P&G – the king of consumer staples

Consumer staple stocks are a valuable asset to have during volatile market downturns. They provide stability and protection from the harsh effects of a bear market. These stocks typically comprise household names that provide goods and services essential to everyday life. Examples of consumer staples include food, beverages, tobacco, personal care products, and household products. These stocks are typically less affected by economic downturns because of their consistent cash flow. As a result, consumer staples can provide investors with safety in market volatility, making them an attractive option for long-term investing. They are great for dividing growth investing and can provide long-term dividend and income growth.

Consumer staple stock products are essential goods and services that individuals and households purchase regularly, regardless of economic conditions. This means that even in tough economic times, spending on consumer staple stock products remain relatively stable, providing a consistent source of earnings for companies in the sector. The fact that consumer staples stocks have historically performed better than most other stocks during market downturns evidence this. We also expected increasing demand from emerging markets and an overall trend towards healthy and sustainable lifestyles to support growth in the sector, helping to maintain earnings over time. As the global population continues to grow and the world’s markets become increasingly interconnected, consumer staple stock products remain an important source of revenue for companies and, ultimately, a source of stability for the economy.

PG for compounding wealth

Consumer staples can be a powerful tool for compounding wealth. These types of products and services provide fundamental goods and services that are in demand regardless of the economic climate. A savvy investor can benefit from the stability of these stocks and the potential for capital appreciation. Consumer staples are backed by strong, established brands and possess an inherent pricing power that allows them to continue generating profits and rewarding shareholders. They also tend to have reliable cash flows, providing portfolio stability and enabling investors to benefit from a steady stream of dividends. When combined with other asset classes, consumer staples can provide a powerful foundation for wealth-building and contribute to an investor’s snowball effect.

A true dividend aristocrat – PG

The dividend aristocrat stocks like PG provide a portfolio with a sense of safety. These stocks are typically companies that have paid increasing dividends for 25 consecutive years and have excellent financial performance, strong balance sheets, and a history of consistent profitability. This means that these stocks have a long track record of rewarding shareholders with dividend payments and have the financial strength to continue doing so in the future. Additionally, these stocks are often less volatile than the broader market, providing a measure of stability to a portfolio. As a result, investors who include dividend aristocrat stocks in their portfolio can benefit from increased safety and the assurance of consistent dividend payments. We can see from Figure 1 that PG has a long history of steady earnings but also some price fluctuations providing a good opportunity from time-to-time to buy and invest in the company.

Figure 1. PG-historic returns for dividend investors showing compounding opportunities (Source: Fastgraphs)

Figure 1. PG-historic returns for dividend investors showing compounding opportunities (Source: Fastgraphs)

It is important to buy stocks at good valuations, as it helps to maximize returns while mitigating risk. Valuations measure how much an investor is paying for a stock relative to its intrinsic value. Good valuations reflect fair market prices and give investors the opportunity to buy stocks when they are undervalued. Buying stocks at good valuations also helps to diversify one’s portfolio across different industries and sectors. Moreover, investing at good valuations allows for more consistent returns over time and gives investors more options for exiting positions. Ultimately, buying stocks at good valuations is an essential part of being a successful investor. We can see from Figure 1 that an investment in 2009 would be made at lower valuation levels, even below 15x, providing the opportunity to participate in long-term growth of the company earnings.

Fitting PG into the portfolio

Consumer staples in the satellite portion of a core-satellite portfolio provide investors with a form of safe-haven asset. These assets are large, established companies that generate steady and predictable profits and are less sensitive to economic cycles. As such, they can provide portfolio stability, especially in market volatility. Consumer staples are also generally considered defensive investments because of their relatively low sensitivity to economic cycles. These investments include well-known companies such as Nestle, Unilever, and Procter & Gamble, which provide reliable and consistent returns over the long term. Consumer staples can provide investors with a great way to diversify their portfolios, and the returns generated from these investments can prove very useful in times of market uncertainty.

Proctor and Gamble (PG) – the investment opportunity

Having a dividend yield of 2.5% and a five-year dividend growth rate of 5.8%, PG is a slow and steady earner. They have paid increasing dividends for over six decades as a dividend king.

