Introduction to Canadian National Railroad (CNI)

As dividend investors seek stable and reliable sources of income, one often overlooked sector is the railroad industry. Among the top contenders in this industry is Canadian National Railroad (CN, CNI ticker on NYSE), a company that has consistently delivered strong financial performance and provided attractive dividends to its shareholders. In this blog post, we will explore why dividend investors should consider adding Canadian National Railroad to their portfolio. We will delve into various aspects such as valuation, earnings, competitors, and more, to provide a comprehensive understanding of the investment potential of this company.

Economic Moat – Canadian National Power!

An economic moat is a key factor that determines a company’s ability to maintain a competitive advantage over its peers. Canadian National Railroad enjoys a wide economic moat rooted in cost advantages and efficient scale. Railroads, including Canadian National , offer a low-cost option for freight transportation, especially for bulk commodities. Railroads enjoy quadruple the fuel efficiency of trucking and can carry significantly more freight at once. CN’s extensive network and route density further enhance its cost advantage and make it difficult for new entrants to replicate its infrastructure. These factors contribute to CN’s wide economic moat and its ability to generate economic profit for the foreseeable future. The moat has enabled CNI to provide long-term benefit to shareholders and is a powerful compounder.

Competitors

When assessing an investment opportunity, it is important to consider the competitive landscape. Canadian National Railroad operates in the Class I railroad industry, where it faces competition from other major players such as Union Pacific, CSX, and Norfolk Southern. While competition exists, CN has been able to narrow the gap in operating ratio relative to its peers in recent years, showcasing its ability to improve efficiency and remain competitive.

However, CN has several competitive advantages that set it apart. Its unique three-coast system spanning Canada coast to coast, and down through the U.S. to New Orleans, provides it with a strong geographic presence. Additionally, CN enjoys exclusive access to Canada’s port of Prince Rupert, contributing to its intermodal franchise growth prospects. These competitive advantages, coupled with the company’s strong financial performance, position it well against its competitors.

Dividend Sustainability

One of the primary concerns for dividend investors is the sustainability of the company’s dividend payments. Canadian National Railroad has a strong history of providing attractive dividends to its shareholders. Despite challenges such as lower volumes and falling fuel surcharges, Canadian National remains committed to its dividend policy. The company’s solid cash flow generation and cost advantages provide a strong foundation for sustaining and potentially increasing its dividend payments in the future.

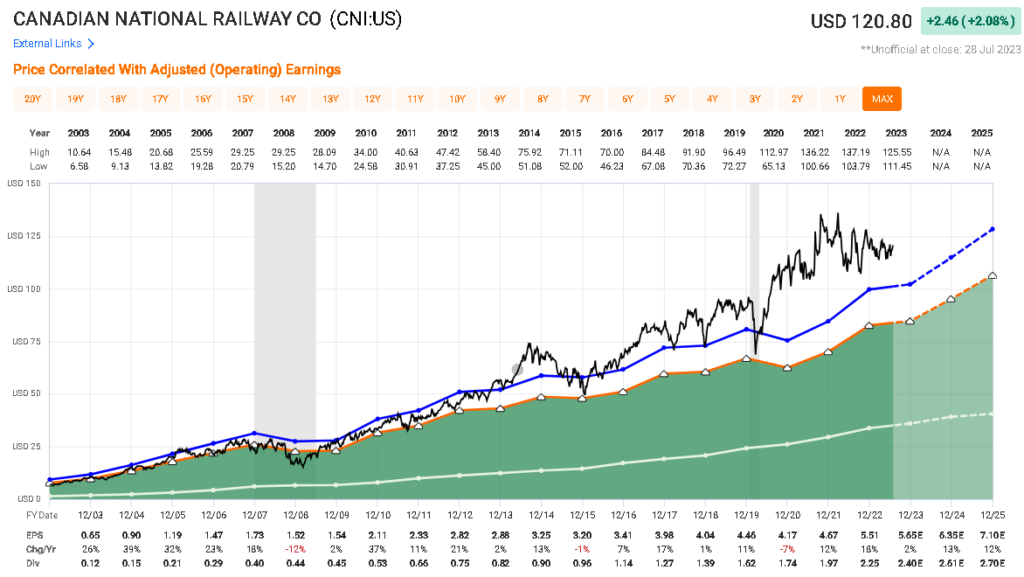

Over time, Canadian National has been a solid compounder, allowing investors to make long-term buys that develop into powerful portfolio positions.

