Are you on the hunt for exceptional long-term dividend growth from blue-chip stocks? These are the stocks that not only pay dividends but also steadily increase over time. And to sweeten the deal, they are considered safe bets and the darlings of the hedge fund industry. So, without further ado, let’s dive into the top blue-chip stocks to buy according to hedge funds, as per a Yahoo Finance article.

Upon closer inspection, we can see that not all these stocks pay dividends. Therefore, I have sorted the top ten stocks by dividend yield using Fast Graphs’ portfolio view. While there is not much diversity among the companies paying dividends on this list, Bank of America, JP Morgan, S&P Global, Apple, and Microsoft appear. The dividend yield ranges from 0.9% to 4%, with some companies’ EPS yield relatively low; all much lower than monster BDC yields! On the other hand, Bank of America and JP Morgan seem to have a high EPS yield, which is unsurprising given the banking sector turbulence.

Out of the top ten stocks, I have extracted the dividend-paying ones, aka the dividend growth stocks, to discuss in detail in this review of key blue-chip stocks.

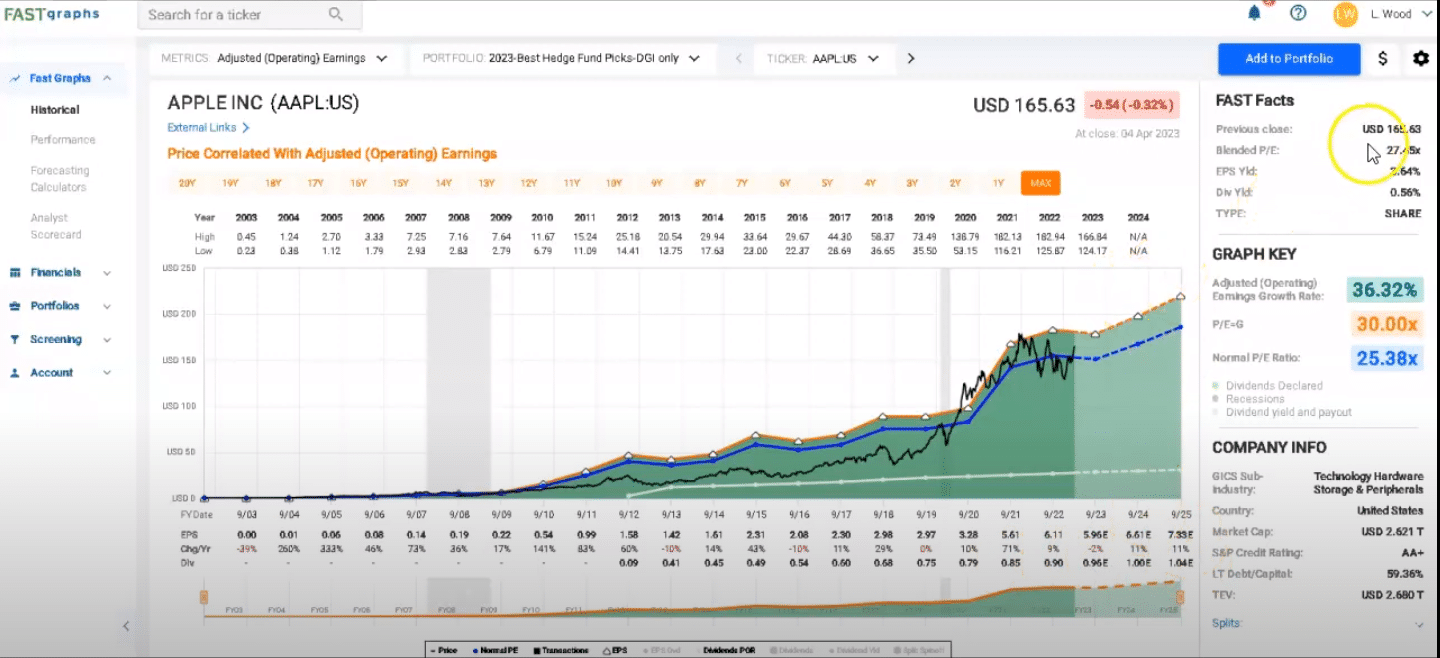

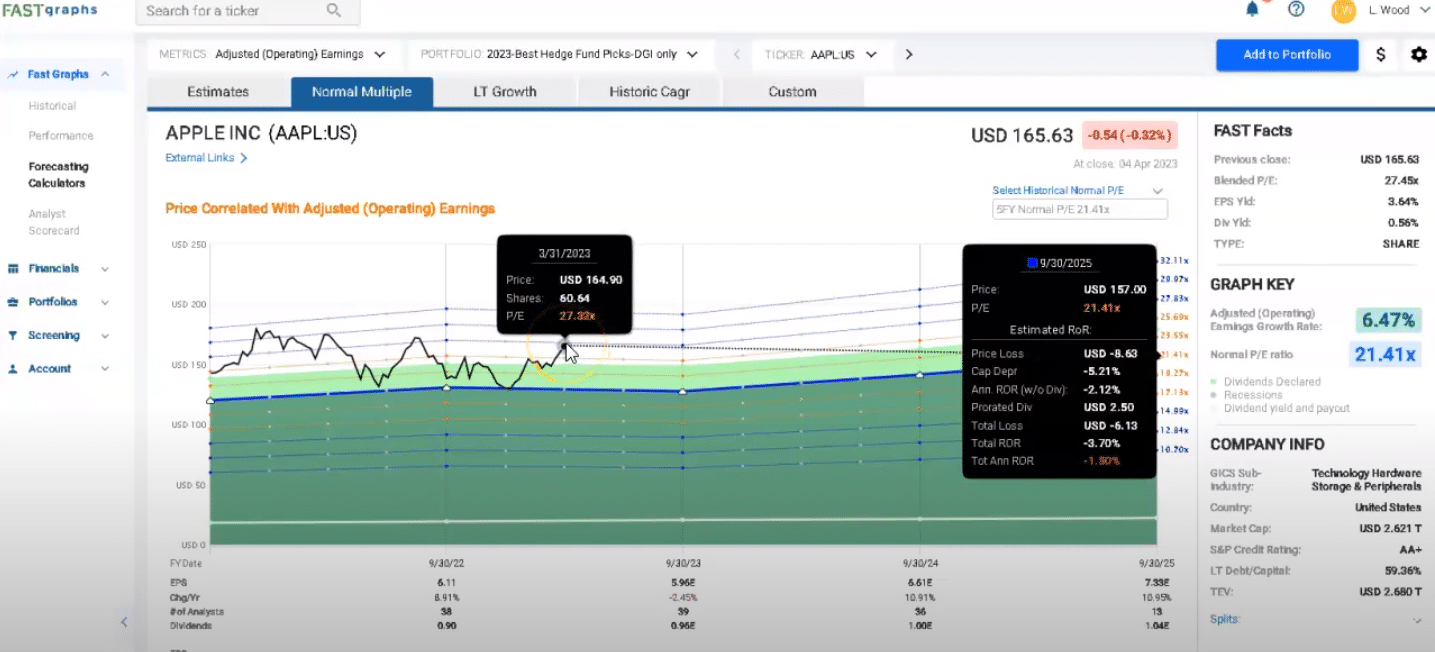

Apple – one of the best-known of the blue-chip stocks

In the world of investing, there are few blue-chip stocks that are as well-known as Apple. With its long history of innovation and success, it’s no surprise that investors are interested in owning a piece of the company. But is now the right time to buy?

Let’s take a closer look at the numbers. Currently, Apple is trading at a blended price-to-earnings (PE) ratio of about 27 times. This is quite richly valued, especially when compared to its historical average.

