The Dark Side of Dividend Aristocrats: Why Blue-Chip Isn’t Always Better

In our quest for financial freedom, we often gravitate towards the allure of blue-chip stocks. However, there is a dark side to relying solely on these so-called dividend aristocrats.

In this article, we delve into the hidden risks that can lurk beneath the surface of seemingly reliable investments. Through case studies and an exploration of alternative strategies, we shed light on why blue-chip isn’t always better.

Join us as we uncover the truth behind dividend aristocrats and empower ourselves with knowledge.

Key Takeaways

- Dividend Aristocrats have consistently increased dividends for 25 consecutive years, but being a Dividend Aristocrat does not guarantee future performance or stock price appreciation.

- Meeting liquidity criteria is a requirement for a company to be classified as a Dividend Aristocrat, ensuring the company can cover its obligations and generate sufficient cash flow.

- Dividend Aristocrats have shown stability and resilience during economic downturns, making them a reliable investment option for steady income and long-term growth.

- Blue-chip stocks, including Dividend Aristocrats, have risks such as high demand leading to potential losses, fluctuations in stock prices, and the possibility of companies reducing or eliminating dividend payments.

Understanding the Concept of Dividend Aristocrats

Dividend Aristocrats are a select group of companies that have consistently increased their dividends for at least 25 consecutive years. These companies must also meet certain selection criteria, such as being part of the S&P 500 index and having a minimum market capitalization requirement.

The historical performance of Dividend Aristocrats has shown them to be resilient during market downturns and capable of delivering consistent returns to investors over the long term.

Dividend Aristocrats Definition

Although it’s widely known, the definition of Dividend Aristocrats may still surprise some investors.

Dividend Aristocrats are a select group of companies that have consistently increased their dividend payments for at least 25 consecutive years. These companies are considered to be blue-chip stocks, representing stable and reliable investments.

The requirements to be classified as a Dividend Aristocrat include being part of the S&P 500 index and meeting certain liquidity criteria. This recognition is highly valued by investors seeking consistent income and long-term stability in their portfolios.

However, it’s important for investors to understand that being a Dividend Aristocrat does not guarantee future performance or stock price appreciation. While these companies have shown a strong commitment to returning value to shareholders through dividends, other factors such as market conditions and industry disruptions can still impact their financial health and overall returns.

Selection Criteria

Investors might be surprised to learn that meeting certain liquidity criteria is one of the requirements to be classified as a Dividend Aristocrat. This classification is not solely based on a company’s ability to consistently increase its dividend payments, but also on its financial strength and stability. Liquidity, in this context, refers to a company’s ability to convert its assets into cash quickly without significant loss in value. It ensures that the company has enough resources to meet its short-term obligations and continue paying dividends even during challenging times.

To give you a better understanding of the liquidity criteria for Dividend Aristocrats, here’s a table showcasing five key indicators:

| Indicator | Definition | Importance |

|---|---|---|

| Current Ratio | Measures short-term liquidity by comparing current assets with current liabilities. | Ensures the company can cover its immediate obligations. |

| Quick Ratio | Measures immediate liquidity by excluding inventory from current assets. | Provides insight into how well the company can pay off debts without relying on inventory sales. |

| Cash Ratio | Measures the proportion of cash and cash equivalents against current liabilities. | Reflects the company’s ability to settle debts using readily available funds. |

| Operating Cash Flow Ratio | Compares operating cash flow with total debt outstanding. | Indicates if the company generates sufficient cash flow to cover debt repayments. |

| Interest Coverage Ratio | Calculates the number of times operating income covers interest expenses. | Demonstrates whether the company generates enough income to comfortably meet interest obligations. |

Understanding these liquidity criteria helps investors assess a potential investment’s financial health beyond just dividend growth, providing them with more freedom and confidence in their decisions.

Aristocrats’ Historical Performance

When considering potential investments, it’s important to examine the historical performance of Aristocrats. These companies have a strong track record of consistently increasing their dividends for at least 25 consecutive years.

Here are some key points to consider:

- Stability: Aristocrats have demonstrated stability and resilience even during economic downturns, making them attractive options for conservative investors.

- Example: In the 2008 financial crisis, many Aristocrats continued to increase their dividends while other companies struggled.

- Dividend Growth: The historical performance of Aristocrats shows that they have consistently increased their dividend payouts over time.

