Introduction – a TIKR Terminal Review

If you are an investor looking for a comprehensive platform that provides business-focused data on stocks, the TIKR terminal is the perfect solution for you. This post aims to introduce TIKR terminal and its features in detail, helping you understand how it can benefit your investments.

TIKR Terminal promises to be one of the most comprehensive platforms for investors by offering a range of analytical tools and features. You can use this platform to find the best stocks, follow top investors, analyze businesses, and monitor your portfolio. Its user interface is simple yet powerful, allowing you to get all the information you need in one place.

One of the key highlights of TIKR is its focus on providing business-focused data. This means that it offers investors access to real-time financial data from company filings and transcripts rather than relying solely on stock prices or other metrics. The platform also provides various financial ratios and valuation metrics that help investors make informed decisions.

Another key feature of TIKR Terminal is its promise of transparency. The platform allows users to see how top investors are investing their money, giving them insights into their investment strategies. This makes it easier for users to identify companies with high growth potential or those which have undervalued stocks.

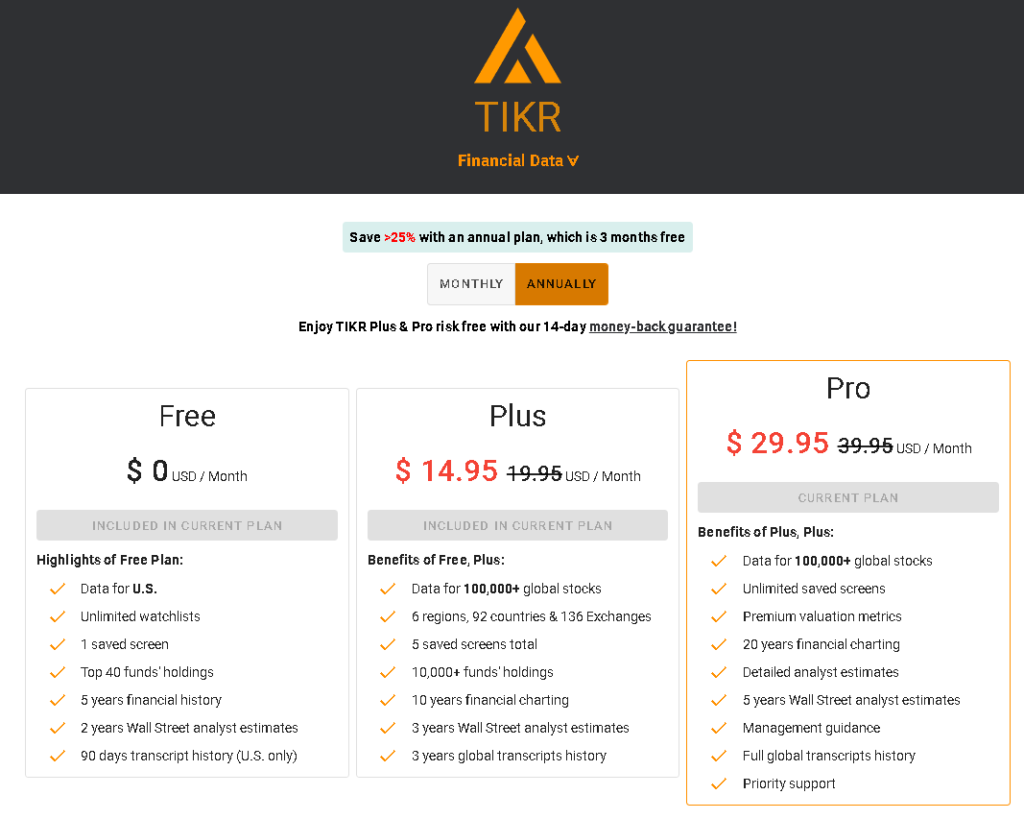

The TIKR terminal pricing options are another aspect worth mentioning. While paying monthly or annually can be expensive for a pro subscription, this post covers all the features included in a pro subscription so that users can determine if it’s worth the cost for them.

