Closed-end funds are investment vehicles that hold a fixed number of shares and trade on exchanges like stocks. Unlike open-end mutual funds, the closed end fund discount stems from how they issue a limited number of shares at their initial public offering (IPO), which means they have a finite amount of capital to invest in securities. At times, the closed-end fund discount can be found, where the value of the underlying assets exceeds the price of the traded shares.

This makes them an attractive option for investors looking to diversify their portfolios with less risk. One advantage of investing in closed-end funds is the potential discount opportunity offered by these types of funds. A discount occurs when the market price of the fund’s shares falls below its net asset value (NAV).

In other words, investors can purchase shares at a lower cost than what it would take to buy all the underlying assets individually. These discounts can provide opportunities for savvy investors to make profits as markets correct themselves over time, while also providing protection against downside risks associated with traditional investments.

Understanding Closed-End Funds

As an investor, you want to have the freedom of choice when it comes to investing in different financial instruments. One such instrument that can help diversify your portfolio is a closed-end fund. However, understanding what they are and how they work before diving into this investment option headfirst is essential.

Closed-end funds are collective investment vehicles that pool money from various investors to invest in stocks, bonds, or other assets selected by professional managers. Unlike open-ended mutual funds where the number of shares outstanding can be increased or decreased based on demand, closed-end funds issue only a fixed number of shares which trade like stock on exchanges. As a result, their prices fluctuate throughout the day based on supply and demand factors.

While closed-end funds offer several benefits over traditional mutual funds such as trading flexibility and access to specialized investments not available through exchange-traded funds (ETFs), there are also some drawbacks worth considering. For instance, fees associated with these types of investments tend to be higher than those charged for ETFs or index mutual funds due to active management requirements. Additionally, historical performance analysis indicates that many closed-end funds often underperform benchmark indices even after accounting for expenses.

Understanding how closed-end funds work is critical if you want to take advantage of the discount opportunities they present in market turmoil.

The next section will provide insights into how these unique investment options operate and why discounts may occur despite strong asset portfolios managed by experienced professionals.

How the Funds Work and Create the Closed End Fund Discount

Having gained an understanding of closed-end funds, investors can explore the opportunities presented by their discounted prices. Closed-end fund shares are traded on the secondary market, so their prices may deviate from their net asset value (NAV).

This means that sometimes a closed-end fund’s share price trades below its NAV, giving investors an opportunity to purchase undervalued assets at a discount.

Investors should also consider taxation when investing in closed-end funds. These funds have different tax implications compared to mutual funds or exchange-traded funds.

Closed-end funds typically distribute capital gains annually which is subject to taxes. Investors should consult with their financial advisors about how these distributions will affect their tax situations.

It is important for investors to keep up-to-date with market trends in relation to closed-end funds. Market trends can influence the performance of these investment vehicles and therefore impact investor returns.

For example, if interest rates rise, fixed-income closed-end funds may experience a decline in value due to lower demand for existing bonds paying lower yields.

In summary, discounted opportunities exist within the world of closed-end funds but they come with unique risks that require careful consideration before investing. Taxation and market trends must be taken into account when making investment decisions in this space as they can greatly impact overall portfolio performance. In the subsequent section, we will explore the types of closed-end funds that are available for investment consideration.

Types of Closed-End Funds

Closed-end funds are a collective investment scheme offering investors a more varied investment portfolio.

- Real estate funds are one type of closed-end fund and allow investors to diversify their portfolio with investments in real estate.

- Bond funds are another type of closed-end fund, which can include government- and corporate-issued bonds, providing investors with a fixed income.

- Equity funds are a third type of closed-end fund, offering investors a chance to invest in stocks and shares of public companies.

Closed-end funds provide investors with additional liquidity, potentially offering discount opportunities compared to other investment types. Therefore, closed-end funds offer investors an excellent opportunity to diversify their portfolios and gain access to a range of investments.

Real Estate Funds

The real estate market trends have been volatile in recent times, making investment strategies for real estate funds crucial.

Real estate closed-end funds are a form of investment that allows investors to pool their resources into a fund managed by experts who invest in various properties and projects. The objective is to provide returns through appreciation or rental income from the investments made.

One potential advantage of investing in real estate closed-end funds is that they can offer exposure to different types of property assets such as commercial, residential, industrial, and retail properties. This type of diversification provides an opportunity to mitigate risks while taking advantage of any growth opportunities within specific markets. They are often distinct from real estate investment trusts (REITs) as the real estate CEFs may hold more leverage.

Additionally, these funds often use leverage to acquire more significant assets than individual investors could achieve on their own.

Investors should know that real estate closed-end funds trade at discounts or premiums relative to their net asset values (NAV). These price fluctuations may present opportunities for those looking to buy when there is a discount or sell when there is a premium. However, it’s important to consider the NAV and other factors like management fees, performance history, and risk profile before investing.

In conclusion, understanding the real estate market trends and implementing sound investment strategies for real estate closed-end funds can present exciting opportunities for investors seeking portfolio diversification beyond traditional stocks and bonds.

