Pharmaceuticals are the backbone of modern medicine, providing essential treatments and cures for a wide range of illnesses. From life-saving cancer drugs to everyday painkillers, the pharmaceutical industry has made incredible strides in improving our health and well-being. Learn to capitalize on this with a pharmaceutical dividend snowball!

As investors, we have the opportunity to not only support this important work, but also reap the rewards of a growing industry.

Investing in pharmaceutical stocks can be a lucrative way to build a healthy dividend snowball, but it requires a solid understanding of the industry and a careful evaluation of the companies involved.

In this article, we will explore the promise of pharmaceuticals and the benefits of investing in this dynamic sector. We will also delve into the risks and challenges of investing in pharmaceuticals, and offer tips for successful investing.

So, join us as we explore the world of pharmaceuticals and discover how you can build a healthy pharmaceutical dividend snowball with pharma stocks.

Key Takeaways

- Pharmaceutical stocks offer stable and long-term dividends, making them attractive for investors.

- Investing in pharmaceuticals involves monitoring factors such as the regulatory environment, drug pipeline, and competition, as well as financial health.

- Diversifying a pharmaceutical portfolio can help mitigate risk, and spreading investments across multiple companies is recommended.

- Staying informed about industry news and developments is crucial for successful investing, as the high failure rate of clinical trials and regulatory changes can impact drug approval and marketability.

The Importance of Pharmaceuticals in Modern Medicine

Pharma plays a vital role in modern medicine by providing treatments and medications that improve the quality of life. From antibiotics to vaccines to painkillers, pharmaceuticals have become an integral part of our lives.

Thanks to these drugs, we can treat diseases, manage chronic conditions, and even prevent illnesses altogether. Without pharmaceuticals, many of us would be left helpless and suffering.

Pharmaceutical companies invest billions of dollars in research and development to create new, more effective drugs. They conduct clinical trials to ensure that these drugs are safe and effective, and they work closely with regulatory agencies to bring new treatments to market.

This is a lengthy and expensive process, but it’s necessary to ensure that patients receive the best possible care. Pharmaceuticals have also given us hope for the future. Breakthroughs in gene therapy, for instance, could offer a cure for diseases that were once thought to be untreatable.

Moreover, the COVID-19 pandemic has highlighted the importance of pharmaceuticals in our lives. The vaccines developed by pharmaceutical companies have allowed us to control the spread of the virus and save countless lives.

Investing in pharmaceuticals is a smart move for those who want to build a healthy pharmaceutical dividend snowball. The industry is stable and predictable, and many pharmaceutical companies offer high dividend yields. Moreover, as the demand for drugs continues to rise, pharmaceuticals are likely to remain a profitable investment.

By investing in pharmaceutical stocks, you can not only build a healthy portfolio but also contribute to the development of life-saving drugs.

The Benefits of Investing in a Pharmaceutical Dividend Snowball

Investing in the healthcare sector can bring impressive returns, particularly in the field of medicine where research and development advancements can lead to life-changing breakthroughs. One key area in healthcare that has consistently been profitable is the pharmaceutical industry.

This sector is responsible for developing drugs and medications that help cure diseases and alleviate suffering. As such, it is an essential component of modern medicine. Investing in pharmaceutical stocks can provide investors with long-term and stable dividends.

Pharmaceutical companies are known for their consistent cash flows, which makes them ideal for dividend investors. These companies often have strong balance sheets, and their products are highly regulated, which means they have less exposure to market volatility. Moreover, the demand for pharmaceuticals is likely to remain high, given the growing global population and the increasing prevalence of chronic diseases. This makes pharmaceutical stocks an attractive long-term investment option.

Investing in pharmaceutical stocks requires a thorough understanding of the industry and the various factors that drive its growth. Some of the key factors that affect pharmaceutical companies’ performance include the regulatory environment, the pipeline of drugs under development, and the competition in the market.

Moreover, investors need to monitor the financial health of the company, including its revenue growth, margins, and cash flows. By staying informed about these factors, investors can make informed decisions about their investment strategy.

Investing in pharmaceutical stocks can be a smart investment choice for those looking for long-term and stable returns. The industry’s consistent cash flows, strong balance sheets, and high demand for its products make it an attractive investment option. However, it is crucial to understand the industry’s nuances and keep abreast of the various factors that drive its growth. By doing so, investors can build a healthy pharmaceutical dividend snowball with pharmaceutical stocks. Understanding the pharmaceutical industry and its drivers is the key to making smart investment decisions in this sector.

