PAX Patria Earnings Growth: 40% Returns Possible with PAX Stock Analysis

One of the investments that I’ve talked about a little bit has been Patria Investments Limited, ticker symbol PAX. I had an investment here largely because of their capital returns policy, which includes returning a huge amount of their free cash flow to shareholders through dividends. Now, that’s obviously attractive if the company can continue to grow. So, is it a growth company? I thought yes, and I continue to believe yes, it is a growth company.

A Closer Look at Patria Investments Limited

Patria Investments is a private market investment firm focused on investing in Latin America. This geographic diversification was appealing to me. They’ve had a fluctuating level of dividend payments over time, and I thought as their earnings increased, the level of dividends would also go up as per their policy of distributing profits to shareholders. However, recent changes have been concerning me quite a bit, and these changes were highlighted in their quarter two earnings call several weeks ago.

Exciting Investment Strategies

In the quarter two earnings call, Patria Investments discussed various aspects of their operations and strategies. One of the more exciting elements they mentioned was their move into real estate investment trusts (REITs). This kind of investment can offer stable returns and is a strategic way to diversify their portfolio. Before diving into quarterly results and future expectations, they shared an update on their capital management strategy.

Capital Management Strategy Update

For this year, they’ve set a 15-cent dividend for each of the last three quarters. While maintaining a fixed dividend isn’t overly concerning, it does represent a change in their past approach to setting high dividends based on earnings. They also announced a share repurchase program of 1.8 million shares over the next twelve months. I think this is a smart move because the shares seem undervalued at the moment. Repurchasing shares can create long-term shareholder value, which I view as a fantastic use of their capital.

“In terms of creating long-term shareholder value, I think that is a fantastic use of the capital.”

They also plan to reduce their level of debt, which is great. Though I’m somewhat disappointed by the shift to pay out less in dividends, I’d like to see some nod toward increasing dividends as earnings grow. It doesn’t have to be significant, but some method of distributing increased earnings would be ideal.

Current Dividend Yield

Currently, despite changes, the stock is yielding about 5%, which isn’t bad. This is particularly notable as Patria is a relatively new company with not much trading history. Their shares have seen prices as high as $22 but are now around $11 or $12.

