Unveiling the Potential of REITs: 3 High Yield and Growth Opportunities

Diving Deeper into the Lucrative World of REIT Dividends Are you ready to unlock a treasure trove of income-generating assets? Real Estate Investment Trusts (REITs) stand as a beacon for investors craving steady streams of income with the added potential for capital appreciation to grow your dividend snowball. Buckle up as we take you on a thrilling ride through the realm of REITs, where the promise of robust dividends awaits!

First up, let’s talk about Arbor Realty. This isn’t your average REIT—think of it as the hidden gem within the bustling real estate market. Known for its high-yield dividends, Arbor Realty is a powerhouse when it comes to delivering impressive returns. If you’re looking for an investment that could provide a significant income boost, this might just be your golden ticket!

But wait—there’s more! We also have Crown Castle and Realty Income in our arsenal. These two are like the dynamic duo of the REIT world. Crown Castle shines bright in the digital infrastructure space, offering a dividend that’s as sturdy as the cell towers and fiber networks it owns. On the flip side, Realty Income, fondly known as “The Monthly Dividend Company,” provides investors with a reliable income flow that could make every month feel like Christmas!

Last but certainly not least, let’s zoom in on Rexford Industrial Realty. This is where growth meets opportunity for total returns. Rexford is making waves in the industrial real estate sector, focusing on infill markets in Southern California. If you have an appetite for a REIT with a high dividend growth rate, Rexford could be the ace in your investment portfolio. Imagine being part of the bustling e-commerce logistics, thriving amidst wireless communication advancements, or capitalizing on the ever-growing demand for residential and commercial spaces.

With these three REITs, you’re not just investing; you’re positioning yourself at the forefront of real estate innovation and growth. So, are you ready to take the plunge into the enticing waters of REIT investing? Whether you’re in it for the high yields or the promising dividend growth, these options provide a canvas for you to paint your financial future. Stay tuned, as we will dive into each of these opportunities in detail, helping you make informed decisions that could lead to financial prosperity beyond your wildest dreams! Join us on this journey and let’s transform your investment portfolio into a fountain of wealth with REITs!

High Yield Opportunities: Arbor Realty

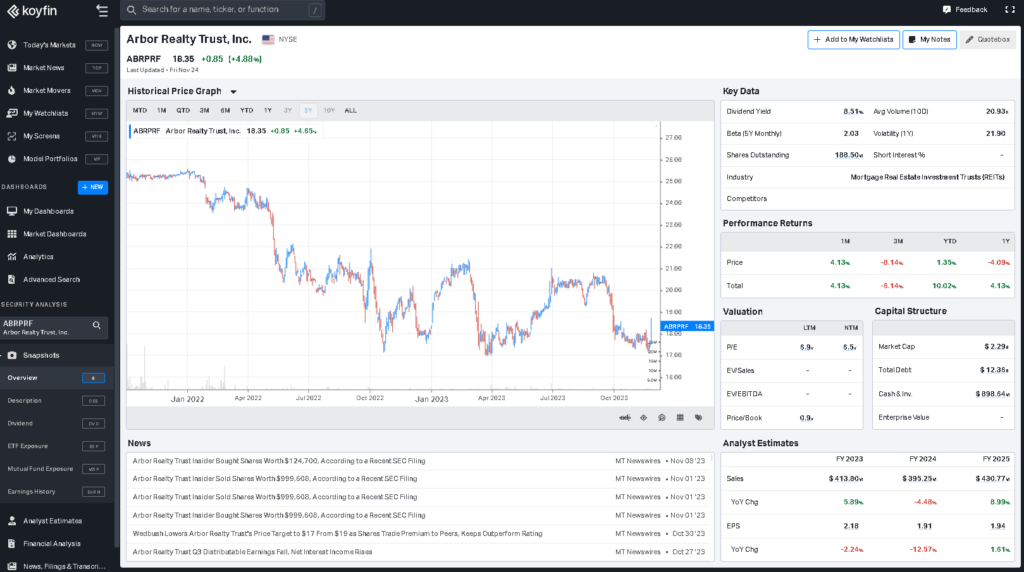

Arbor Realty (ABR), with its current share price at US$12 and a notable dividend yield surpassing 13%, emerges as a compelling choice for investors focused on income generation. This high dividend yield significantly exceeds the average found in the broader market, making it particularly appealing for those seeking steady cash flows. Furthermore, Arbor Realty’s commendable history of surpassing analyst expectations suggests a robust operational performance, which is a positive indicator for future dividends.