Understanding the Pharmaceutical Industry

As you explore the world of medicine, you’ll find that the pharmaceutical industry is one of the most fascinating and important areas to understand. It encompasses the development, production, and distribution of drugs and other medicinal products that are essential to maintaining human health.

The industry is highly regulated and constantly evolving, with new advancements in science and technology leading to innovative treatments and therapies. At its core, the pharmaceutical industry is driven by research and development. Companies invest heavily in discovering and testing new drugs, with the hopes of bringing them to market and improving patients’ lives.

This process can take years and cost billions of dollars, with no guarantee of success. However, successful drugs can generate significant profits for companies, leading to a strong return on investment. The pharmaceutical industry also plays a crucial role in the global economy. It creates jobs, spurs innovation, and contributes to the overall health and well-being of society.

As such, it is an attractive area for investors looking to build a healthy pharmaceutical dividend snowball. However, investing in pharmaceutical stocks requires a thorough understanding of the industry, as well as an evaluation of individual companies’ financials, pipelines, and management teams.

As we move into the next section, it’s important to keep in mind the complexities of the pharmaceutical industry and the potential risks and rewards of investing in it. By evaluating pharmaceutical companies with a critical eye, we can make informed decisions that help us build a strong and sustainable portfolio.

Evaluating Pharmaceutical Companies

You’ll need to take a closer look at the nuts and bolts of the companies you’re considering if you want to invest wisely in the world of medicine. Here are three key factors to evaluate when assessing pharmaceutical companies:

- Pipeline: A strong pipeline of drugs in development is crucial for the long-term success of a pharmaceutical company. Look for companies with a diverse portfolio of drugs in various stages of development. This will ensure that they have a steady stream of potential blockbusters that could drive future growth.

- Financials: As with any stock, you’ll want to examine the financial health of the company before investing. Look at factors such as revenue growth, profitability, debt levels, and cash flow. You’ll want to see a history of steady growth and a balance sheet that’s not too heavily leveraged.

- Competitive Advantage: The pharmaceutical industry is highly competitive, so it’s important to invest in companies with a strong competitive advantage. This could mean having a patent on a blockbuster drug, a unique manufacturing process, or a strong brand name. A sustainable competitive advantage will help a company maintain its market share and fend off competition.

Assessing these factors will help you make more informed decisions when choosing which pharmaceutical companies to invest in. Remember that the industry is constantly evolving, so it’s important to keep up with the latest developments and news.

Now that you have a better understanding of how to evaluate pharmaceutical companies, it’s important to think about diversifying your portfolio. This will help mitigate risk and provide more stable returns over the long-term.

In the next section, we’ll explore some strategies for diversifying your pharmaceutical portfolio.

Diversifying Your Portfolio for a strong Pharmaceutical Dividend Snowball

If you want to maximize your chances of success in the world of medicine, it’s time to start thinking about how to diversify your portfolio. Pharmaceutical companies can offer great returns, but they also carry a certain amount of risk. By spreading your investments across multiple companies, you can help mitigate that risk and increase your chances of long-term success.

To start diversifying your portfolio, consider investing in companies that operate in different areas of the pharmaceutical industry. The table below provides some examples of different areas of focus and the companies that operate within them. By investing in companies that operate in different areas, you can help ensure that your portfolio is not overly reliant on any one sector.

| Area of Focus | Pharmaceutical Dividend Snowball Company |

|---|---|

| Oncology | Roche Holding AG |

| Immunology | Johnson & Johnson |

| Neurology | Biogen Inc. |

| Vaccines | Pfizer Inc. |

| Generics | Teva Pharmaceutical Industries Ltd. |

Another way to diversify your portfolio is to invest in companies of different sizes. Large pharmaceutical companies like Pfizer and Johnson & Johnson may offer stability and consistent dividends, but smaller companies may offer greater growth potential. By investing in a mix of both large and small companies, you can balance stability and growth potential.

Consider investing in companies that operate in different geographic regions. While many pharmaceutical companies are based in the United States and Europe, there are also companies operating in Asia, Latin America, and other regions. By investing in companies based in different regions, you can help spread your investments across different economies and reduce your exposure to any one country’s economic risks.