Despite this, the company has a solid track record of dividend growth. Over the past ten years, Apple has steadily increased its dividend yearly, and analysts expect this trend to continue in the coming years.

Looking at the analyst scorecard for earnings, we can see that over a two-year forward period, analysts get it wrong about 8% of the time. Half of the time, they get it right, and about 42% of the time, the company beats analyst expectations, showing the benefits of investing such powerful and predictable blue-chip stocks.

But what does this all mean for forecasting? One important thing to remember is that if growth begins to ease off, prices might return closer to a 15 times PE multiple. If this were to happen over the next three or four years, by the end of 2025, we could be looking at a total rate of return of minus 32%, or about minus 15% per year.

At the current valuation, Apple represents a high-risk investment. If the company trades at its normal multiple of about 21 times PE and returns to this level by the end of the 2025 financial year, we’re still looking at an annualized rate of return of about minus 1.5%.

While Apple is certainly a great company and very strong, it’s worth noting that long-term estimated growth is at about 10% per year. If you’re looking to be a long-term investor, you could begin to dollar-cost average and buy at the current price. Even if prices return to a 15 times PE level over the next five years, you won’t necessarily lose money, but your money won’t be growing very quickly either.

As an investor, it’s important to be cautious and careful when buying high-priced stocks like Apple. Buying at the right value is key, which is why it’s always a good idea to look for lower PE ratios or prices to adjust for phantom operations for reads. Doing this can avoid potential downside risks and make a more informed investment decision.