TIKR Terminal offers a comprehensive range of analytical tools designed specifically for investors who want quick access to business-focused data on stocks. Its user-friendly interface makes it easy-to-use while still providing in-depth analysis that delivers valuable insights into company performance as well as top investor strategies. If you’re looking for an all-in-one investment tool designed with busy professionals in mind – look no further than TIKR Terminal.

Pricing Options

As a savvy investor, you’re always on the lookout for the best tools to help you make informed decisions. And if you haven’t already heard of TIKR terminal, then let me introduce you to one of the most promising platforms out there. A key part of the message of this TIKR Terminal review is there is a price tag but it gives access to some amazing granularity of data.

But before we get too far ahead of ourselves, let’s talk about pricing options. After all, cost is always a factor when it comes to investing.

TIKR terminal offers both monthly and annual subscription plans for its pro version. The monthly plan costs about $40 per month paid month-by-month, or about $30 a month if maid for a year in advance. While these prices may seem steep at first glance, it’s important to consider what’s included in the pro subscription.

First off, with a pro subscription, you’ll have access to TIKR’s most powerful features. This includes real-time stock data and news updates and advanced portfolio monitoring tools that allow you to track your investments with ease.

There are also occasional sales that can help lower the cost of entry for new users. Keep an eye out for these promotions if you’re considering signing up.

Of course, if the cost is still too high for your budget or investment goals, TIKR offers a free version that provides some basic features like searching and tracking individual stocks. However, keep in mind that this free version lacks many of the more advanced features that are available with a pro subscription.

Ultimately, though, when it comes down to it – paying for quality data and insights can be worth every penny when making informed investment decisions.

When considering pricing options on any platform or service, remember: You get what you pay for! Investing wisely requires using reliable data-driven analysis tools like TIKR Terminal Pro Subscription Plan. A TIKR Terminal review like this should give you an insight into the value you can derive.

In conclusion: The pricing options offered and covered in this TIKR Terminal review might seem daunting at first, but they provide great value in terms of features compared to other platforms. As an investor, investing in such a tool can provide you with the edge you need in today’s fast-paced market.

Stock Analysis

When it comes to investing in the stock market, making informed decisions is crucial. In this section of the TIKR Terminal review, we explore how it can help you analyze stocks and make well-informed decisions.

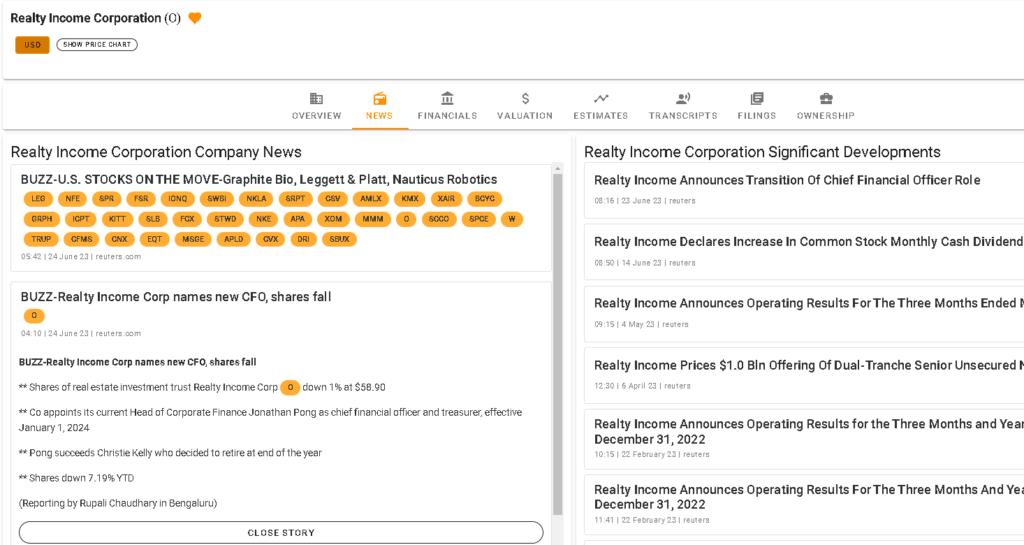

One of the key features of TIKR Terminal is its ability to provide comprehensive information about a company’s financials, news, filings, and ownership. To get started with stock analysis on TIKR Terminal, you can simply search for a stock using its ticker symbol or company name. Once you have identified the stock you want to analyze, the platform provides an extensive range of information.

