Investing in equities with high dividend yields can be a great way to maximize returns in the long run. However, dividend investors must know the risks associated with chasing yield and the potential for lower returns when certain companies are overvalued. To help mitigate these risks, investors can consider growth at a reasonable price (GARP) as a strategy for dividend investing. GARP invests in stocks that offer a blend of value, quality, and growth potential that is often overlooked by other investors. In this blog post, we will discuss the benefits of GARP for dividend investors and provide strategies to identify and select stocks that fit GARP criteria. We will also discuss the risks and challenges associated with GARP investing and how to overcome them. By correctly implementing a GARP approach, dividend investors can maximize their returns while minimizing the risks associated with dividend investing.

GARP investing is a popular strategy among investors. This approach seeks out stocks that are expected to appreciate in value over the long term and are selling at a reasonable price relative to their peers. It also encourages diversification, as investors can purchase a range of stocks with different characteristics. Furthermore, GARP investing is a low-risk approach that can protect investors from major market downturns by selecting stocks that have low correlations with each other and the overall market. Additionally, GARP investing can provide investors with exposure to growth stocks that they would not have access to if they only focused on value investing. By combining these two strategies, investors can benefit from the upside potential of growth stocks while still being protected by the downside protection of value stocks. Therefore, GARP investing is a popular strategy among investors and can help compound wealth with the snowball effect.

Diversify your portfolio by investing in stocks

Diversifying your portfolio by investing in stocks is a great way to increase your potential returns and manage risk. Stocks offer returns in the form of dividends, capital appreciation, and potential for capital gains. Diversifying your portfolio by investing in stocks also provides investors with an additional layer of protection against market volatility. Additionally, stocks are typically more liquid than other asset classes, making them an attractive option for investors looking to buy and sell quickly. Investing in stocks allows dividend investors to benefit from the growth of the underlying businesses and the cash flow they provide.

Analyze a company’s stock performance

As part of the Growth at a Reasonable Price (GARP) strategy, dividend investors should analyze a company’s stock performance as part of their investment decision-making process. A company’s stock performance reflects the market’s perception of the company, which helps determine its stock price. By analyzing a company’s stock performance, investors can gain insight into the company’s financial health and growth prospects. To analyze a company’s stock performance, investors should look at its historical stock price trend, compare it to the market and industry performance, and study the company’s financial performance. They should also consider any company-specific news that could influence the stock price. By combining this analysis with other fundamental and technical analyses, investors can determine whether a company is a good long-term investment or offers a good dividend yield.

When selecting stocks for a GARP portfolio, it is important to focus on companies with steady growth history, with a price-earnings ratio below the average of the wider market. Investors should also assess a company’s financial health, considering factors such as cash flow, debt levels, earnings per share, and dividend yield. It is also important to analyze a company’s competitive landscape and management team. Investors should compare the company’s market price to its intrinsic value to determine if a stock is growing at a reasonable price. Last, investors should also research the company’s expected growth rate, as this will help them decide if the current price is reasonable for the expected future growth. By undertaking such research, investors can make informed decisions when selecting stocks for their GARP portfolio.

When employing this investment strategy, investors should look for stocks that have steadily growing earnings. Steadily growing earnings show that a company is performing well and has a strong future outlook. Such companies are likely to produce good returns for investors. Additionally, companies with steadily increasing earnings are more likely to have their share price increase in the long run. Moreover, these stocks offer a safe investment, as their earnings are not volatile, meaning that returns are more predictable. Therefore, GARP investors should focus on steadily increasing earnings stocks, as this can help ensure that their investments are successful.

Calculate dividend yield

The third step in growth at a reasonable price for dividend investors is to calculate dividend yield. This is the ratio of annual dividend payments to the current stock price. It measures the return on investment that investors can expect from a company’s dividends. A high dividend yield can signify a company’s potential for growth and stability, while a low dividend yield can mean that the company’s stock may not be a good long-term investment. Simply divide the annual dividend payments by the current stock price to calculate dividend yield.

Monitor dividend growth rate

For dividend investors looking for growth at a reasonable price, monitoring the dividend growth rate is key. This measure reflects the rate at which a company is increasing its dividend payments over time, and can provide insight into the health of a company’s operations and its ability to reward shareholders. When evaluating a company for growth at a reasonable price, it is important to look at the company’s historical dividend growth rate and the rate at which other companies in the same sector are increasing their dividends. This can help investors determine whether the current dividend yield is sustainable and if the company is likely to increase its dividends in the future. Good GARP candidates will have a reasonable dividend growth rate, unlike many BDCs.

Track total return on investments

The fifth principle of growth at a reasonable price for dividend investors is to track the total return on investments. Total return accounts for the price appreciation of an asset and any dividends or interest payments generated by the asset. Tracking total return on investments allows for a more accurate measure of the performance of an investment, and can help investors better understand the true return on their investments. It is important to remember that it is not just the price appreciation of an investment that matters, but also the total return generated by the investment.