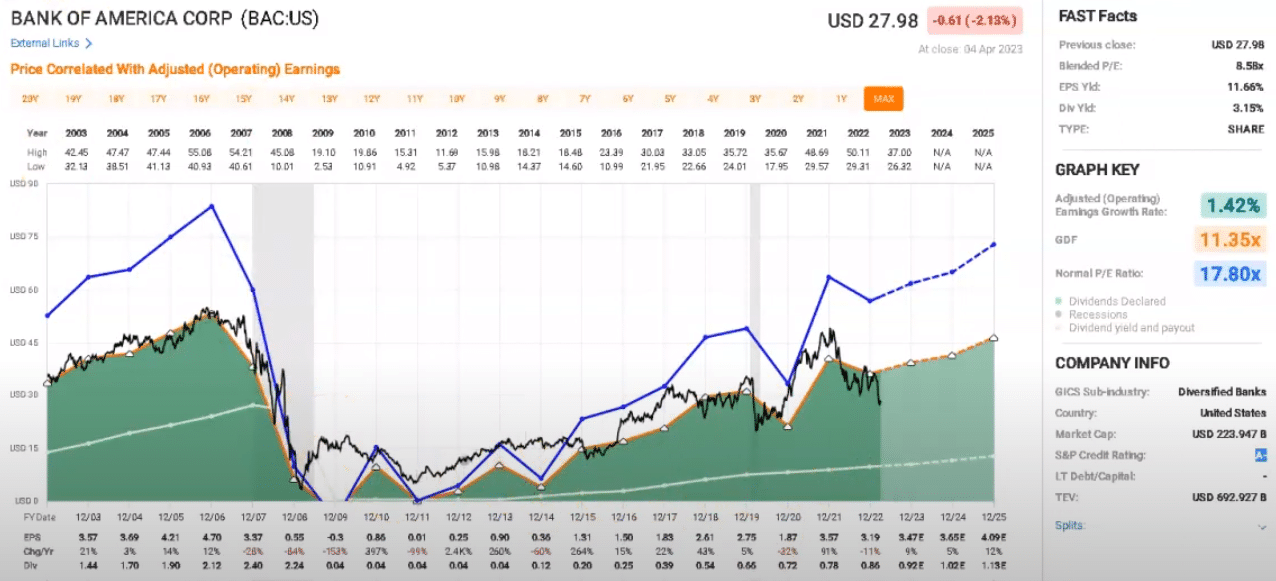

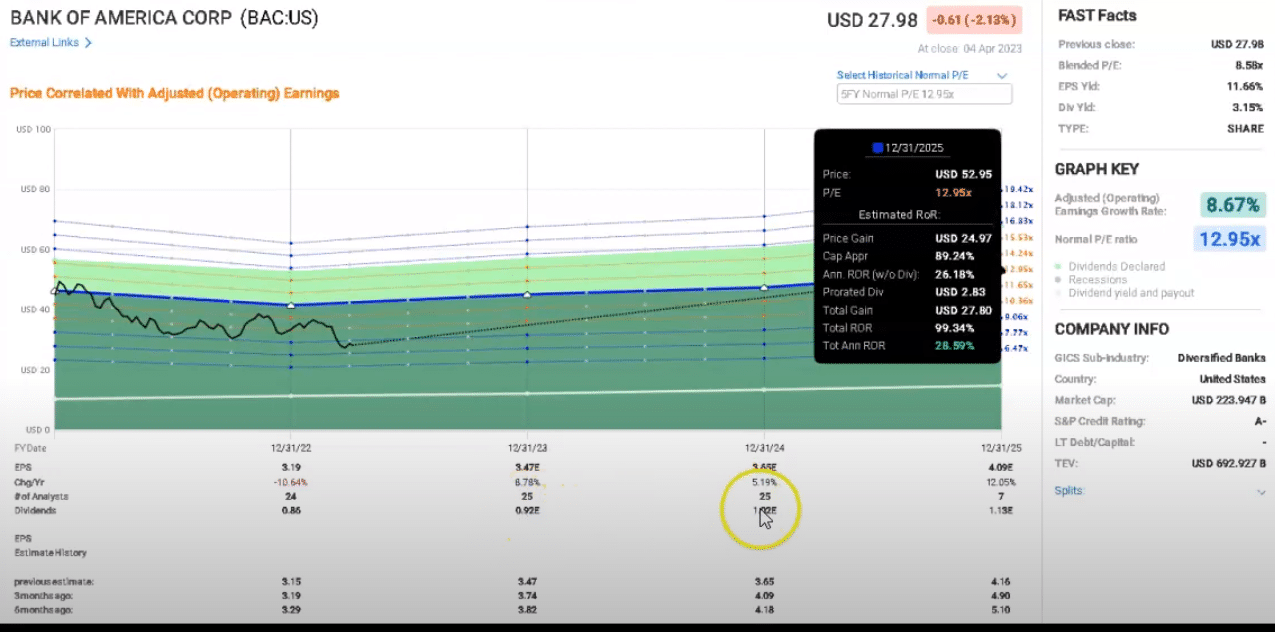

Bank of America

Bank of America, like many other blue-chip stocks in banking, has experienced turmoil in recent times, but it seems to have impacted smaller regional banks much more than larger ones. Despite this, the stock has recently experienced a steep decline, with a blended PE of around 8.8 times, and a minus credit rating by S&P. However, Bank of America has been able to raise its dividend consistently and beautifully since the global financial crisis and its recovery period.