Canadian National Valuation

When evaluating an investment opportunity, it is crucial to assess the valuation of the company. Canadian National Railroad boasts a strong track record in terms of its financial performance, which makes it an attractive prospect for dividend investors. Despite a 9% decline in revenue excluding foreign exchange in the second quarter of this year, the company remains committed to inflation-plus rate hikes, ensuring a steady stream of income for its shareholders. Although there may be some short-term challenges, the long-term growth prospects of the company remain intact, making it an attractive investment at its current valuation.

Valuation is a crucial factor to consider when evaluating an investment opportunity. In the case of CN, its fair value estimate has recently been boosted to USD 114 per share, indicating potential upside for investors. This increase in fair value is primarily driven by the impact of foreign exchange rates on the company’s USD fair value. It’s worth noting that CN’s fair value is translated into U.S. dollars using an exchange rate of approximately CAD 1.32/$1 as of July 24.

Earnings

A major consideration for dividend investors is the earnings potential of the company. Canadian National Railroad has historically generated solid cash flow, with free cash flow averaging in the high-teens as a percentage of sales over the past decade. This consistent cash generation has allowed the company to provide attractive dividends to its shareholders. Additionally, CN’s diverse mix of revenue sources, including intermodal, agriculture, and chemicals, provides a robust foundation for future earnings growth.

Examining a company’s earnings is vital for dividend investors, as it provides insight into the company’s profitability and ability to sustain dividend payments. In 2021, CN experienced a 9% growth in organic revenue, driven by the recovery of the industrial sector from pandemic lows, a new contract with Teck Resources, and increased demand for intermodal containers due to retailer restocking and tight trucking-market capacity. Pricing was also favorable, with core rates up 5%.

However, 2021 also presented challenges for CN, such as the chip shortage impacting auto activity, port disruptions affecting international-intermodal operations in the second half, and flooding in British Columbia affecting carload volumes in the fourth quarter. Despite these disruptions, CN’s adjusted operating ratio (expenses/revenue) improved by 350 basis points to 57.9%, showcasing the company’s efficiency gains. However, CN’s operating ratio still lags behind its peers.

In 2022, CN’s revenue grew by 16% (excluding foreign exchange) due to continued yield expansion, contract-rate gains, elevated accessorials, and higher fuel surcharges. Although volumes declined 3% in the first half due to labor-related network headwinds and harsh winter weather, second-half strength in coal, recovering grain and auto carloads, and improved network fluidity resulted in flat total volume. CN’s adjusted operating ratio improved by 130 basis points to 59.9% in 2022, primarily driven by efficiency improvements and solid pricing.