The company’s ability to maintain and potentially increase dividends can be attributed to several factors. Firstly, it may have a strong balance sheet with sufficient cash flow to support its dividend payments, indicating financial health and stability. Secondly, the company’s management could be committed to returning value to shareholders, signaling confidence in the business’s prospects. However, investors should consider that analysts anticipate a potential earnings decline of roughly 15% by 2024. This projected decrease might raise concerns about the sustainability of such high dividends in the long term. Despite this, the total estimated annualized rate of return, including dividends and potential capital appreciation, is quite attractive at 28%. This figure suggests that even with the expected earnings drop, the investment could still yield substantial returns for investors.

Arbor Realty stands out as a potentially lucrative investment for those prioritizing current dividend yield due to its impressive dividend rate, track record of performance, and promising rate of return estimate. Investors should weigh these benefits against the risks associated with the projected earnings dip and assess their own risk tolerance and investment goals when considering adding Arbor Realty to their portfolios.

For investors seeking stability, Arbor Realty also offers a preferred stock option with an 8.5% dividend yield and potential price appreciation.

why might you look at Preferred Stock rather than Common Stock? Preferred stocks can be a valid choice for investors heading into a recession for several reasons:

- Stable Dividends: Preferred stocks typically offer higher dividend yields compared to common stock, and these dividends are generally more secure. The 8.5% dividend yield from Arbor Realty’s preferred stock can provide a steady income stream, which is particularly attractive during economic downturns when other types of investments might cut or suspend dividends.

- Dividend Priority: In the event of bankruptcy or liquidation, preferred shareholders are paid out dividends before common stockholders. This feature provides an additional layer of security during uncertain economic times.

- Potential for Price Appreciation: While preferred stocks are generally less volatile than common stocks, they still hold the potential for price appreciation. During a recession, if the issuing company remains strong and keeps making dividend payments, the preferred stock could become more attractive to investors, potentially driving up its price.

- Interest Rate Sensitivity: Preferred stocks often behave similarly to bonds, which means they can be sensitive to changes in interest rates. However, during a recession, interest rates typically decrease as a measure to stimulate the economy. If rates are cut, the fixed dividend yield from preferred stocks becomes more attractive compared to newer issues, which may offer lower yields.

- Tax Advantages: In some cases, dividends from preferred shares are taxed at a lower rate compared to income from bond interest, providing a tax-efficient income source for investors. See a professional for tax help!

Balanced Choices: Crown Castle and Realty Income

For investors looking for a balanced approach, Crown Castle and Realty Income provide compelling options. Both REITs offer a dividend yield of approximately 6% and possess a good track record of growing their adjusted funds from operations (AFFO).