In conclusion, dividend investing is one of the most popular and successful methods for investors to generate passive income and build wealth over the long term. Growth at a reasonable price (GARP) is a powerful investing strategy emphasizing capital appreciation and dividend income. It allows investors to profit from stocks with good growth potential and reasonable dividends, helping to maximize returns. With careful research and strategic planning, GARP investing can be an effective way for dividend investors to achieve their long-term financial objectives.

GARP candidates today

We will provide a few GARP candidates in the coming weeks. For instance, in pharmaceutical stocks, you might consider Novartis (NVS).

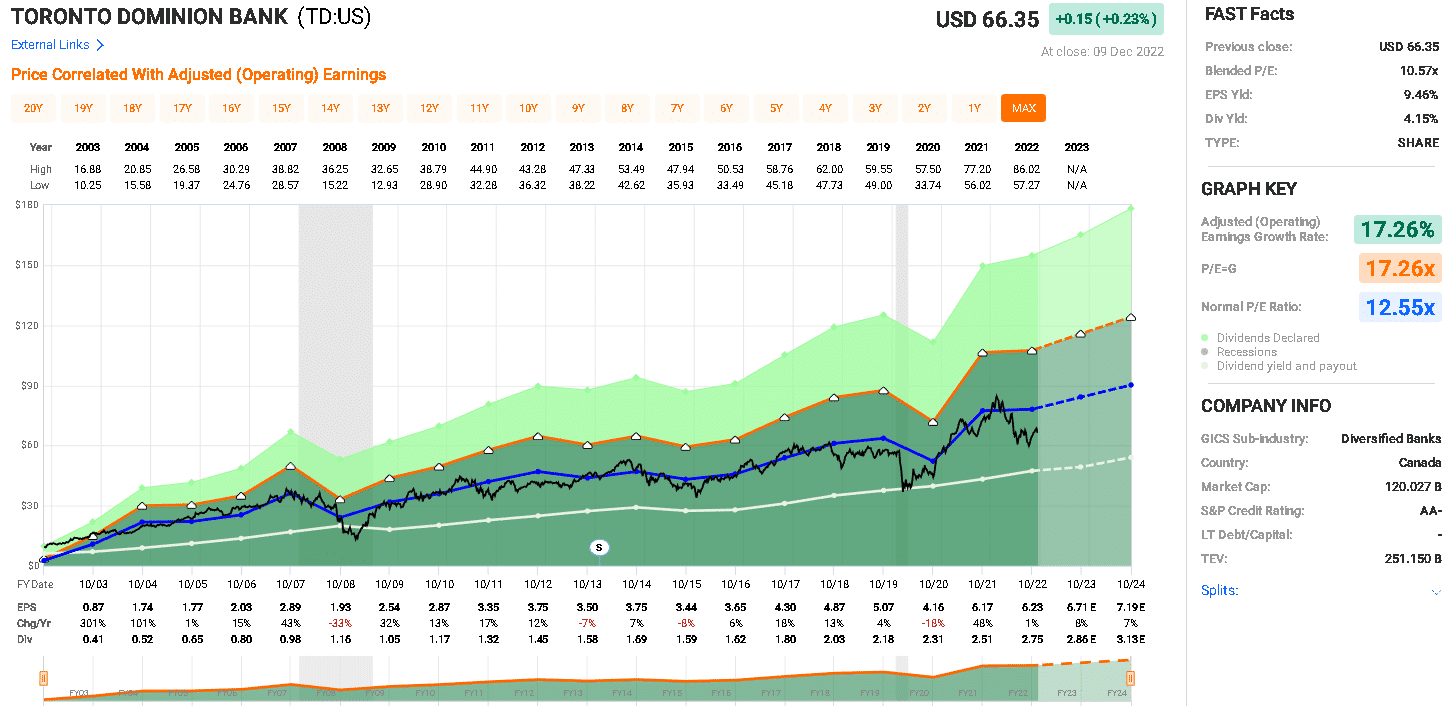

Here is one candidate – the Canadian bank stocks are less volatile than their US cousins, and most are available to investors through US exchanges. One example of a stalwart GARP candidate is Toronto Dominion Bank (TD). It has a long history of dividend payments and, while impacted by the global financial crisis in 2008-2009, earnings continued to grow from that point on despite some quieter years, such as 2013 and 2015 (Figure 1).

The company has an “A” Morningstar Financial Health Grade, a current dividend yield of 4.3%, and a five-year Dividend Growth Rate of 8.2% (Source: Stock Rover). Hold this for a sufficient period of time and you should do well.

This is a good firm, with a good and strong track record. There is the potential for further price declines. It has historically, over the last five years, traded at an 11.25x P/E ratio (Figure 2) and currently trades at 10.57x, showing it is reasonable value now. But it is not a ‘value stock.’

It is well-followed by analysts, and while their earnings estimates have been revised downwards lately, if their current estimates are met at the end of the 2024 year for the bank, and the prices return to a ‘normal’ P/E ratio, then we might expect a total rate of return of 30% or an annualized rate of return of 15% (Figure 2).

Figure 2. TD-GARP for dividend investors-forecast returns (Source: FAST Graphs)

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.