- Example: Some Aristocrats have achieved double-digit annual growth rates in their dividends.

Considering these factors, it is evident that Aristocrats can be a reliable investment option for those seeking steady income and long-term growth. However, it’s essential to delve deeper into the allure of blue-chip stocks: a closer look at their potential risks and drawbacks.

The Allure of Blue-Chip Stocks: A Closer Look

Blue-chip stocks have long been a popular choice for investors seeking stability and consistent returns. In this discussion, we will explore the factors that contribute to their attraction, including the perceived safety they offer in uncertain markets.

Additionally, we will review their historical performance to gain insights into their potential as long-term investments. However, it is important to uncover potential pitfalls associated with blue-chip investing and consider alternative investment strategies that may offer greater diversification and growth opportunities.

Blue-Chip Stocks’ Attraction

Perhaps you’re drawn to blue-chip stocks because of their stability and reputation in the market. Blue-chip stocks have long been seen as a safe haven for investors, offering steady dividends and consistent growth. Here are some reasons why blue-chip stocks continue to attract investors:

- Reliability: Blue-chip stocks are often backed by companies with solid track records, established brands, and strong financial positions.

- Dividend payments: Many blue-chip stocks have a history of paying dividends consistently over time, making them appealing to income-focused investors.

However, it is important to consider the following points before investing in blue-chip stocks:

- Limited growth potential: Due to their size and maturity, blue-chip companies may not offer the same level of growth opportunities as smaller or newer companies.

- Market risks: Even though blue-chip stocks are considered stable, they can still be impacted by broader market trends and economic downturns.

While blue-chip stocks offer stability and reliable dividend payments, it is crucial for investors seeking freedom to carefully analyze all aspects before making investment decisions.

Perceived Safety Explained

Investors frequently gravitate towards blue-chip stocks, viewing them as a secure and dependable investment choice. However, it’s crucial to comprehend that perceived safety doesn’t always equate to actual protection – this is one aspect of the dark side of dividend aristocrats. While blue-chip stocks are often large, well-established firms with a track record of steady earnings and dividends, they do come with their own set of risks.

One such risk is the possibility of overvaluation. Blue-chip stocks often command premium valuations due to their perceived stability. This means investors might end up paying an inflated price for these shares, another facet of the dark side of dividend aristocrats. Additionally, the dependency on dividend payments can introduce vulnerability during economic downturns. There may be instances where companies need to reduce or eliminate dividends to conserve capital, revealing yet another element of the dark side of dividend aristocrats.

The table below showcases some of the potential risks investors should be cognizant of when considering blue-chip stocks:

| Risk | Explanation | Example |

|---|---|---|

| Overvaluation | High demand drives up prices, potentially leading to losses | Buying a stock at its peak and experiencing a subsequent dip |

| Dividend cuts | Companies reducing or eliminating dividend payments | A company struggling financially and needing to conserve cash |

| Market volatility | Fluctuations in stock prices due to market conditions | A sudden drop in share prices during a market downturn |

It is crucial for investors to thoroughly assess the risks associated with blue-chip stocks before making investment decisions. While they may offer perceived safety and reliability, it is important not to overlook their vulnerabilities and to understand the Dark Side of Dividend Aristocrats. Freedom-seeking investors should exercise caution and consider diversifying their portfolios to mitigate these risks effectively.

Historical Performance Review

In our previous discussion, we explored the concept of perceived safety when it comes to dividend aristocrats. Now, let’s delve into a historical performance review of these blue-chip stocks.

When considering the historical performance of dividend aristocrats, it is important to note that past results may not necessarily indicate future success. However, examining their track record can provide valuable insights.