Examining Earnings and Growth Potential

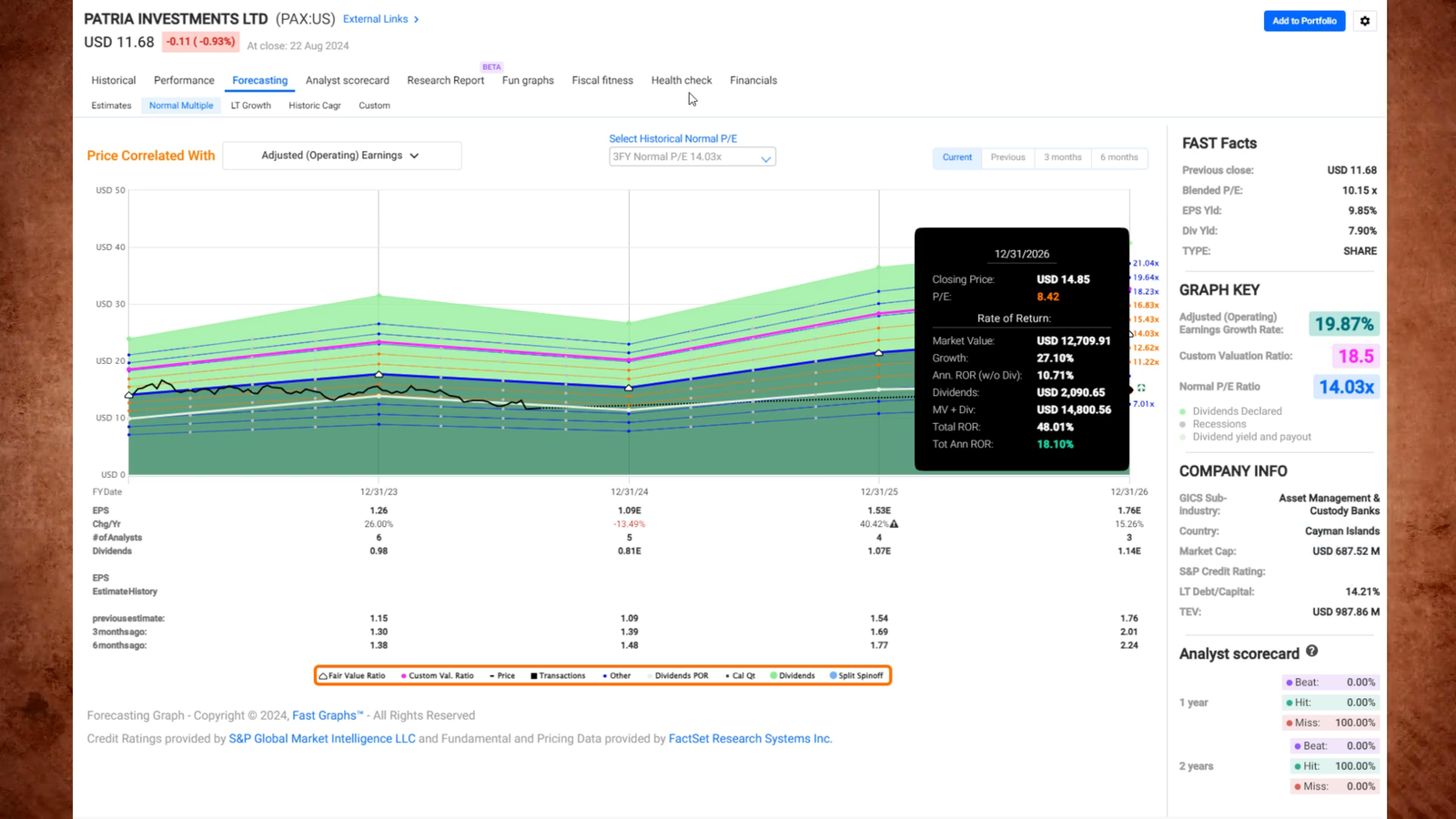

The company has experienced significant swings in earnings per share (EPS). Long-term, I expect Patria Investments to grow fairly quickly. If we stick to a normal multiple of about 14 times earnings, we could see strong annualized returns of up to 40%. Even if they fall short and trade at about 8 times earnings, we could still be looking at around an 18% annualized return.

However, this depends heavily on the dividend yield. Based on the recent changes in their capital management strategy, I’m not entirely convinced these estimates are reasonable. Over the last six months, there has been a drop in earnings, leading analysts to lower their earnings growth expectations.

Growth Projections

Looking forward, there’s an expected 40% increase in earnings next year, followed by another 15% in 2026. Capturing this powerful earnings growth with a position now could be very profitable. Despite my disappointment with the dividend changes, a share buyback program can also be lucrative. Reducing debt is an additional positive move. Even if we assume they do not reach higher P/E multiples, the EPS growth should still generate substantial long-term returns.

“Long-term, I’m just going to miss the steady dividends that we’ve enjoyed in the past.”

Is PAX Still a Good Investment?

If Patria Investments can hit these growth targets, it could still be a compelling long-term hold. Comparing their management strategy to firms like Apollo and Brookfield Asset Management (BAM), they could become a powerful growth story. Even though dividends may not be as plentiful as before, strong EPS growth should result in substantial share growth.

My Take on Patria Investments Limited (PAX)

Despite the changes, they will continue paying dividends as part of their capital management program. But what do you think? Does this shift in the capital management program change your outlook on investing in PAX? Does it make you less interested, or do you still see the potential for capital appreciation alongside a decent income with a current yield of about 5%? Let me know in the comments below!

And don’t forget to watch this next video YouTube thinks you would benefit from seeing.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.