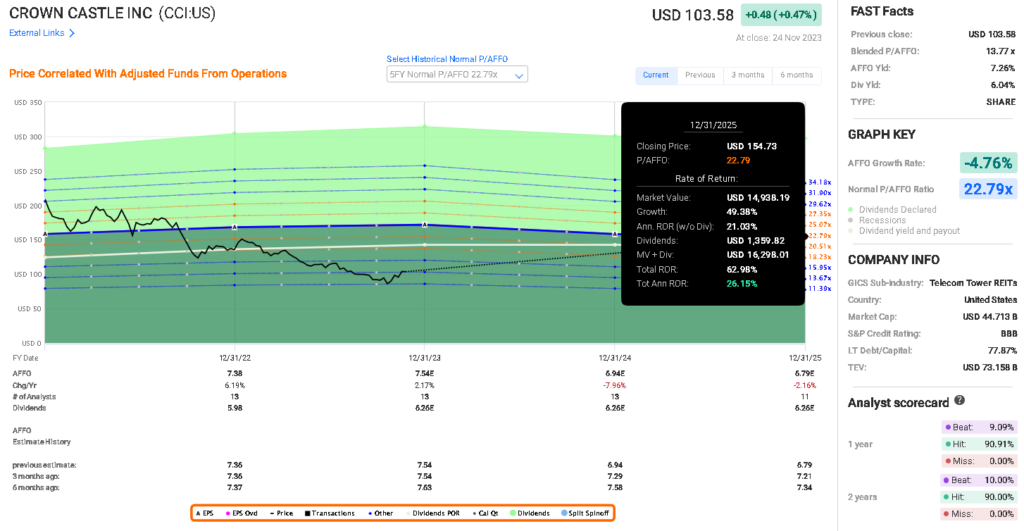

Crown Castle (CCI) stands out as a stellar option for investors seeking a harmonious blend of current yield and potential for dividend growth. As an infrastructure provider for wireless communications, including cell towers and fiber networks, Crown Castle operates in a sector that is both essential and expanding, with the relentless growth of mobile data and the advent of 5G technology acting as tailwinds. The company’s Triple B S&P credit rating underscores its financial health and provides investors with confidence in its ability to meet its debt obligations. Additionally, the approximately 6% dividend yield is not only attractive in the current yield landscape but also sustainable given Crown Castle’s history of consistent AFFO growth. This track record is crucial as it supports continuous dividend increases, contributing to the total return for shareholders. With a robust 26% total annualized rate of return by the end of 2025 (based on multiple expansion and analysts’ AFFO projections), Crown Castle represents a compelling investment for those prioritizing both immediate income and dividend growth prospects.

Moreover, Crown Castle’s investment appeal is magnified by its strategic positioning within the telecommunications infrastructure space. The company owns a vast portfolio of more than 40,000 cell towers and approximately 80,000 route miles of fiber supporting small cells and fiber solutions. This extensive network is crucial for telecom operators as they expand and upgrade their services, ensuring a steady demand for Crown Castle’s assets. The long-term leases with built-in rent escalators further enhance the company’s revenue stability and visibility, which is pivotal for sustaining and growing dividends over time. This combination of a solid asset base, contractual revenue security, and the essential nature of its services makes Crown Castle a prime candidate for investors looking to balance immediate yield with future growth, setting the stage for potentially lucrative total returns in the medium to long term.

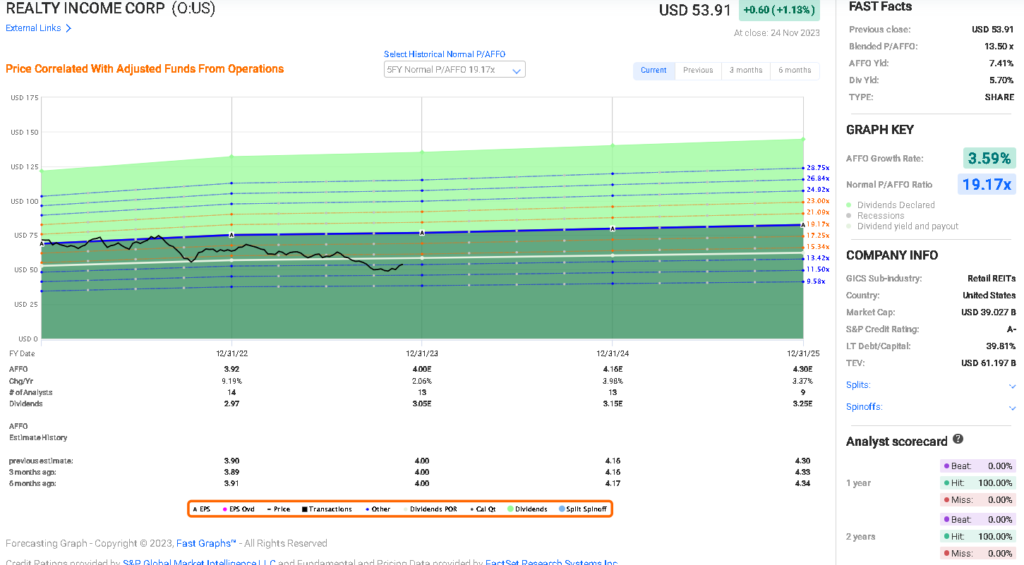

Realty Income’s A- rating by S&P signifies a strong creditworthiness, implying lower risk for investors. The company’s history of exceeding analyst estimates suggests a robust and well-managed operation, indicating that the management team is adept at navigating market conditions and generating shareholder value. The projected 4% annual increase in Adjusted Funds From Operations (AFFO) demonstrates confidence in the company’s ability to grow its cash flows, which is fundamental for a real estate investment trust (REIT) since it can lead to consistent dividend payouts. Additionally, the estimated total annualized return of 27% presents a compelling opportunity for both capital appreciation and income, making Realty Income an attractive investment choice for those seeking both growth and stability in their portfolio.