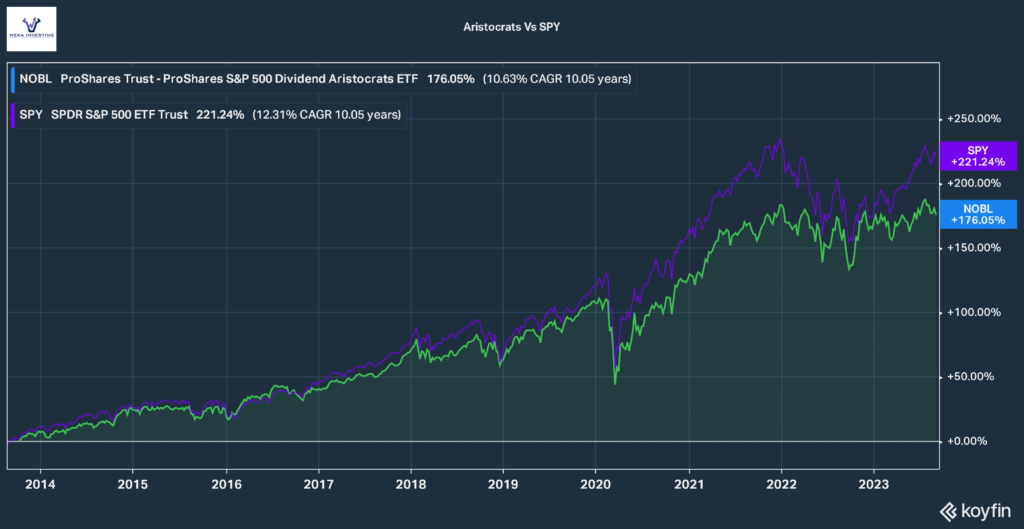

Over the long term, dividend aristocrats have displayed consistent dividend payments and capital appreciation. This stability has made them attractive to income-focused investors seeking reliable returns. Returns from the NOBL Dividend Aristocrats Index have been close to SPY.

Additionally, some studies suggest that dividend-paying stocks tend to outperform non-dividend-paying stocks over time.

While historical performance can give us an idea of how dividend aristocrats have fared in the past, it is crucial to analyze other factors such as current market conditions and individual company fundamentals before making investment decisions.

Potential Pitfalls Uncovered – A Look at the Dark Side of Dividend Aristocrats

Delving into the potential perils and dark side of dividend aristocrats, it’s crucial to factor in aspects such as market volatility and shifts in industry trends. Although these blue-chip stocks boast a robust history of regular dividends, they aren’t exempt from market oscillations. The dark side of dividend aristocrats can be exposed by such market volatility, impacting the stock price and paving the way for potential investor losses.

Moreover, alterations in industry trends can destabilize the business models of these dividend aristocrats. This can hamper their ability to churn out steady income and uphold their reputation as dependable dividend providers – another element of the dark side of dividend aristocrats.

From this perspective, it’s vital for investors to stay abreast of market conditions and keep a watchful eye on industry advancements when contemplating investments in dividend aristocrats. Adopting a proactive stance and being conscious of potential risks can empower investors to make more enlightened decisions about their portfolio distribution.

As we segue into the next section on alternative investment strategies…

Notwithstanding the potential traps linked with dividend aristocrats, there exist alternative investment strategies that offer avenues for diversification and potentially superior returns. It’s critical to remember that understanding the dark side of dividend aristocrats can help navigate these alternatives more effectively.

Indeed, while the dark side of dividend aristocrats presents certain risks, it also enlightens investors about the complexities of the market, aiding them in making informed decisions and exploring diversified investment strategies.

Alternative Investment Strategies

Despite the potential pitfalls, there’s an array of alternative investment strategies that can provide diversification and potentially higher returns. These strategies offer investors the freedom to explore different avenues beyond traditional blue-chip investments.

Here are two sub-lists outlining some alternative options:

Real Estate Investments:

- Rental properties: Investing in residential or commercial rental properties can generate regular income through rent payments.

- Real estate investment trusts (REITs): These publicly traded companies allow investors to pool their money together to invest in a diversified portfolio of real estate assets.

Commodities Investments:

- Precious metals: Gold, silver, and other precious metals can act as a hedge against inflation and economic uncertainty.

- Energy commodities: Investing in oil, natural gas, or renewable energy sources allows investors to benefit from fluctuations in energy prices.

The Hidden Risks of Relying on Dividend Aristocrats

When it comes to investing in dividend aristocrats, certain concealed dangers are lurking beneath the surface. This is the dark side of dividend aristocrats. Unexpected downturns among these ostensibly dependable stocks can have a substantial effect on investor’s portfolios.

To counteract these hazards, it becomes vital to apply robust risk management techniques and contemplate different avenues towards dividends. This is an essential step in understanding the dark side of dividend aristocrats.

Furthermore, while blue-chip stocks may appear to be a secure investment, they too harbor their own potential pitfalls that require meticulous evaluation.

In the end, the conversation between diversification and dividends becomes a key aspect in navigating through the intricate realm of investing, especially when trying to avoid the dark side of dividend aristocrats.