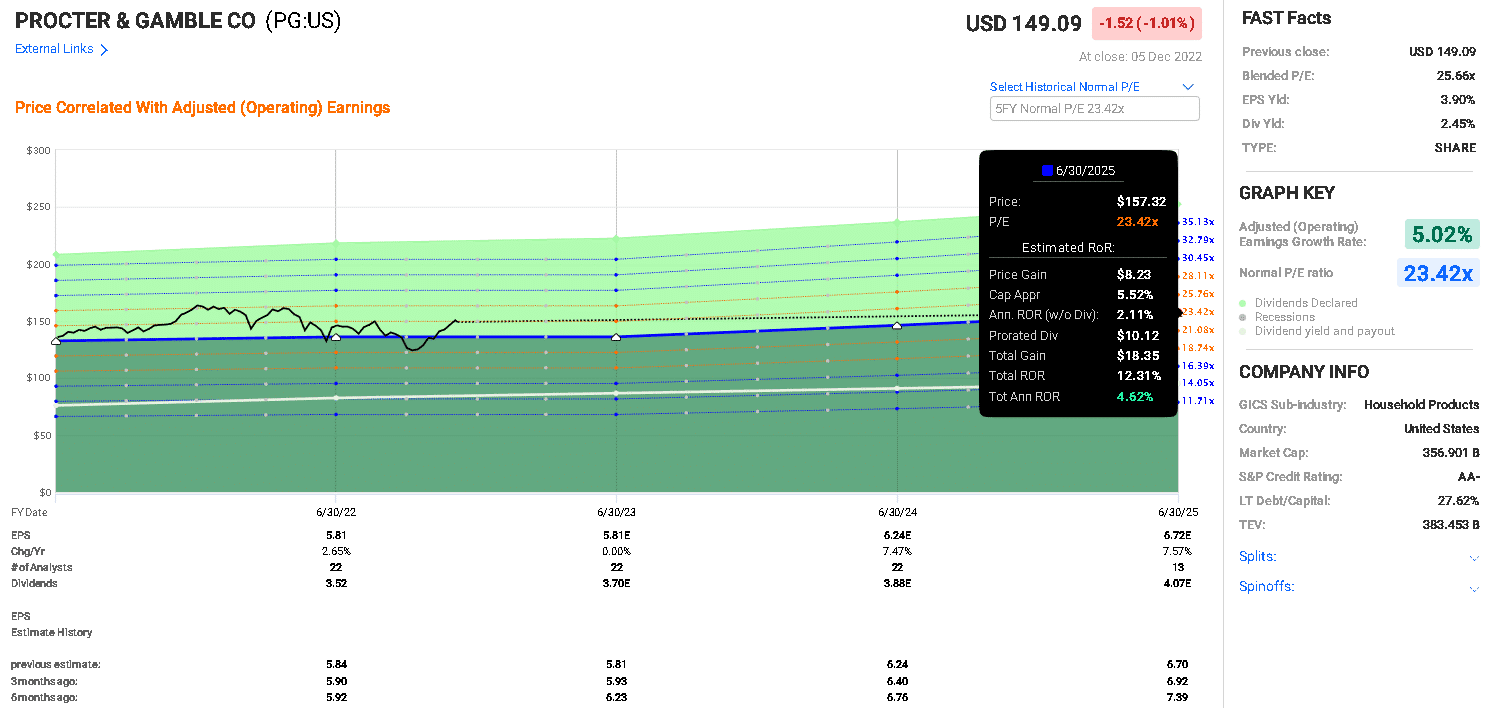

Considering the valuation, we can see that the 25x P/E multiple is high. Investors place a high value on the extreme quality of this stock. Figure 2 shows the expected earnings for PG over the next several years, based on analysts’ estimates. If prices return to the ‘normal’ valuation achieved over the last five years, of about 23x P/E, and the earnings are realized, then we can see approximately 2.6% annualized rate of returns for an investment in PG today (Figure 2).

Figure 2. PG-forecasting for dividend investors providing a sense of potential returns (Source: FAST Graphs)

Figure 2. PG-forecasting for dividend investors providing a sense of potential returns (Source: FAST Graphs)

So – is PG a good buy?

Yes – insofar as the quality of PG is well recognized. It is an undisputed King of stocks and consumer staples! If all goes well, the earnings should continue and it should eek out a small positive rate of return over the next several years, with 7.5% earnings gains expected for 2024 and 2025 years (Figure 2).

No – insofar as the current P/E multiples mean the dividend yield is relatively low, and there is a risk of a fall; even a fall from 25x to 15x P/E would represent substantial capital loss and risk to investors. Examining Figure 1 carefully, we can see that in the GFC, the stock multiples did plummet allowing buying the stock at below 15x earnings

Final thoughts on investing in PG

At the moment, I consider PG to be overvalued. It is one stock on my list that I would love to invest in, but I cannot bring myself to pull the trigger at these prices and this P/E multiple. I am very much a fan of waiting for a better valuation. There is also no shortage of other good candidate firms in the current market. Even if looking for stable candidates at a better valuation that will provide security in rough market conditions, I think healthcare and pharma stocks are a good option, and candidates like AMGEN might be considered.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.