In conclusion, diversifying your pharmaceutical portfolio is key to maximizing your chances of success in this industry. By investing in companies with different areas of focus, sizes, and geographic locations, you can help mitigate risk and increase your chances of long-term success. However, there are still risks and challenges to investing in pharmaceuticals, which we will explore in the next section.

Risks and Challenges of Investing in Pharmaceuticals

As investors, we need to be aware of the risks and challenges associated with investing in pharmaceuticals. One of the biggest challenges is the high failure rate of clinical trials, which can lead to significant losses, and could destroy a growing pharmaceutical dividend snowball.

In addition, regulatory changes can impact the approval and marketability of drugs, while intellectual property disputes can lead to costly legal battles that can halt a pharmaceutical dividend snowball. Therefore, it’s essential to carefully evaluate pharmaceutical investments and consider these potential risks before investing.

Clinical Trial Failures

Don’t let clinical trial failures discourage you, because even the most successful pharma companies experience setbacks. A strong success could boost a pharmaceutical dividend snowball. In fact, approximately 90% of drugs that enter clinical trials fail to make it to market. However, it’s important to note that not all clinical trial failures are equal.

Here are four things to keep in mind when evaluating clinical trial failures:

- Understand the reason for the failure: Was it due to safety concerns, lack of efficacy, or other reasons? Knowing the specific reason can help determine if the drug has potential for success in the future.

- Evaluate the rest of the pipeline: A single clinical trial failure does not necessarily mean the entire pipeline is doomed. Look at the company’s other products in development and their potential for success.

- Consider the competition: Is the company’s drug competing with similar drugs already on the market? If so, it may be more difficult to gain regulatory approval.

- Look at the company’s financials: Does the company have enough cash reserves to continue development of the drug, or will they need to raise additional funds?

With these considerations in mind, investors can make informed decisions about whether to hold on to a stock or sell after a clinical trial failure. Moving forward, it’s important to understand the potential impact of regulatory changes on the pharmaceutical industry.

Transitioning to the next section, regulatory changes have the potential to shift the landscape of pharmaceutical investing.

Regulatory Changes

Get ready for some big changes in the pharmaceutical industry, because regulatory changes are shaking things up. The Food and Drug Administration (FDA) has been increasing scrutiny on drug approvals, and the European Medicines Agency (EMA) has been implementing new regulations on clinical trials.

This means that pharmaceutical companies are facing more hurdles in getting their drugs approved and on the market, making the contribution to a pharmaceutical dividend snowball important. However, these regulatory changes could also lead to more transparency and accountability in the industry.

The FDA is pushing for more data sharing and the EMA is requiring more rigorous testing. This could ultimately lead to safer and more effective drugs being brought to market.

As investors, it’s important to stay up-to-date on these regulatory changes and how they may impact pharmaceutical stocks. As we move into the next section about ‘intellectual property disputes’, it’s important to note that regulatory changes are just one piece of the puzzle when it comes to investing in pharmaceuticals.

Understanding the industry as a whole, including clinical trial successes and failures, as well as intellectual property disputes, can help us make informed decisions about which pharmaceutical stocks to invest in.

Intellectual Property Disputes

The pharmaceutical industry is currently dealing with intellectual property disputes, which can greatly impact the success of individual companies. These disputes often arise when a company’s patent for a particular drug is challenged by a competitor or when a generic version of the drug is introduced into the market.

The implications of these disputes are significant, as they can lead to a loss of revenue for the company and a decrease in investor confidence. As investors, it’s important to stay up-to-date on any ongoing intellectual property disputes in the pharmaceutical industry.

By doing so, we can make informed decisions about which companies to invest in and when to sell our shares. Additionally, it’s important to consider the potential impact of these disputes on the company’s long-term growth and profitability.

In the next section, we’ll discuss some tips for successful investing in the pharmaceutical industry.

Tips for Successful Investing

As investors, we need to stay informed about the market trends and the performance of our investments. This involves keeping up with the latest news, financial reports, and industry developments.

Patience and discipline are also crucial for successful investing, as the market can be unpredictable and volatile. It’s important to have a long-term thinking approach and not get caught up in short-term fluctuations, but rather focus on the fundamentals of our investments.

