In today’s unpredictable market, it is becoming increasingly difficult for investors to find stocks that can deliver consistent, long-term growth at a reasonable price (GARP). Pharmaceutical stocks can be an excellent option for investors looking for growth opportunities without paying a premium price. Today we check out the NVS dividend and opportunity.

Pharmaceutical companies often develop and produce patented drugs and therapies, providing them with a competitive edge in the market that can lead to substantial long-term profits. By investing in pharmaceutical stocks, investors can benefit from this competitive edge while potentially gaining exposure to a sector that is often less volatile than the broader market. This blog post will discuss the merits of investing in pharmaceutical stocks for growth at a reasonable price (GARP). We will discuss what makes pharmaceutical stocks attractive to investors, some of the key risks and challenges associated with investing in the sector, and some of the major players in the pharmaceutical industry. We will also offer tips and advice on selecting the right stocks and creating a diversified portfolio that compounds with time like a dividend investor’s dream.

There are a range of stocks, like Novartis, that offer strong price appreciation and income, such as the powerful NVS dividend.

Analyzing the Pharmaceutical Sector

When analyzing the pharmaceutical sector, the competitive landscape is one of the most important things to consider. Companies in the pharmaceutical industry are typically large and well-established, with long-established distribution networks and deep research and development capabilities. Companies that possess the ability to innovate and differentiate their products in an increasingly competitive market should be the ones to focus on. Analyzing the competitive landscape can be done by studying market share and product innovation and identifying potential future trends. It is also important to consider the potential risks associated with the pharmaceutical industry, including regulatory concerns and market volatility. By studying the competitive landscape and potential risks, investors can make informed decisions when investing in pharmaceutical stocks.