The first section that investors should explore is news. News can be incredibly helpful in understanding a company’s current state and upcoming events that might impact its performance. Through TIKR Terminal, users can access news coverage from various sources, such as Reuters and MarketWatch.

The next section that investors should look at is financials. Financial statements are an essential part of any investment decision since they give an insight into a company’s revenues, expenses, profits or losses over time. With TIKR terminal’s interface for financial data analysis, tools like balance sheets and income statements are made available to users.

Valuation metrics are another critical aspect of analyzing stocks with TIKR Terminal. The platform includes several valuation metrics such as price-to-earnings (P/E) ratios and price-to-book value (P/B) ratios which gives investors an understanding of whether a stock is overvalued or undervalued.

Analysts’ Estimates are another crucial piece of information when it comes to analyzing stocks on TIKR terminal. Analysts often provide revenue estimates annotated with A (actual, past data) or E (estimated) for different years in the future, along with their corresponding number of estimates given by analysts, which helps investors understand what future expectations there may be around a particular stock.

Transcripts from earnings calls where companies discuss their performances are also provided by the TIKR Terminal. Through transcripts, investors can get an insight into management’s view of the company’s performance, future plans, and other valuable information.

Filings are another important component of analyzing stocks on TIKR Terminal. Companies are required to file certain reports with regulatory agencies, such as the Securities and Exchange Commission (SEC). This includes 8-Ks, 10-Qs, and other filings that provide detailed information about a company’s finances and operations. A key part of our TIKR terminal review is the access to required information for investors.

Finally, ownership structures give investors an understanding of who owns a particular company. TIKR Terminal provides comprehensive data on institutional ownership, which shows what percent of shares are held by institutions like mutual funds or pension funds.

TIKR Terminal is an excellent platform for stock analysis. It provides users with extensive information, such as news coverage, financial statements, valuation metrics, estimates from analysts and transcripts from earnings calls to help investors make well-informed decisions. By using this platform for stock analysis purposes, you can gain a deeper understanding of companies you may want to invest in or track their performance over time.