When it comes to forecasting, the analyst scorecard for Bank of America is nowhere near as nice as it is for Apple. Analysts often struggle to estimate earnings for the bank, even two years out or even one year out. However, it is currently trading around 8.5-8.6 times, while over the past five years, it has traded around 13 times. If prices were to return to those levels by the end of 2025, you could double your money over that period, representing an annualized rate of return of about 29%.

However, given that this is a bank stock, many things can go wrong, so it is important to keep that in mind. Despite this, there are some positive things to note. There has been a slight decline in estimated earnings for 2023 and a more substantial decline in estimated earnings over 2024 and 2025. Coupled with a relatively nice dividend yield of around 3%, estimated dividend increases are also reasonable.

Looking at recent changes in dividend increases, it was around 20-40% in 2018-2019, and large single-digit or very low double-digit in the last couple of years. This means you are discussing a reasonable starting dividend yield here and some reasonably good dividend growth. While there is no fix on long-term growth estimates, estimates from Yahoo Finance suggest that growth over the next five years is expected to be relatively low, at only 3.3% per annum.

However, the benefit of buying such blue-chip stocks now is that it is a good time to buy in terms of having a relatively low price-to-earnings ratio. This suggests some good potential upside, even though earnings might grow slowly over the next five years. We are pricing most of this estimated growth in the next several years, so there is some really nice potential here for Bank of America.