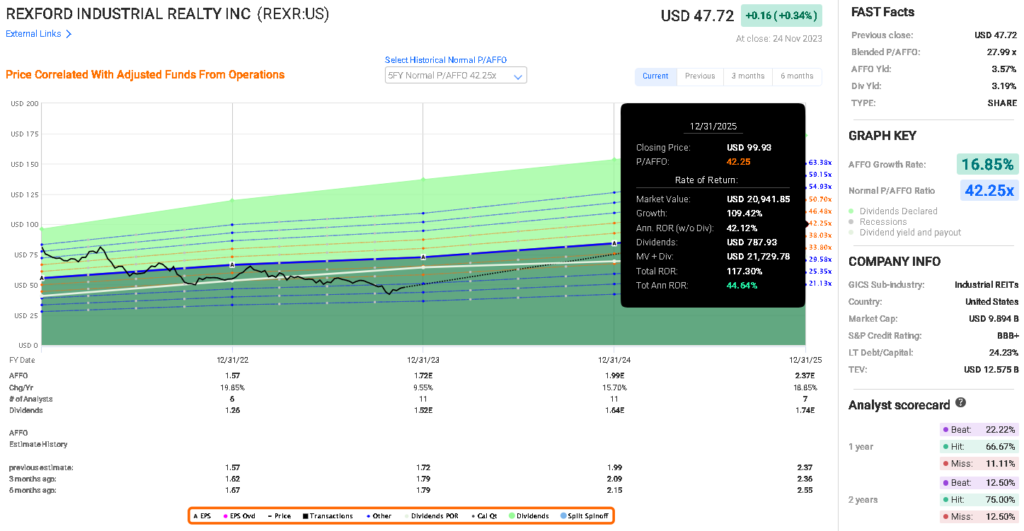

High Dividend Growth Opportunities: Rexford Industrial Realty

Dividend growth investing is a strategy that has long been favored by investors seeking both income and capital appreciation. Companies like Rexford Industrial Realty (REXR), which cater to this investment philosophy, offer a compelling blend of potential for increasing payouts and stock price gains. The allure of dividend growth lies in the power of compounding, as reinvested dividends purchase more shares, which in turn can generate additional dividends. This cycle can significantly enhance an investor’s total return over time. Moreover, companies that consistently grow their dividends are often financially healthy with strong cash flows, suggesting they are well-positioned to weather economic downturns and still deliver shareholder value.

Rexford’s solid S&P credit rating underscores the company’s financial stability, a reassuring factor for investors who prioritize security alongside growth. The company’s history of meeting or exceeding financial expectations paints a picture of a reliable management team adept at navigating market fluctuations. Forward-looking projections indicating substantial AFFO (Adjusted Funds From Operations) gains in the next two years suggest that Rexford is poised for continued success. For investors, this translates into not just a steady income stream through dividends but also the potential for capital appreciation. As the market recognizes the company’s growth and rewards it with a higher share price, investors could see their holdings increase in value, thereby boosting the total annualized rate of return. This dual benefit is the hallmark of dividend growth investing and what makes options like Rexford particularly attractive to discerning investors.

Conclusion

REITs can be valuable assets for dividend-focused investors, providing a steady stream of income and potential capital appreciation. In this blog post, we explored three REITs that cater to different investment objectives. Arbor Realty offers high dividends, Crown Castle and Realty Income strike a balance between income and growth, and Rexford Industrial Realty presents an opportunity for high dividend growth. As always, it’s crucial to conduct thorough research and consider individual investment goals and risk tolerance before making any investment decisions. With the diverse array of REIT options available, investors can find opportunities that align with their specific needs.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.