Financial Data

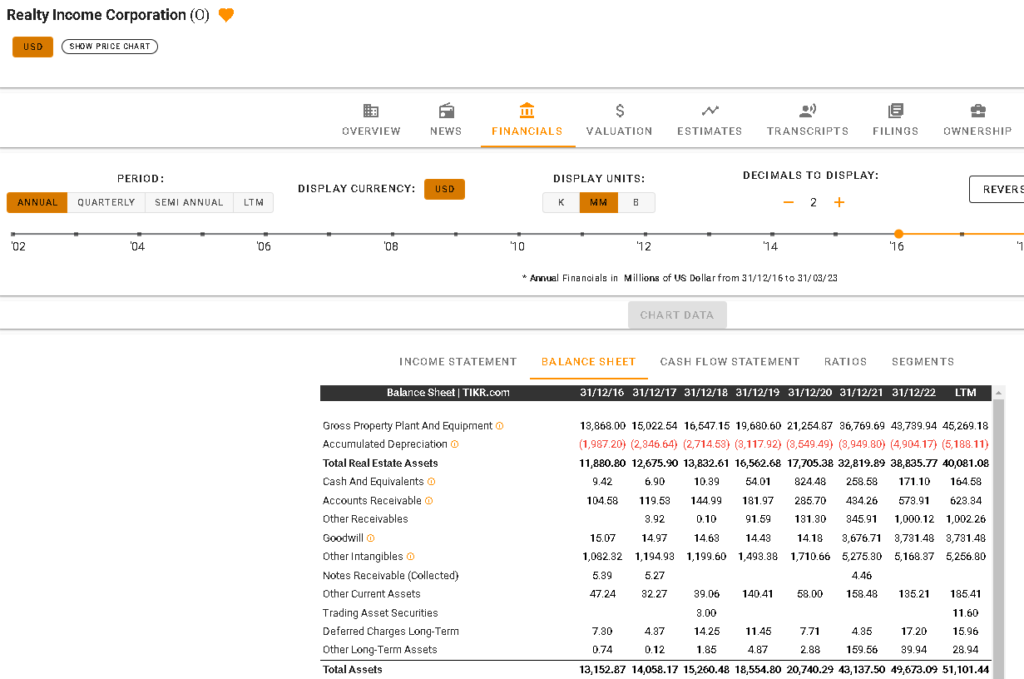

In this section, we will delve deeper into the financial data capabilities and coverage as part of the TIKR terminal review. The TIKR terminal is a powerful tool that allows users to analyze a company’s finances from up to 20 years ago. The platform provides detailed financial information, including total revenues, rental revenues, and various other metrics that can be analyzed using scroll bars or line charts. Any TIKR terminal review should focus on the strength of this depth of data.

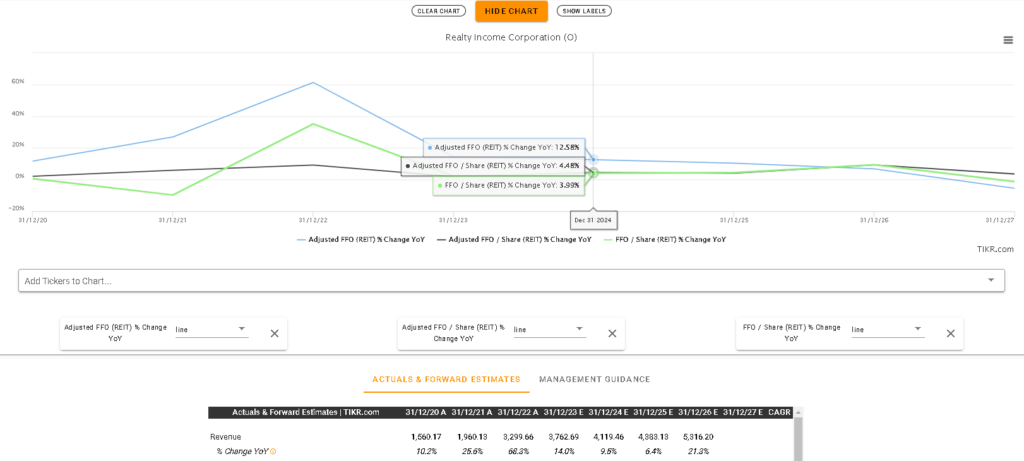

One of the most important metrics in analyzing a REIT company’s finances is its free funds from operations (FFO) payout ratio. This ratio measures the amount of money a company has left over after paying for operating expenses and capital expenditures. It gives investors an idea of how much money a company has left to pay dividends or reinvest in the business. TIKR has exceptional FFO and AFFO data, unlike many other comparable platforms! This access makes it very useful for REIT investors.

Another important metric and coverage is balance sheets, a core part of this TIKR Terminal review. Balance sheets show the current financial position of a company by listing its assets, liabilities, and equity at a specific point in time. They are essential for investors who want to understand how much cash and other resources a company has available for investments or dividends.

TIKR also provides valuable information on stocks’ income statements, which show the revenue earned by companies during specific periods. The income statement is one of the most critical financial documents because it shows how much revenue was generated from sales and how much was spent on operating costs.