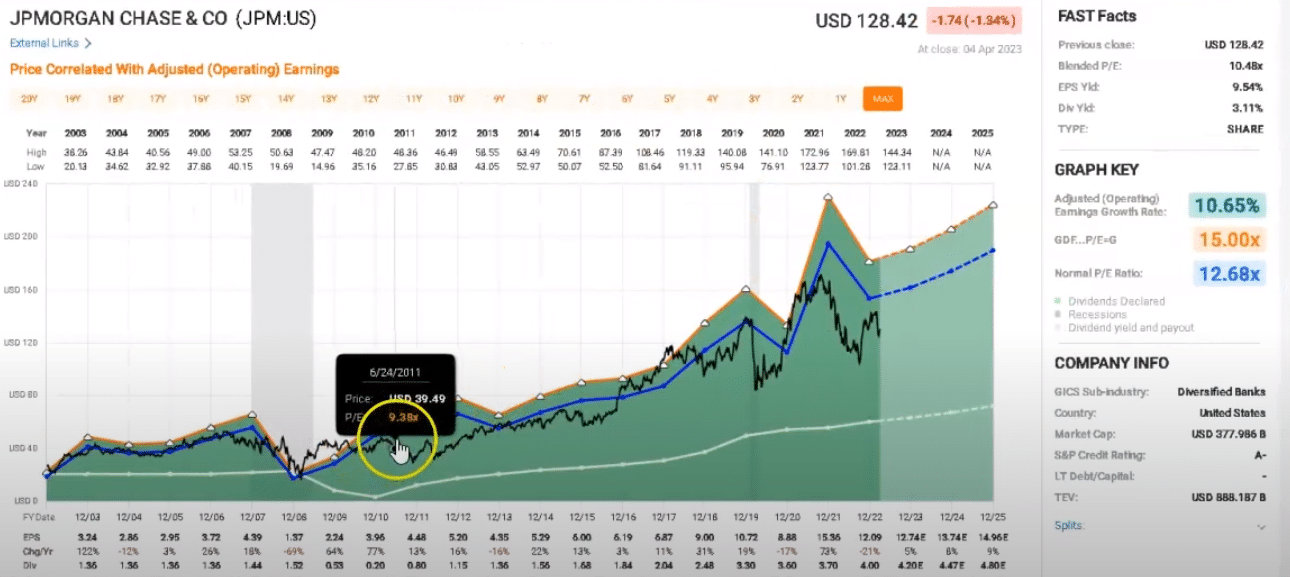

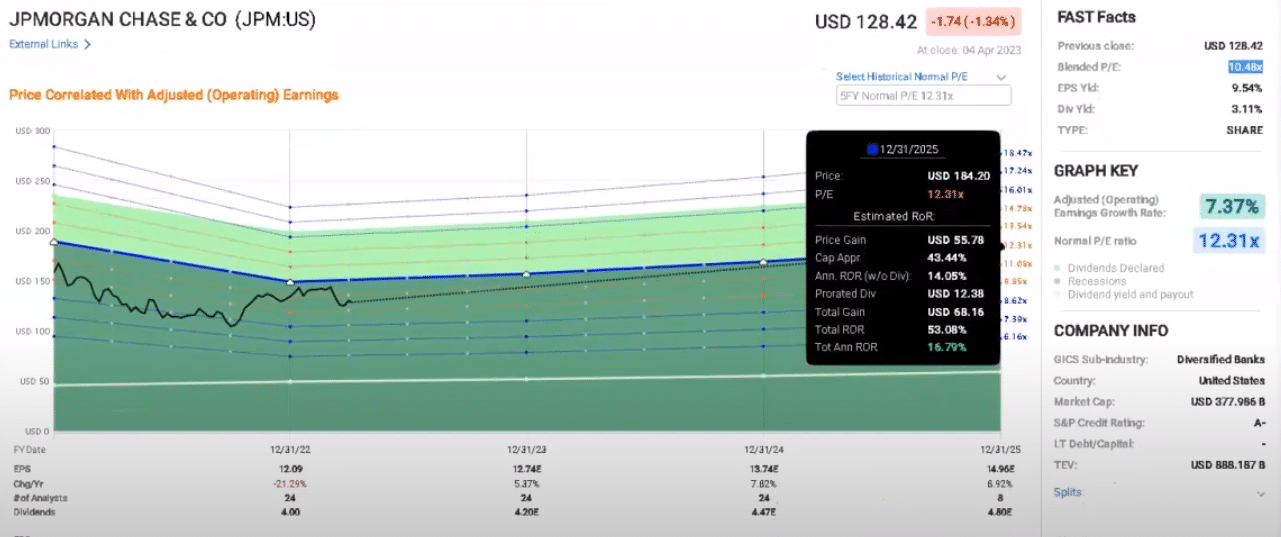

JP Morgan Chase

In the world of finance, JP Morgan Chase is a name that needs no introduction. As one of the world’s largest and most successful blue-chip stocks in banking and finance, it has consistently provided shareholders with strong returns and solid dividend growth.

JP Morgan is trading at a blended PE of approximately 10.5 times, a relatively modest valuation that belies the company’s impressive growth trajectory. If prices were to return to the 12.3% price-to-earnings level seen over the past five years, we might expect to see an annualized rate of return of around 17% by the end of 2025.

Perhaps the most encouraging thing about JP Morgan is its strong track record of beating analyst expectations. Over a two-year Ford estimate, analysts get it right around 75% of the time, while the company beats expectations a quarter of the time. This consistency is a testament to JP Morgan’s robust business model and the skill of its management team.

In contrast to Bank of America, JP Morgan has seen relatively stable and consistent earnings estimates over the last six months. In fact, these estimates have been revised upwards, suggesting that analysts are increasingly optimistic about the company’s prospects. This is a trend that bodes well for long-term shareholders and should give investors confidence in the bank’s ability to weather any short-term volatility.

While some analysts predict that JP Morgan’s earnings per share will decline over the next five years, this doesn’t necessarily mean that the company is in trouble. Even if earnings do begin to flatten or drop, the bank’s strong dividend yield of around 3% provides a solid foundation for long-term investors to build on.

Ultimately, JP Morgan Chase has a proven track record of delivering value to shareholders. With a robust business model, consistent dividend growth, and a strong management team, it is well-positioned to continue delivering impressive returns for many years.