Unforeseen Dividend Aristocrat Failures

You might not realize the unforeseen failures that can occur with dividend aristocrats. While these blue-chip stocks are often seen as safe and reliable investments, there are certain risks that investors need to be aware of.

- Dividend cuts: Despite their reputation for consistent payments, dividend aristocrats are not immune to reducing or eliminating their dividends altogether. This can happen due to a variety of reasons such as declining profitability, economic downturns, or changes in company strategy.

- Market underperformance: Just because a stock has a long history of increasing dividends does not guarantee its future performance. Dividend aristocrats may fail to keep up with the overall market returns and lag behind other more growth-oriented investments.

It is important for investors to understand that even the most established companies can face challenges and experience setbacks. Conducting thorough research and diversifying your investment portfolio can help mitigate the risks associated with dividend aristocrats.

Risk Management Strategies

Investors can lessen the threats associated with dividend aristocrats, including the dark side of dividend aristocrats, by applying effective risk management strategies.

One principal strategy is diversification. By distributing investments over various sectors and asset classes, investors can diminish the effect of any single company’s downfall on their entire portfolio, thereby counteracting the dark side of dividend aristocrats.

Another vital strategy is to carry out comprehensive research and due diligence prior to investing in a dividend aristocrat. This involves scrutinizing financial statements, gauging the company’s competitive stance, and evaluating its capacity to sustain consistent dividend payments, thereby mitigating the dark side of dividend aristocrats.

Moreover, establishing reasonable expectations is key. Dividend aristocrats may not invariably offer high yields or generate extraordinary returns, but they frequently provide steadiness and dependable income over an extended period.

Lastly, it’s crucial for investors to periodically reassess their portfolios and make necessary modifications based on fluctuating market conditions or individual company performance, ensuring they navigate the dark side of dividend aristocrats effectively.

Alternative Dividend Approaches

One way to explore alternative dividend approaches is by considering the potential benefits of high-yield dividend stocks. These stocks offer a unique opportunity for investors who desire freedom in their investment strategy.

Here are some reasons why high-yield dividend stocks can be advantageous:

- Higher income potential: High-yield dividend stocks typically offer higher yields than traditional blue-chip stocks, allowing investors to earn more income from their investments.

- Diversification: Investing in high-yield dividend stocks provides an opportunity to diversify one’s portfolio beyond the usual blue-chip holdings, potentially reducing risk and increasing overall returns.

Blue-Chip Stocks Pitfalls

Understanding the potential drawbacks of investing in blue-chip stocks is crucial before delving into high-yield dividend stocks. Blue-chip stocks, despite their perceived safety owing to their stability and well-established reputations, come with certain risks. One of the key challenges is overvaluation. Owing to their reputation, these stocks are typically priced higher than other market offerings, which could limit their scope for future growth. This largely unseen dark side of dividend aristocrats can be a significant hurdle.

Another aspect that reveals the dark side of dividend aristocrats is their vulnerability to economic downturns and market fluctuations. The large scale and extensive industry exposure of these stocks make them more prone to such risks. Therefore, recognizing the dark side of dividend aristocrats is key to avoiding potential pitfalls in investment.

As we transition into the next section addressing ‘diversification versus dividends’, it’s crucial to keep in mind that an investor’s focus should not be solely on high-dividend yields or dividend aristocrats. This is a core principle in understanding the dark side of dividend aristocrats.

Investors must be aware of the dark side of dividend aristocrats and realize that a balanced perspective is needed when building an investment portfolio. Exclusive focus on high-dividend yields can lead to an imbalance, highlighting the dark side of dividend aristocrats and the risks associated with over-reliance on them.

Therefore, careful consideration and analysis of these factors are essential for investors before making significant allocations to blue-chip stocks in their portfolios. Being aware of these potential pitfalls helps in understanding the dark side of dividend aristocrats and aids in making informed decisions.

Diversification Versus Dividends

When considering our investment portfolio, it’s important to strike a balance between diversification and focusing solely on high-dividend yields. While dividends can provide reliable income, relying too heavily on them may limit the potential for growth.

Here are some key points to consider:

- Diversification:

- Spreading investments across different sectors and asset classes can help mitigate risk.

- It allows us to take advantage of opportunities in various industries and regions.

- High-Dividend Yields:

- They can offer a steady stream of income, especially for retirees or those seeking passive cash flow.