Identifying Stocks with Growth Potential

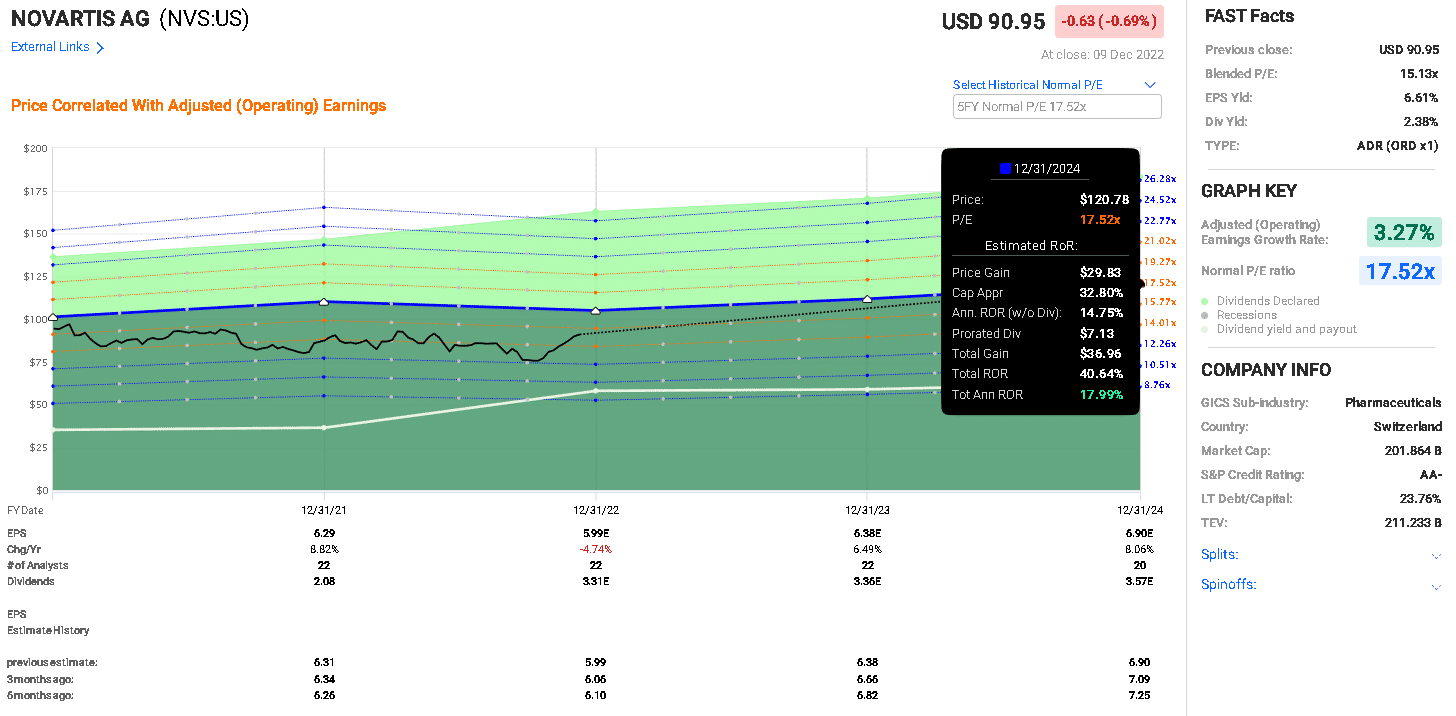

With Pharmaceutical Stocks for Growth at a Reasonable Price (GARP), one of the most important steps is identifying stocks with growth potential. This means looking for companies with strong financials, a strong track record of growth, and a clear roadmap for future growth. It’s also important to pay attention to potential risks associated with the stock. Some potential risks include regulatory issues, competition, and patent expirations. Once you’ve identified stocks with growth potential, it’s important to look deeper into the company’s financials and industry to ensure they’re a good investment. You can also consider growth in the dividend, such as we see in the NVS dividend, below.

Evaluating the Financials of GARP Stocks

Evaluating the financials of GARP stocks is key when deciding which stocks to invest in. Analyzing the financials helps evaluate the risk and reward potential of investing in the stock. A few key financial metrics to consider when evaluating GARP stocks are the Price to Earnings ratio (P/E), Price to Sales ratio (P/S), Price to Book ratio (P/B), and dividend yield. The P/E ratio helps assess the stock’s price relative to its earnings.

The P/S ratio helps evaluate the stock’s price relative to the company’s sales. The P/B ratio measures the stock’s price relative to the company’s assets. Finally, the dividend yield helps assess the stock’s income potential. Analyzing these financial metrics can help you decide if a particular GARP stock is a good investment choice. Many stocks, such as we see with the NVS dividend, often have a strong P/E ratio.

Risk Considerations

When investing in pharmaceutical stocks for growth at a reasonable price, one of the key risk considerations is the regulatory environment and the approval of products from regulatory agencies like the FDA. Companies may spend big money on research and development for a product only to have it denied approval. This could cause a significant loss of revenue for the company and a corresponding fall in its share price. Another risk to consider is the potential for competition from other companies producing the same or similar products. This could reduce the company’s market share and impact its profitability. Additionally, changes in consumer demand can have an equally significant impact on the company’s share price. Investors must, therefore, be aware of these risks and ensure they diversify their investments to minimize potential losses.

Taking Advantage of Opportunities in the Pharmaceutical Sector

The pharmaceutical sector is a rapidly growing industry, with new discoveries and innovations constantly providing a wealth of opportunities for investors. Taking advantage of these opportunities can be immensely rewarding financially and in terms of the growth potential. Pharmaceutical stocks offer investors the chance to benefit from increased sales, lower costs, improved margins, and the potential for long-term growth. With the right strategy and research, investors can capitalize on these opportunities and build a portfolio of profitable pharmaceutical stocks with growth potential.

In conclusion, pharmaceutical stocks can offer great growth opportunities at a reasonable price. Through GARP investing, investors can identify stocks with strong fundamentals and the potential to generate meaningful returns. Investors should also be mindful of the risk associated with these stocks, as they may be more volatile than the market as a whole. Ultimately, GARP investing offers investors the opportunity to seek high-growth investments with an acceptable level of risk.

Novartis (NVS) – a GARP candidate today with the powerful NVS dividend

I’ve noted that many pharmaceutical stocks have been trending higher, and NVS is no exception. This has a Morningstar Financial Health Grade of “A” and a Stock Rover Quality Score of “98/100” (Source: Stock Rover). NVS is a really strong, solid company that will help you compound your wealth and earnings. The dividend yield is lower at 3.7%, with a five-year DGR of 4.1% (Source: Stock Rover). As we might expect, while this beats investing in the SPY, the dividend yield is lower than in other sectors, such as in BDCs. The NVS dividend has a long history. There has been a rise in the NVS dividend each year since 1996.

The current price of 90.95 is lower than the average of six analysts’ targets at 97.53%. This suggests that there is still an upside, along with a good yield and a safe dividend payer. The potential upside is also clear in Figure 1, suggesting that NVS continues to trade below the five-year normal P/E of 17.25x as it is currently only at 15.13x. While not exceptional value, this is a safe pick and a suitable long-term GARP play. If prices return to their ‘normal’ P/E by the end of 2024 and earnings are as estimated, then this would represent a 40% rate of return or a 18% annualized rate of return.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.