Furthermore, TIKR terminal allows investors to conduct cash flow analysis using real-time data provided by companies’ filings with regulatory authorities like SEC (Securities and Exchange Commission). Cash flow analysis helps investors understand how cash flows through a business over time by examining changes in cash balances on balance sheets.

TIKR terminal’s intuitive user interface makes it easy for users to customize their portfolio view according to their preferences. Users can choose between different chart types, like bar charts or line charts, when analyzing data on certain stocks or funds they are interested in investing in.

In addition to stock analysis features discussed earlier, TIKR offers an innovative way for users to compare the performance of different symbols on charts. Users can add Innovative Industrial Properties or MPW on charts with Realty Income to compare their performance quickly.

In our opinion in this TIKR terminal review, it provides in-depth financial data analysis capabilities for investors looking to make informed decisions about their investments. The platform offers detailed information on a company’s finances, including balance sheets, income statements, and cash flow analysis. With its intuitive user interface and customizable portfolio view options, our assessment in this TIKR terminal review is that it is an excellent tool for investors who want to take a deep dive into financial data and make informed investment decisions.

Adding Other Symbols – Comparisons

TIKR terminal is a versatile platform that allows investors to monitor and analyze stocks, but did you know that it also allows you to add other symbols besides stocks? This section will focus on the different symbols you can add and how to use them to compare their performance.

As an investor, it’s crucial to diversify your portfolio beyond just stocks. TIKR terminal understands this and has made provisions for investors to add other assets, such as industrial properties and realty income. Adding these symbols will enable investors to get a comprehensive overview of their investments, allowing them to make better decisions.

To start adding other symbols, click on the “Add Symbol” button located on the top right corner of your dashboard. From there, input the symbol code of the asset you want to analyze. For instance, if you want to compare Innovative Industrial Properties with Realty Income, enter “IIPR” for Innovative Industrial Properties and “O” for Realty Income.

Once you have added both symbols, TIKR terminal will display a chart comparing their performance over time. You can customize the chart by selecting different time frames or changing the chart type from line charts to candlestick charts.

Another exciting feature of adding other symbols is that it enables users to compare assets from different sectors easily. Comparing assets across sectors provides valuable insights into how various industries are performing relative to each other. By doing this analysis in TIKR terminal, instead of switching between multiple platforms or sources, can save investors lots of time. Any TIKR terminal review should highlight the benefit of this.

TIKR terminal provides investors with an opportunity not only limited stock analysis but also to add other symbols, such as industrial properties and realty income. By doing so, investors can get a comprehensive overview of their investments, compare metrics across different companies or assets, and compare performance across various sectors. Adding other symbols is easy in TIKR terminal; simply click on the “Add Symbol” button and input the symbol code of the asset you want to analyze.

Estimates & Future Projections

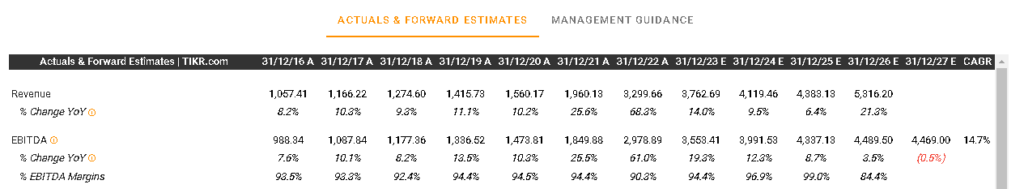

As an investor, one of the most crucial aspects of decision-making is estimating future projections and making informed decisions based on those predictions. This is where TIKR Terminal comes in handy, providing a wealth of data and information to make informed decisions.

In this section, we’ll explore how TIKR Terminal can help you analyze estimates and future projections for stocks. We’ll look at different revenue estimates annotated with A or E for different years in the future, along with their corresponding number of estimates given by analysts. We’ll also demonstrate how these projections can be displayed as percentage changes.