By carefully considering all relevant factors including NAV discounts/premiums, management fees, and performance history, and identifying emerging growth sectors with high yields; investors can take full advantage of this dynamic sector while mitigating risks associated with volatility inherent in global capital markets today.

Bond Funds

Real estate closed-end funds are just one type of investment vehicle available to investors looking for diversification beyond traditional stocks and bonds. Another option is bond funds, which invest in a variety of fixed-income securities like government, municipal, or corporate bonds. Bond funds can allow investors to generate regular income through interest payments while offering potential capital appreciation.

One advantage of investing in bond funds is that they offer diversification benefits as they hold multiple bonds from different issuers, sectors, and geographies. This diversification helps reduce default or credit risk risks, market volatility, and interest rate fluctuations. Not all bond funds are created equal; some may focus on high-yield (junk) bonds but come with higher risks than those holding investment-grade debt.

Investors should consider yield analysis strategies when evaluating bond funds as these will help determine if the fund offers attractive returns compared to other similar investments. Yield analysis considers several factors including current yields, duration, credit quality, and expenses among others. Investors must also understand the fees charged by the fund manager because these can eat into their returns over time.

In conclusion, bond funds can be an excellent addition to an investor’s portfolio due to their diversification benefits and steady income stream. However, before investing in any bond fund, it’s crucial for investors to conduct thorough research on the underlying holdings and the management team responsible for making investment decisions. By doing so, investors can make informed decisions based on their financial goals while mitigating risks associated with this dynamic sector of global capital markets today.

Equity Funds

Investing in different types of closed-end funds offers investors a range of investment options that can help diversify their portfolios beyond traditional real estate and bonds.

In addition to bond funds, equity funds are also available. Equity funds invest in stocks or shares issued by companies listed on the stock exchange or privately held firms. These funds aim to generate returns through capital appreciation as well as dividends paid out to shareholders.

Investors should consider factors such as past performance and market trends when evaluating equity funds. Equity fund performance varies depending on several variables like the sector, geography, company size, and style (value vs growth). The management team responsible for making investment decisions also plays an important role in determining whether an equity fund will perform well over time or not. Investors must conduct thorough research before investing in any equity fund.

Some CEFs focus on particular segments or sectors of the market. For instance, investors looking for stability in utilities and infrastructure might consider funds such as UTG or UTF.

Market trends are another crucial factor affecting equity funds’ performance since they influence investor sentiment toward various sectors and companies. For instance, when there is high demand for technology-related products during the COVID-19 pandemic times, it positively impacted tech-related equities resulting in good market returns for some technology-focused equity investments.

In conclusion, equity funds offer viable alternatives to traditional investments because they hold many benefits such as the potential for strong capital appreciation and dividend payouts from profitable companies. However, it’s vital for investors to do their homework carefully before investing in any equity fund – this includes understanding the underlying holdings and fees charged by management teams among other things.

By taking these precautions into account when selecting an appropriate investment vehicle based on personal financial goals while keeping risks at bay, investors can increase their chances of achieving long-term success with confidence.

Advantages of Investing in Closed-End Funds

Investing in closed-end funds offers several advantages that appeal to investors seeking higher returns and diversification. One of the most significant benefits is their ability to trade on stock exchanges like other securities, making them more accessible than mutual funds or exchange-traded funds (ETFs). This feature allows for greater liquidity, as investors can buy or sell shares at any time during market hours.