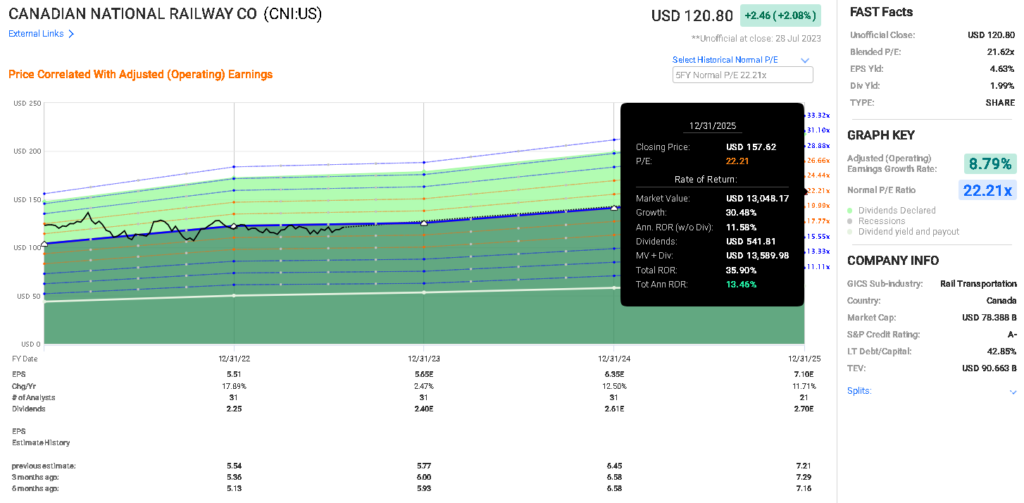

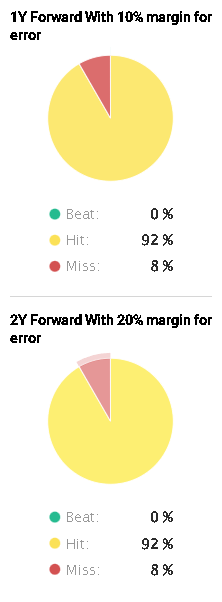

Earnings remain relatively easy to forecast with good guidance from the management team and stable operations, as evidenced by the impressive FastGraph’s Analyst scorecard results below.

Future Outlook

Assessing a company’s future prospects is crucial for dividend investors, as it helps determine the sustainability of dividend payments. In 2023, CN’s revenue is expected to decline by 1%-2% due to lower intermodal activity and pricing, as well as disruptions from wildfires and a Canadian ports strike. However, core pricing gains are anticipated to remain positive, supported by the railroads’ commitment to inflation-plus pricing. CN’s adjusted operating ratio is projected to deteriorate slightly in 2023 due to wage inflation and muted volumes.

Looking ahead to 2024, CN’s adjusted operating ratio is expected to improve to around 57.8%, driven by a recovery in intermodal volumes and the company’s renewed focus on precision railroading. Over the long run, CN is expected to maintain sound pricing power and effectively neutralize diesel price shocks through surcharges. The company’s midcycle operating ratio is projected to be in the range of 57%-57.5%.

Risks and Uncertainty

Assessing the risks and uncertainties associated with an investment is crucial for dividend investors. CN is exposed to the health of the Canadian and U.S. economies, as well as industrial and retail end markets. Downside risk to freight demand is currently elevated due to sluggish North American industrial production and limited retail sector inventory restocking.

Additionally, adverse winter weather can impact CN’s efficiency by blocking tracks and necessitating shorter trains. The company also faces exchange-rate risk, although its low coal exposure mitigates volume losses to cheap natural gas. Environmental, social, and governance risks include liabilities associated with hazardous material spills and the risk of reregulation for some of CN’s U.S. operations. Stringent safety regulations can also impact the company’s economic profit.

Capital Allocation

Assessing a company’s capital allocation strategy is essential for dividend investors, as it determines how the company utilizes its resources and returns cash to shareholders. CN has been awarded a Standard capital allocation rating, indicating its sound balance sheet and fair and reasonable investing practices. The company consistently returns cash to shareholders through share repurchases and rising dividends.

CN has a history of operational excellence and prudent investment in capacity to maintain high-quality operations and attract new business. The company has also made strategic acquisitions, such as the Illinois Central and TransX, which have strengthened its competitive positioning. CN’s focus on precision railroading and efficiency improvements further support its capital allocation strategy.

Conclusion about Canadian National (CNI) as an Investment

Canadian National Railroad presents an attractive investment opportunity for dividend investors. With a boosted fair value estimate, strong earnings growth, and a focus on operational efficiency, CN has the potential to deliver consistent and reliable dividend income. While risks and uncertainties exist, CN’s competitive positioning, capital allocation strategy, and long-term outlook make it a compelling choice for dividend investors seeking exposure to the transportation and logistics sector.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.