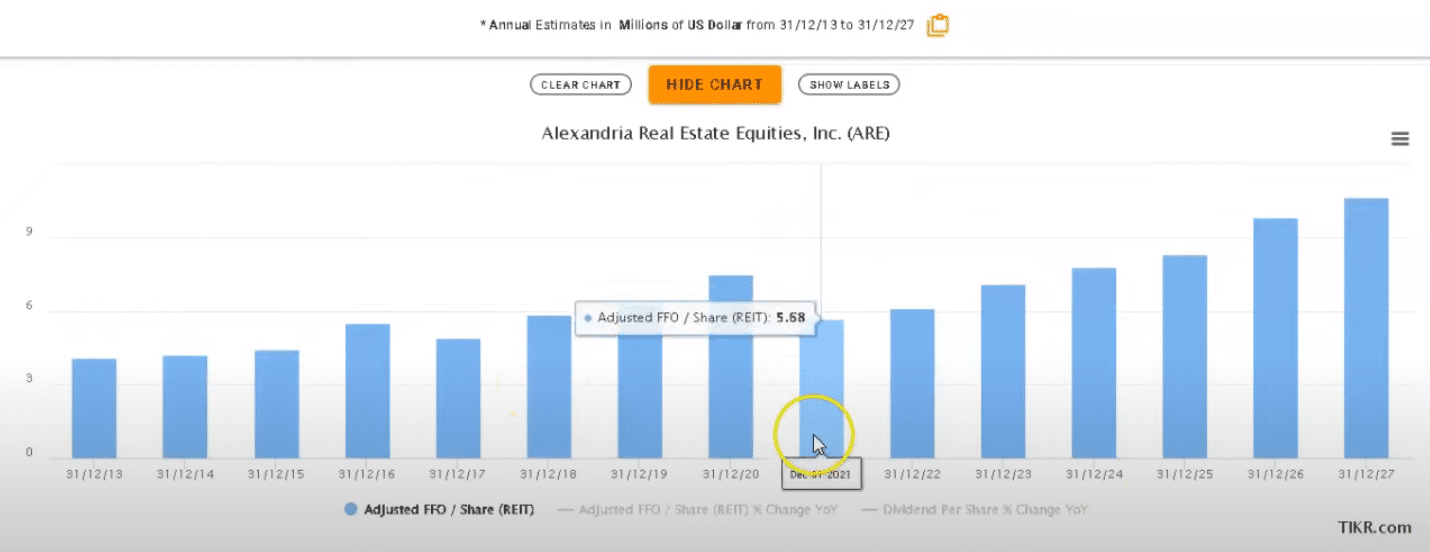

The forecasting calculator shows that Alexandria is currently trading at an 18-times price-to-adjusted funds from operations (AFFO) ratio. While it may warrant a premium, it does not justify the 28-times ratio at which it has historically traded. Assuming a 20-times ratio and that analysts’ AFFO estimates are accurate, the total rate of return would be approximately 32% by the end of 2024, translating to an annualized return of 17%.

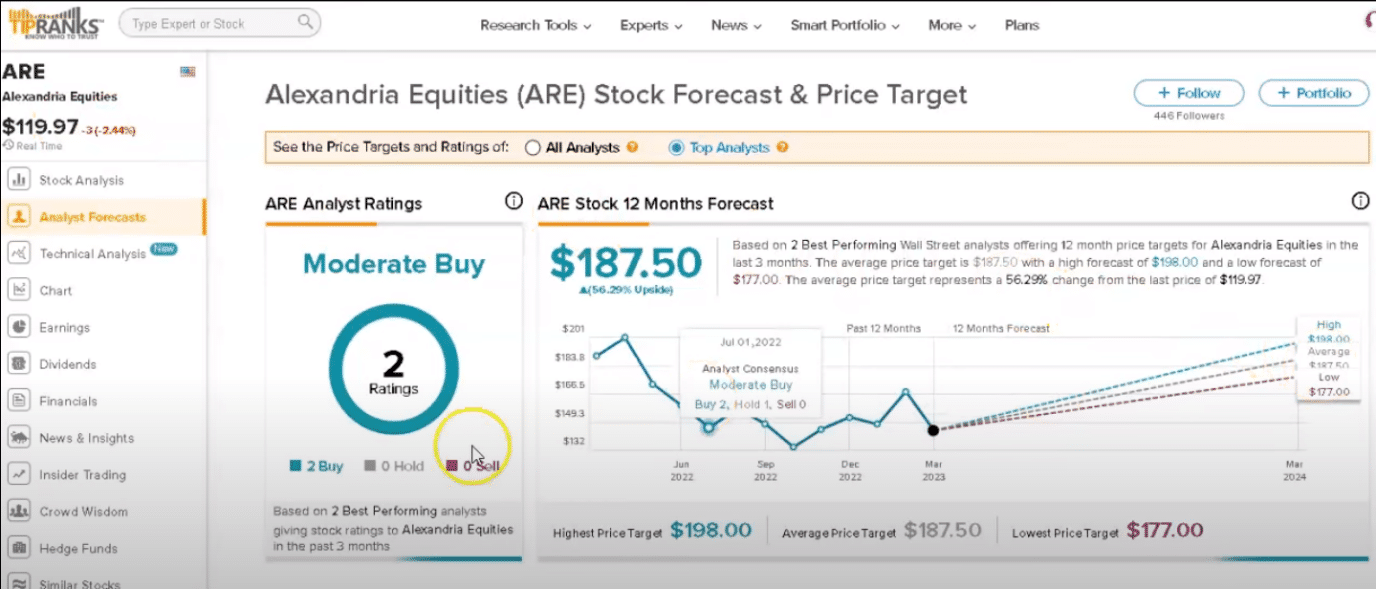

Analysts’ estimates from TipRanks offer a range of price targets from $177 to nearly $200, with substantial upside potential from the current price of $120.

Conclusion

Alexandria Real Estate is a strong, solid REIT with promising tenants, a focused strategy, and exciting future opportunities. The recent price declines present an appealing entry point for potential investors. Share your thoughts in the comments below – do you currently hold a position in Alexandria Real Estate, or is it on your radar for future investments? Don’t forget to subscribe and join the conversation. We’ll see you soon!

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.