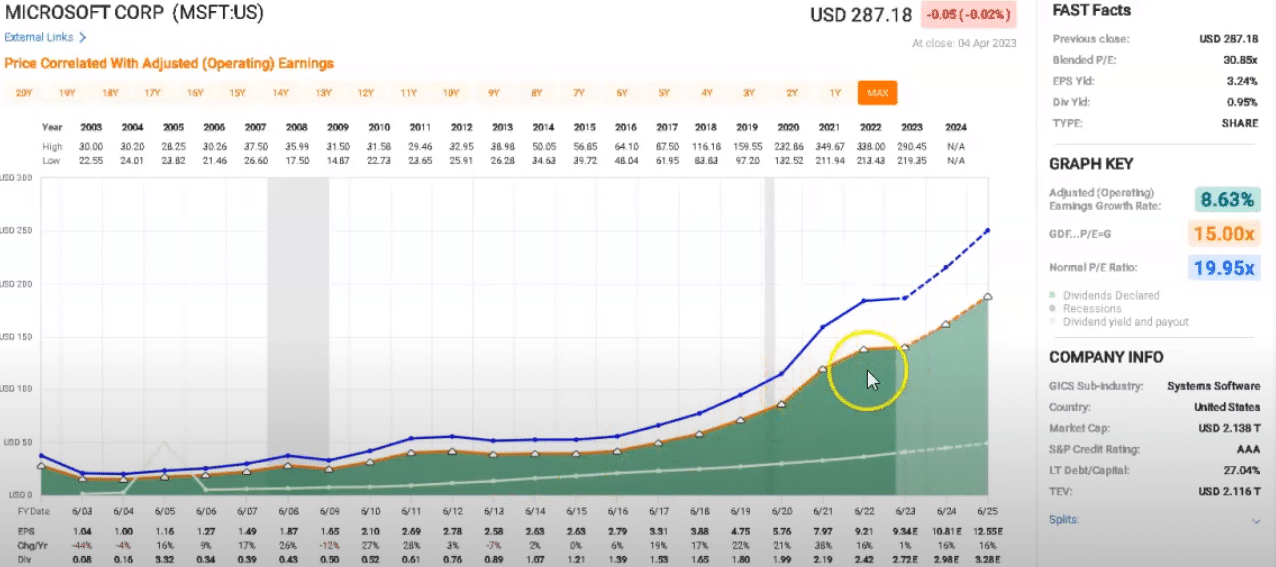

Microsoft – steady growth in blue-chip stocks

Microsoft has a solid track record of success, making it a great option for investors looking for a reliable long-term investment. One of the world’s top blue-chip stocks in terms of credit rating, Microsoft boasts a Triple A rating, with only Johnson & Johnson being the only other company to hold the same rating. The company has also shown a solid track record of dividend growth over the years, although its dividend yield is relatively low, sitting at just under one percent.

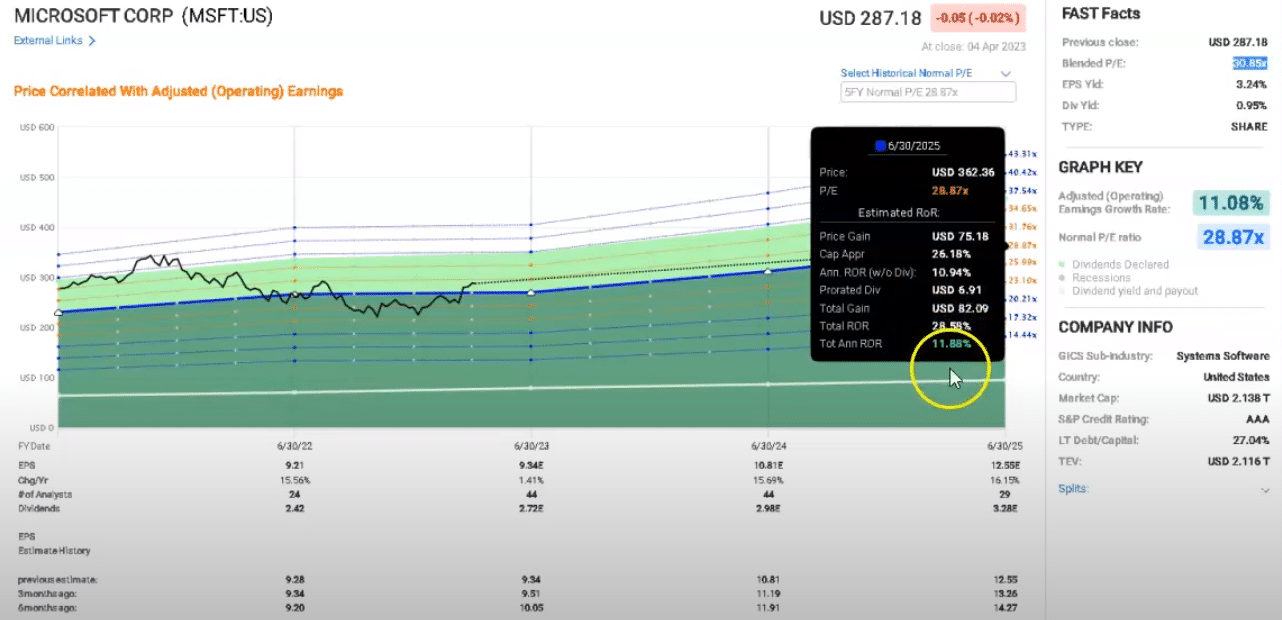

Analyst estimates show that Microsoft is expected to see a 15 percent improvement in earnings in the 2024 financial year, with a further 16 percent improvement expected in the 2025 financial year. They have revised these estimates downward over the last six months so that the current price may look quite elevated. However, historically, Microsoft has usually traded at around 28 times price to earnings ratio, making it more attractive to investors looking for suitable blue-chip stocks.

Currently, Microsoft is trading at 30 times the price-to-earnings estimate, which may be a bit rich for some investors. Investors expect continued strong growth, so the price-to-earnings ratio is relatively high. If the company’s earnings and prices work out over the next few years, investors could look at a total rate of return of about 28 percent or an annualized rate of return of 12 percent, a reasonable return when we consider blue-chip stocks.

However, there is some downside risk, as the current price is much higher than the blue line representing the historical 20 times price to earnings ratio. If prices were to return to this ratio in the next several years, investors might take a small loss by the end of the 2025 financial year, even after considering the dividends.

