Who is Main Street Capital (MAIN) and is the MAIN dividend good?

Main Street Capital is a leading investment firm that specializes in equity and debt investments in lower middle market companies. This business development company (BDC) seeks to invest in companies with strong revenue growth potential and management teams that are looking to recapitalize or buy out their businesses. Main Street Capital has a long track record of successful transactions, including management buyouts, recapitalizations, and buyouts. We look at the strength of the MAIN dividends, the investment opportunities, and how you can earn a good rate of return with MAIN as it is a long-term compounder.

Is Main Street Capital a good stock

Main Street Capital is a good stock for investors who are looking for a reliable and consistent investment. The company has a strong history of dividend payments, and its share price has been relatively stable over the past few years. Main Street Capital is also a well-run and profitable business, which is another positive for potential investors.

How does Main Street Capital make money?

Main Street Capital is a private equity firm that invests in small businesses throughout the United States. The firm primarily invests in businesses that have strong financials and a clear path to growth. Main Street Capital also offers business counseling and financing options to help struggling businesses reach their full potential.

Investment opportunity in Main Street and the MAIN dividends

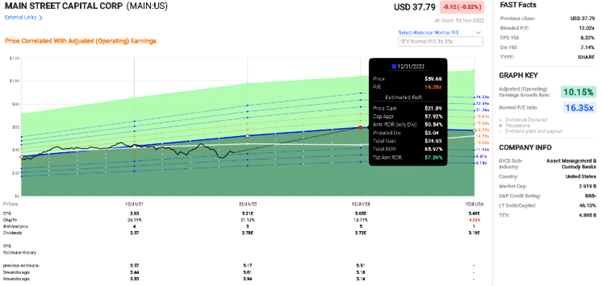

What does the investment opportunity look like in Main Street for a dividend investor? Based on analysts’ estimates and a return to the ‘normal’ P/E ratio over the last five years, we can see in Figure 1 that there is strong expected growth in earnings. By the end of 2023, if prices return to the ‘normal’ P/E multiple, we might expect nearly 65% rate of return in total for the period. We can pair this with reasonable dividend yield of over 7%. From this – we can say the MAIN dividends are attractive!

Is this good? Is MAIN a good long-term investment? We can see that in Figure 2 if we compare the results to the SPY, without dividends, then MAIN was about the same overall annualized rate of return as SPY. If, however, we include and reinvest our dividends, then the CAGR for MAIN outstrips SPY during this period. Note that the starting point is in 2008 and if you run this test over different periods you would get different results. Overall – investments in MAIN have been adding investments into a strong and consistent compounder.

Can we put much stock into analysts’ estimates of what future earnings may be to allow us to calculate the future expected returns, as we see in Figure 1? The answer is – sort of. FAST Graphs has a useful tool that allows us to judge the analysts’ accuracy. We can see this snapshot in Figure 3. In general, from the pie charts on the right-hand side, we can see that the level of accuracy is reasonable both one and two years out. From this, we can have some confidence that the firm will achieve the desired outcomes.

What about the MAIN Dividends?

Overall, MAIN is a good dividend stock. It has a long history of paying dividends, and its current dividend yield is just over 7%. While MAIN’s dividend yield is not the highest in the market, it is still a decent yield. Furthermore, MAIN has a strong track record of increasing its dividend payout each year. For all these reasons, MAIN is a good option for investors looking for a good dividend stock. It gives the opportunity to both benefit from a slowly growing dividend, and a strong starting dividend yield, and also they have equity growth through their investments in other businesses that drive the overall earnings growth for the company.

Great things about investing in Main Street Capital and MAIN dividends

Since its establishment in 2006, Main Street Capital has been dedicated to investing in small businesses and helping them grow. In addition to providing financing and mentorship, the company also provides access to its extensive network of investors and business resources.

Some of the benefits of investing with Main Street Capital include:

-A direct connection to experienced business owners

-Access to a wide range of investment opportunities

-The opportunity to support local businesses and help them grow

-Equity in their investments helps support growing earnings over time and a growing dividend

Alternative BDCs to Main Street Capital

Alternative BDCs to Main Street Capital are available in the market. Some of them specialize in different sectors of the economy, while others offer more diversified investment portfolios. Regardless of their specific features, all alternative BDCs offer investors a unique way to access the capital markets and invest in a range of businesses across the United States. We will cover some of these investments in the future.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.