Staying Informed

Stay informed about the latest developments in the pharmaceutical industry by regularly checking reliable sources to maximize your potential for long-term dividends.

As an investor, it’s crucial to keep up with the industry news. This includes new drug approvals, clinical trial results, and mergers and acquisitions. This information can help you make informed decisions about which companies to invest in and when to buy or sell stocks.

One way to stay informed is to follow reputable pharmaceutical news sources, such as FierceBiotech, STAT News, and BioPharma Dive. These sources provide up-to-date information, insights, and analysis on the industry’s latest developments.

Additionally, attending industry conferences and events can give you a firsthand look at the latest advancements and emerging trends.

By staying informed, you can make informed decisions and build a solid portfolio that can generate long-term dividends. Remember that patience and discipline are key traits to have as an investor. By staying patient and disciplined, you can weather market fluctuations and make rational, strategic decisions that will benefit your portfolio in the long run.

Patience and Discipline

Holding onto your investments can be like tending a garden, requiring patience and discipline to nurture them over time. When it comes to pharmaceutical stocks, it’s important to remember that their value can fluctuate based on a variety of factors, including regulatory changes and clinical trial results. However, if you’ve done your research and chosen a solid company with a promising pipeline, it’s worth holding onto your investment through the ups and downs.

Here are three tips for practicing patience and discipline with your pharmaceutical investments:

- Set a long-term goal and stick to it. Don’t let short-term market fluctuations sway your investment decisions.

- Stay informed about your company’s progress and any changes in the industry. This will help you make informed decisions and avoid knee-jerk reactions.

- Resist the urge to constantly check the stock price. It can be tempting to obsess over daily fluctuations, but this can lead to unnecessary stress and potentially poor decision-making. Instead, focus on the bigger picture and trust in your investment strategy.

As we look towards the future, it’s important to remember that pharmaceutical stocks are a long-term investment. By practicing patience and discipline, we can build a healthy pharmaceutical dividend snowball and reap the rewards of our investments in the years to come.

Long-Term Thinking for a Pharmaceutical Dividend Snowball

As we discussed earlier, patience and discipline are crucial when investing in pharmaceutical stocks. However, they are not the only keys to success. Long-term thinking is equally important when building a healthy pharmaceutical dividend snowball with pharma stocks.

When we talk about long-term thinking, we mean an investment strategy that focuses on the future growth potential of a company. This approach requires that we look beyond the short-term fluctuations in stock prices and instead focus on the company’s fundamentals. To illustrate this point, let’s take a look at the following table:

| Pharmaceutical dividend snowball candidate | Dividend Yield | P/E Ratio |

|---|---|---|

| Pfizer | 4.4% | 7.8 |

| Johnson & Johnson | 2.8% | 16.2 |

| Merck & Co. | 2.65% | 22 |

As you can see, each of these companies offers a dividend yield that is higher than the average yield for the S&P 500. Additionally, they all have a relatively low P/E ratios, which suggests that the market may be undervaluing them. By focusing on these fundamentals, we can see that these companies have the potential for long-term growth and are likely to continue paying dividends for years to come. By taking a long-term approach, we can build a strong and resilient pharmaceutical dividend snowball.

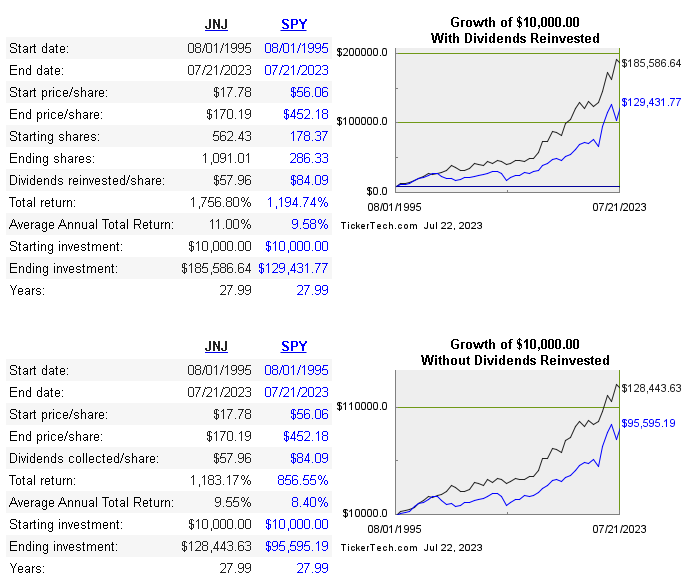

A fabulous case is Johnson & Johnson (JNJ). A long-term investor creating a pharmaceutical dividend snowball here has fantastic long-term appreciation and income growth, resulting in a portfolio that is larger than if they had instead invested in the S&P500 and with greater income at the same time.