Microsoft is one of the strong blue-chip stocks with excellent growth potential, but investors should carefully consider the price before investing. With a solid track record and a Triple-A credit rating, Microsoft is a great long-term investment option for those willing to weather potential price fluctuations. At the right entry price, it could be a powerful compounder and create strong dividend snowball.

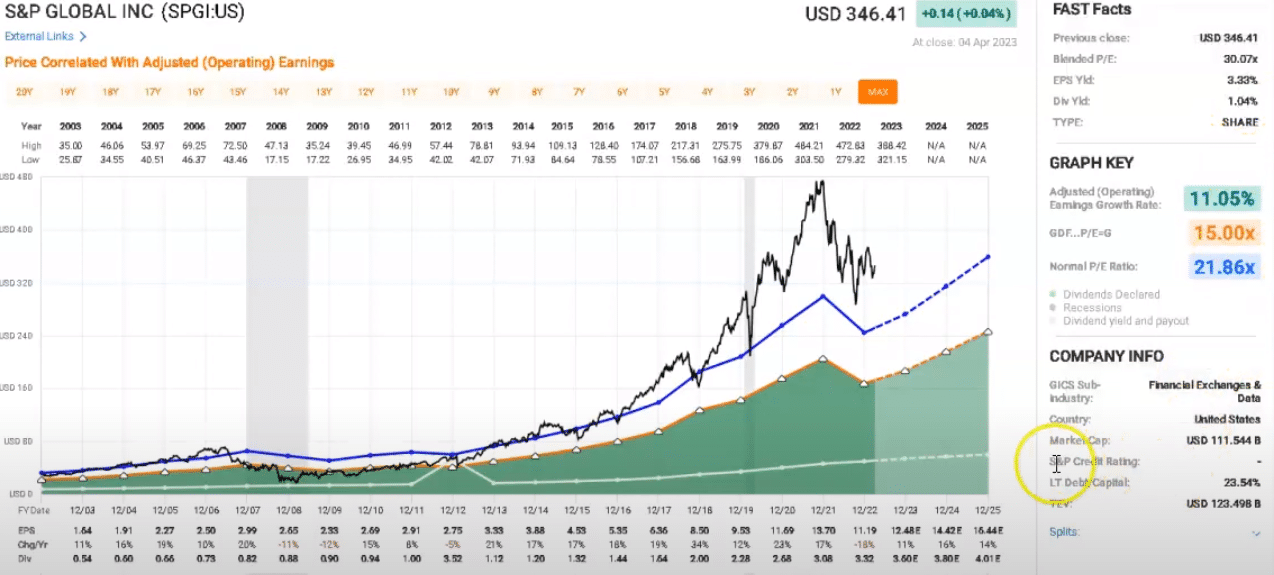

S&P Global – a fabulous pick amongst the blue-chip stocks

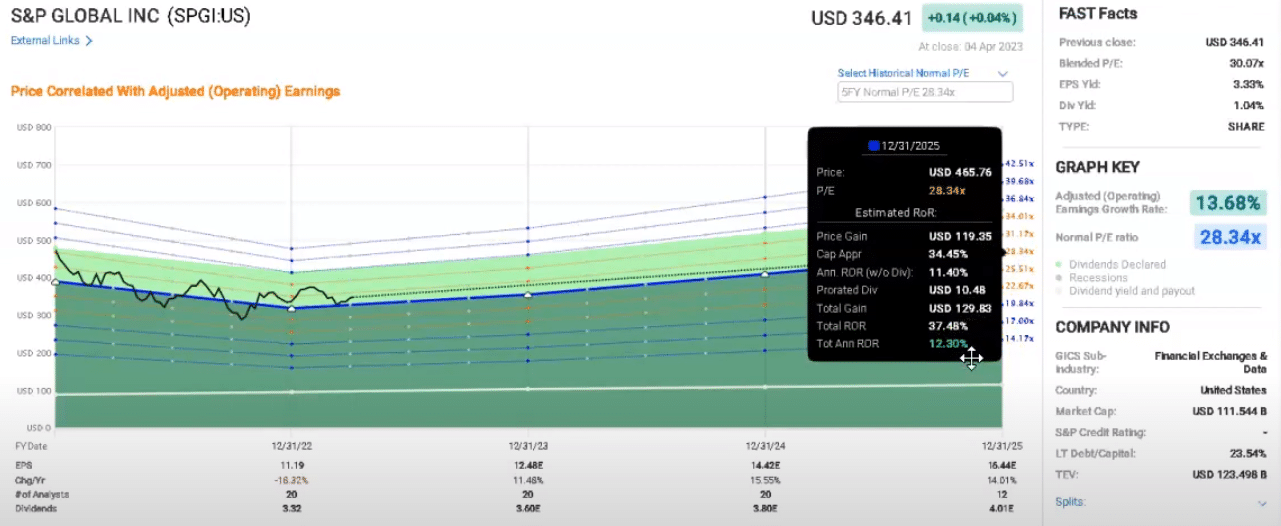

Another of the blue-chip stocks on my radar is S&P Global, which has a dividend yield of about 1%. In recent years, the company has shown strong dividend increases. The analysts’ expectations for S&P Global are also high. The company has had an exceptional scorecard over the last two years, with the analysts getting it right most of the time and the company beating expectations about one in six times. However, it is trading at a very high 30 times PE, which is a concern.

