Ares Capital stock (ARCC) is another Business Development Company (BDC) that offers a method for investors to start compounding wealth and growing their income. It is the largest BDC and is well-established and well-regarded by investors and analysts. In comparison to some BDCs, such as Main Street Capital (MAIN) which invest in equity in companies, ARCC focuses on lending and maintains a portfolio of high-quality first-lien loans to growing firms. As such, Ares Capital stock does not experience the growth that MAIN sees and, instead, focuses on delivering a strong dividend yield that is well-covered by the underlying investments.

Investing in Ares Capital can be a great way to build wealth and secure your financial future and is well-recognized by many investors. There are many advantages to investing in Ares Capital that make it an attractive choice for investors both big and small. As one of the largest non-bank lenders, Ares Capital offers a wide range of investment options and opportunities for lower risk and higher returns than traditional banking. This article will discuss why investing in Ares Capital is beneficial and what types of returns you can expect from an investment.

Ares Capital stock (ARCC) – compounding wealth with time

If you’re looking to diversify your investment portfolio, business development companies (BDCs) are a must-have. These publicly traded investments not only provide security but also offer investors the opportunity to capitalize on the growth of the economy. With BDCs, you can enjoy both capital appreciation and steady income from dividends – an appealing combination for any investor. The icing on the cake? BDCs are managed by seasoned experts who bring years of experience in corporate finance and capital investments. By investing in BDCs, you’ll be putting your money in the hands of capable professionals who know how to maximize returns while minimizing risk. Don’t miss out on this valuable option for growing your wealth!

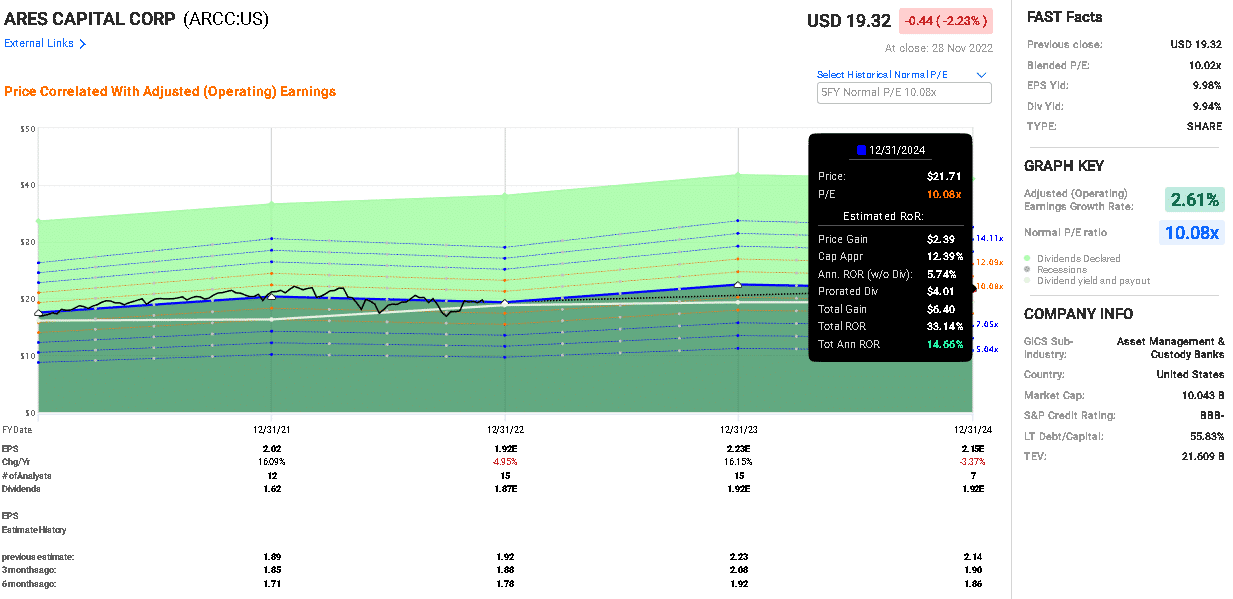

Historically, if we look at the price returns from ARCC, we would be disappointed as the prices have tracked sideways since inception, delivering relatively negligible returns (Figure 1). There are opportunities to buy ARCC at a discount from time-to-time and, and with the right entry at lower prices, investors can grow wealth and lock in steady dividend streams with time.

Compounding wealth is a powerful investment strategy that can help you achieve financial independence. By reinvesting all of your earnings back into the initial investment in Ares Capital Stock, you can create a snowball effect where your money grows exponentially over time. This growth can lead to large gains that you can benefit from in the long run. Not only does this strategy create a steady flow of passive income, but it also helps further grow your initial investments. One of the most appealing aspects of compounding wealth is that it requires minimal effort on your part once you’ve made the initial investment. You can sit back and watch as your money works for you, generating returns and increasing in value year after year. It’s no wonder that so many people choose to make their money work for them by utilizing compounding wealth as one of their core financial strategies. If you’re looking for a way to build wealth over time while minimizing risk, compounding wealth is definitely worth considering!

The ARCC dividend

Investing for dividend yield is a popular strategy for many investors. It allows individuals to receive income from their investments and has the potential to create wealth over time. BDCs are an often overlooked but highly attractive option for those looking to invest for dividend yield. BDCs provide capital to small- and medium-size businesses, which can help drive economic growth. They have attractive tax advantages and are well-positioned to capitalize on the current economic environment.

Ares Capital stock is not a disappointment in terms of the dividend yield. ARCC has a 9.9% dividend yield and a five-year dividend growth rate of 2.5% (source: Stock Rover)

Investment opportunities in Ares Capital Stock

There are some good opportunities for compounding wealth and growing income with Ares Capital stock. At present, it is not undervalued (as it has been several times in the past, notably during the depths of the pandemic issues in 2020). However, the company is growing with the headwinds from rising interest rates promising stronger earnings in the near future. As such, investing today could return an annualized rate of return of about 14% over the coming year, mostly from dividends but partly also from potential capital appreciation as ARCC’s earnings increase.

Final thoughts and risks

One of the biggest risks for investing in Ares Capital stock would be a general and long-term recessionary environment. It would hurt the ability of ARCC’s clients to repay loans and, therefore, hurt ARCC’s earnings. As a consequence, tough economic times would likely see the share price substantially reduced. This is not the type of investment you want to make with significant margin involved!

If you like dividends as much as I do, BDCs are useful to substantially increase the portfolio dividend income. As such, they play a role in a well-diversified portfolio that focuses on growing and developing dividend yields.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.