- However, chasing only high-yielding stocks may lead to concentration risk and potential losses if the underlying company faces financial challenges.

Striking a balance between diversification and dividend focus ensures we maintain flexibility and freedom in our investment strategies while maximizing potential returns.

Case Studies: When Blue-Chip Stocks Fail to Deliver

Have you ever wondered why blue-chip stocks sometimes fail to deliver as expected? While these stocks are often seen as a safe bet for investors seeking stable returns and reliable dividends, there have been cases where even the most esteemed companies have fallen short.

It is crucial to analyze these situations and understand the reasons behind their failure.

One such case study is General Electric (GE), once considered a pillar of American industry. In recent years, GE faced numerous challenges, including mismanagement, heavy debt burden, and an inability to adapt to changing market conditions. As a result, the company was forced to cut its dividend in 2017 after more than a century of uninterrupted payments.

Another example is IBM, which struggled with declining revenues and failed attempts at transitioning into new technologies. Despite being a longtime dividend payer and part of the Dow Jones Industrial Average since 1979, IBM has experienced stagnant growth and diminishing shareholder returns in recent years.

These instances highlight the importance of not solely relying on blue-chip stocks for dividend income. Exploring alternative strategies can provide opportunities beyond traditional blue chips that may deliver better results for investors seeking freedom from underperforming investments.

In our next section, we will explore alternative dividend strategies that offer potential advantages over blue-chip stocks.

Exploring Alternative Dividend Strategies: Beyond the Blue-Chip

Let’s delve into other dividend strategies that offer potential advantages beyond the traditional blue-chip stocks.

When it comes to investing, diversification is key. Here are some alternative dividend strategies to consider:

- Dividend ETFs:

- These exchange-traded funds provide instant diversification by investing in a basket of dividend-paying stocks across various sectors.

- They offer exposure to a wide range of companies and can be an efficient way to access dividends without having to pick individual stocks.

- Dividend Growth Stocks:

- Investing in companies with a track record of consistently increasing their dividends over time can lead to significant long-term returns.

- These stocks often have strong financials and solid growth prospects, making them attractive investments for those seeking both income and capital appreciation.

By exploring these alternative dividend strategies, investors can potentially benefit from increased diversification and the opportunity for higher returns. However, it’s important to note that no investment strategy is without risk. Conduct thorough research and consult with a financial advisor before making any investment decisions.

Frequently Asked Questions

What Are the Specific Criteria a Company Must Meet to Be Classified as a Dividend Aristocrat?

To be classified as a dividend aristocrat, a company must meet specific criteria such as being in the S&P 500 index, having increased dividends for at least 25 consecutive years, and meeting certain liquidity requirements.

How Do Dividend Aristocrats Compare to Other Types of High-Yield Investment Options?

Dividend aristocrats, compared to other high-yield options, provide stability and consistent returns. However, it’s important to consider the potential drawbacks and risks associated with these blue-chip stocks before making investment decisions.

Can You Provide Examples of Well-Known Companies That Were Once Considered Dividend Aristocrats but No Longer Meet the Criteria?

Sure, some well-known companies that were once considered dividend aristocrats but no longer meet the criteria include General Electric, which faced financial difficulties, and AT&T, which had to cut its dividend due to high debt levels.

Are There Any Potential Downsides to Investing in Dividend Aristocrats?

There can be potential downsides to investing in dividend aristocrats. While they may offer stable returns, some companies that were once considered aristocrats no longer meet the criteria, which raises concerns about their long-term sustainability.

What Alternative Strategies Can Investors Consider if They Are Not Interested in Investing in Blue-Chip Stocks or Dividend Aristocrats?

Investors seeking alternatives to blue-chip stocks or dividend aristocrats can explore various strategies. These may include growth-oriented stocks, mid-cap or small-cap investments, thematic investing, sector-specific ETFs, or even international markets for diversification and potential higher returns.

Conclusion – Dark Side of Dividend Aristocrats

In conclusion, it is crucial to acknowledge the dark side of dividend aristocrats and question the notion that blue-chip stocks are always better.

While these companies may seem enticing with their long track record of consistent dividends, they can come with hidden risks that investors often overlook.

Through case studies, we have seen how even seemingly reliable blue-chip stocks can fail to deliver.

It is imperative for investors to explore alternative dividend strategies beyond the traditional blue-chip approach in order to mitigate these risks and secure a more diversified portfolio.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.