When we look forward, assuming prices remain at that level and the analyst estimates for earnings are accurate, we’re talking about a total rate of return of about 38% over the next several years or an annualized rate of return of about 12%. However, the analysts have been revising down the estimates for earnings over the last six months for each of these years forward. Essentially, this means that the blue line would have been dropping downwards, and if we had done this calculation six months ago, it probably would have looked like a much healthier rate of return. This reflects the relatively high-priced earnings multiple here and those relatively volatile earnings estimates, pricing strong 11%, 15%, and 14% annualized growth for each year.

If earnings drop, we’ll be left exposed potentially with quite a high PE stock that could fall a reasonable amount of the way down. If it returns to a 20 times price-to-earnings multiple, which is a reasonable benchmark for a long-term growth stock, we’re talking about a total rate of return of -3%. This is just because if growth drops, prices could reduce, and these earnings can also reduce substantially over the next several years, all of which are possible even when looking at blue-chip stocks.

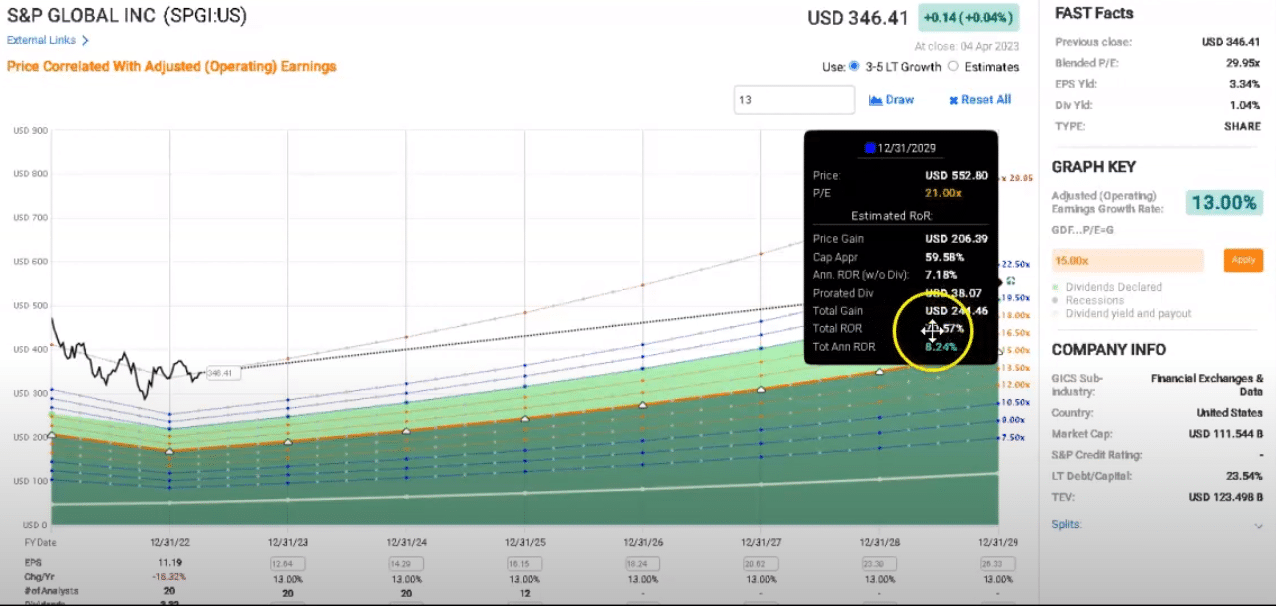

However, the analysts’ expectations for S&P Global are quite high, with some expecting a very strong long-term growth rate of about 28% per year. While this is an impressive figure, I’m dubious about seeing a large company growing that much that fast and that consistently. A more reasonable estimate would be about 13% annualized growth over the next five years, as suggested by analysts’ reports on Yahoo Finance (a different group of analysts than FastGraphs uses).

If S&P Global can achieve this 13% per year over five years, you might capture some strong total returns even at the current elevated price. Although, it does slip down to a relatively low single-digit total annualized rate of return.

In conclusion, both Microsoft and S&P Global are strong companies, but the current high valuations and PE ratios present some downside risks. It’s essential to take a more conservative approach and be mindful of the potential for earnings to drop off and prices to reduce substantially over the next several years. Keep a close eye on analyst estimates and expectations, and remember that long-term success in investing requires patience and discipline.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.