TIKR Terminal provides access to a vast database of revenue estimations for stocks backed up by research from a plethora of analysts. These estimations are critical when deciding which investments to make or avoid. By comparing the actual earnings reports against these predictions, investors can gain insights into the accuracy and reliability of different analysts’ forecasts. A key outcome here in our TIKR terminal review is that this is a standout feature. Note that TIKR does not provide a direct or clear way to assess analyst accuracy like FAST Graphs does, but TIKR provides detailed analysts’ reports.

For instance, suppose you’re looking at Apple Inc stock. In that case, you can use TIKR Terminal to view revenue projections annotated with either “A” or “E,” indicating whether the estimate is an actual figure or an estimate from an analyst’s report.

Furthermore, suppose you want more information about these revenues. In that case, TIKR Terminal allows you to see each estimate’s corresponding number from various analysts who contributed to it. This feature enables investors to compare and contrast different analyst opinions regarding the same company’s earnings potential.

To make things even better for users, TIKR Terminal allows investors to display these revenue estimates as percentage changes over time instead of just raw numbers. This feature makes it easier for users to identify patterns in projected growth rates over time more easily.

Another significant advantage that TIKR Terminal offers investors concerning estimates and future projections is its ability to track revisions made by various analysts over time effectively. As new information becomes available about companies’ financials, analysts frequently revise their estimates. TIKR Terminal enables investors to track these revisions over time efficiently.

TIKR Terminal’s ability to analyze estimates and future projections is an essential tool for any investor looking to make informed decisions based on reliable data. By providing access to a vast database of revenue estimations backed up by research from a plethora of analysts and enabling users to display these figures as percentage changes over time, TIKR Terminal makes it easier for investors to identify patterns in projected growth rates over time. In addition, the platform allows users to track revisions made by various analysts effectively.

Conclusion & Recommendations

After exploring the TIKR terminal and its various features in the previous section, it is time to summarize our findings and give recommendations on who might benefit from this platform at this end of our TIKR terminal review.

First, let us reiterate some of the promises of TIKR. The platform aims to provide business-focused data that is more relevant to stocks than ETFs. It offers access to real-time market data, tracking top investors’ portfolios, analyzing businesses, monitoring your portfolio, and finding the best stocks. Additionally, TIKR allows users to look at financial data from up to 20 years ago using scroll bars or line charts. With these promises in mind, let us delve into some of our conclusions.

TIKR terminal is an excellent platform for those who want a deeper understanding of their investments. It offers a wide range of financial and company-specific metrics that can help investors make informed decisions based on their analysis. For example, if you are interested in investing in a particular stock but want more insights into its past performance or future projections based on analyst estimates – TIKR has got you covered.

Furthermore, TIKR’s focus on business-focused data sets it apart from other investment platforms that often prioritize technical indicators over fundamental analysis. If you are someone who enjoys studying financial statements or reading earnings transcripts to gain a better understanding of your investment’s performance – then our assessment in this TIKR terminal review is that it could be perfect for you.

On the other hand, if you are primarily interested in trading rather than investing -TIKR may not be your best choice as it doesn’t offer tools for day trading such as charting software or news feeds tailored towards short-term traders’ needs.

Finally, yet importantly; we must mention pricing options when reviewing Tikr Terminal. The price can be steep if paying monthly or annually for a pro subscription; however, occasional sales may occur- so keep an eye out! One thing we do like about Tikr is that it offers all of its features in a pro subscription, so you don’t have to worry about being nickel-and-dimed for every feature.

We believe that the TIKR terminal is an excellent resource for investors who want to gain a deeper understanding of their portfolios. It provides access to business-focused data, financial statements, estimates and future projections from analysts, which can help guide their investment decisions. However, traders looking for comprehensive charting software or news feeds tailored towards short-term trading may find the platform less useful.

Therefore, our recommendation is that TIKR Terminal could be ideal for long-term investors who are interested in fundamental analysis and want a comprehensive toolset to aid them in their investment decisions. If you’re someone who enjoys researching companies and analyzing financial statements, then TIKR Terminal could be a great choice!

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.