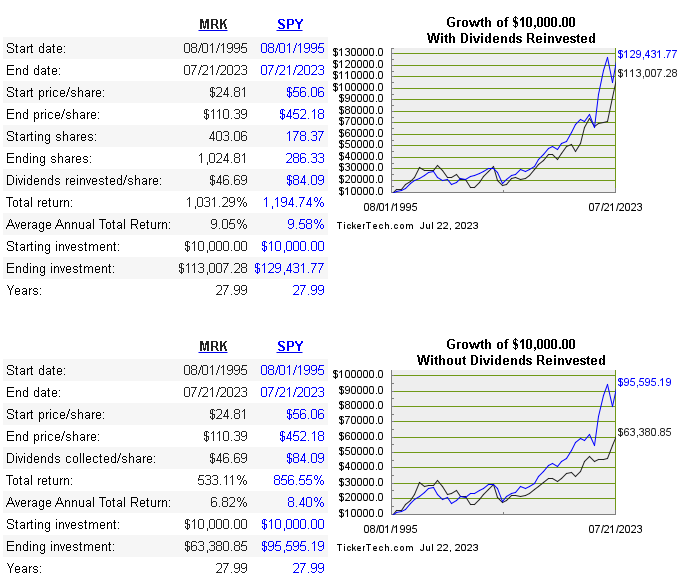

Not all long-term candidates for a pharmaceutical dividend snowball work as well as JNJ! Consider, for example, the case of Merk (MRK). It more-or-less follows the S&P500 results, over time, when dividends are re-invested. At the end, however, it has a similar portfolio value but substantially more income available to the investor.

Frequently Asked Questions about the pharmaceutical dividend snowball

How does the pharmaceutical industry impact healthcare costs and accessibility?

The pharmaceutical industry’s impact on healthcare costs and accessibility is complex. While drug development can increase costs, it can also lead to better treatments and cures. Access to medications can also be improved through insurance coverage and government programs.

What is the process for obtaining FDA approval for a new drug?

To obtain FDA approval for a new drug, the drug must go through rigorous clinical trials to prove its safety and effectiveness. For example, the COVID-19 vaccine went through three phases of clinical trials before receiving emergency use authorization. The approval process is necessary to ensure public safety and prevent harmful drugs from entering the market.

How do patent laws affect the profitability of pharmaceutical companies?

Patent laws provide pharmaceutical companies with exclusive rights to produce and sell their drugs, allowing them to charge higher prices. This leads to increased profitability and dividends for shareholders, making pharmaceuticals an attractive investment option.

What are some of the ethical considerations related to investing in pharmaceutical stocks?

When investing in pharmaceutical stocks, we must consider the ethical ramifications of profiting from medicine. As the saying goes, “with great power comes great responsibility,”and we must ensure that our investments align with our values and contribute to a healthier world.

How do global economic and political factors impact the pharmaceutical industry?

Global economic and political factors can greatly impact the pharmaceutical industry. Changes in regulations, trade agreements, and economic conditions can affect market demand, pricing, and profitability. It is important to monitor these factors when investing in pharma stocks.

Conclusion

In conclusion, investing in pharmaceutical stocks can be a great way to build a healthy pharmaceutical dividend snowball. The pharmaceutical industry plays a vital role in modern medicine, and its importance is only expected to grow in the coming years. By investing in pharmaceutical companies, investors can benefit from the industry’s growth potential, as well as from the steady stream of revenue generated by drug sales.

However, it’s important to remember that investing in pharmaceuticals isn’t without risks and challenges. Investors must carefully evaluate companies, diversify their portfolios, and stay up-to-date on industry news and developments. Yet, with the right approach, investing in pharmaceuticals can be a rewarding and lucrative venture.

So, if you’re looking to build a healthy pharmaceutical dividend snowball, consider adding some pharmaceutical stocks to your portfolio.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.