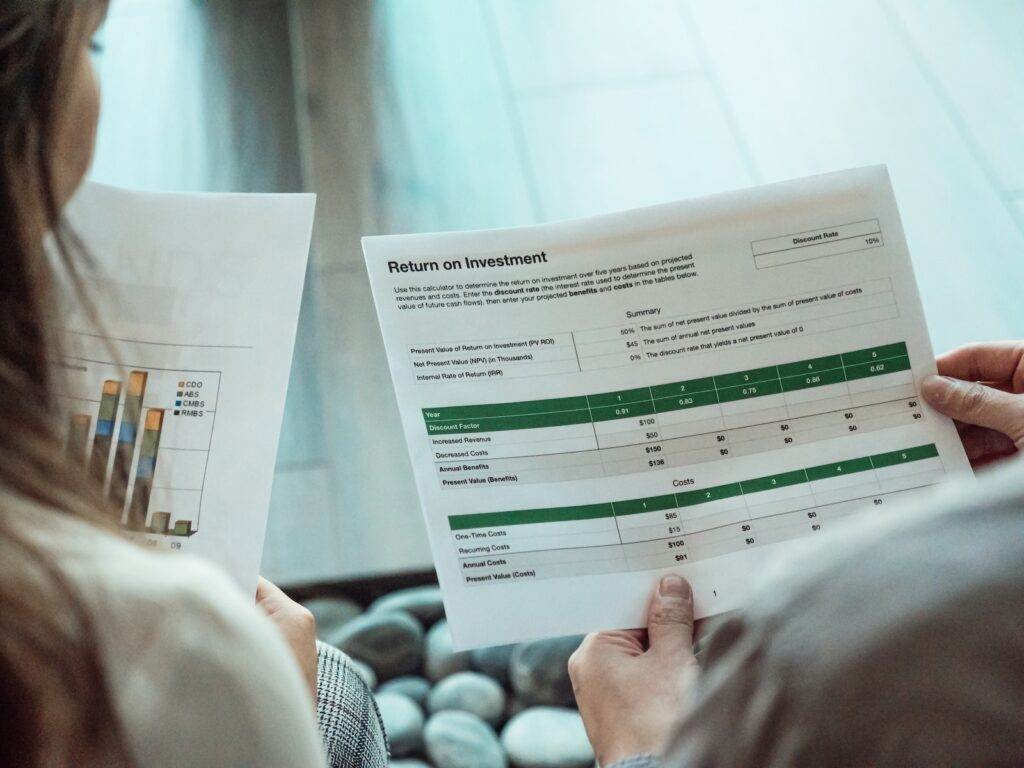

Performance analysis is another advantage of investing in closed-end funds. Unlike open-ended mutual funds, which must redeem shares upon request, closed-end funds have a fixed number of outstanding shares. Thus, their net asset value (NAV) reflects only the fund’s underlying assets’ daily fluctuations without being influenced by investor redemptions. This structure makes it easier for investors to analyze performance and make informed decisions based on historical data.

Another benefit of closed-end funds is that they offer professional investment management services at a lower cost compared to managed accounts or private equity investments. Management fees charged by these types of funds are typically lower because they do not require active trading strategies or constant monitoring required in other products with high maintenance costs.

In conclusion, investing in closed-end funds provides several advantages that attract new and experienced investors. Greater accessibility through stock exchange listings, ease of performance analysis, and reduced-cost professional management services contribute to this product’s popularity among investors.

Moving forward, however, it is essential to consider the potential risks associated with this type of investment before committing capital. The following section outlines some disadvantages one should be aware of when considering an investment in closed-end funds.

Disadvantages Of Investing In Closed-End Funds

According to a recent study, investing in closed-end funds can be disadvantageous due to various reasons.

Firstly, tax considerations are often overlooked by investors when it comes to investing in these types of funds. Closed-end funds tend to distribute capital gains and dividends annually, making them subject to taxation at the investor’s marginal rate.

Secondly, market volatility poses another challenge for closed-end fund investors. Unlike open-end mutual funds which continuously issue and redeem shares at their net asset value (NAV), closed-end funds trade on an exchange where prices are determined by supply and demand factors rather than NAV. This means that during periods of high market volatility or economic uncertainty, the discounts may widen significantly.

Furthermore, closed-end funds can carry higher expenses than other investment options such as index funds or ETFs. These fees include management, administrative, and distribution expenses, among others. High expense ratios reduce returns and make it difficult for investors to outperform benchmark indices.

Lastly, liquidity risk is another factor that should be considered before investing in closed-end funds. Due to their relatively small size and low trading volume, buying or selling shares in a timely manner may prove challenging especially during times of heightened market stress.

Moving forward from this topic’s discussion on the disadvantages of investing in closed-end funds due to tax considerations and market volatility; let us now delve into what discounts are in closed-end funds.

What is the Closed-End Fund Discount?

Despite the disadvantages of investing in closed-end funds, there are potential opportunities to be found.

One such opportunity is buying these funds at a discount. A discount occurs when the market price of a closed-end fund falls below its net asset value (NAV). This means that investors can buy shares at a lower cost than what they are actually worth.

On the other hand, premiums occur when the market price of a closed-end fund rises above its NAV. This means investors would have to pay more for shares than what they are actually worth. While discounts and premiums fluctuate over time, historical trends show that discounts tend to be more common than premiums.

Investors who purchase their shares at a discount may benefit from two possible scenarios: first, if the market price increases and returns to NAV; or second, if the fund’s assets increase in value. In both cases, investors could potentially realize greater profits because they purchased shares at a discounted rate.

However, it’s important for investors to carefully evaluate why discounts exist before taking advantage of them. The reasons for discounts vary depending on several factors including overall market conditions and investor sentiment towards specific sectors or regions.

In the subsequent section, we will explore some of these factors in order to gain insight into why discounts occur in closed-end funds.

Why Does the Closed-End Fund Discount Happen?

Closed-end funds offer investors the advantage of discounted prices due to market conditions. These discounted prices provide investors the opportunity to purchase shares of a fund at a lower cost.

The cause of discounts in closed-end funds can be attributed to a variety of factors, such as the fund’s size, asset mix, trading volume, and market sentiment. Investors can take advantage of discounts by monitoring the fund’s market price and net asset value ratio.

Active management strategies are also employed in order to minimize the discount or maximize the premium. Lastly, some investors may use arbitrage strategies to make money from the discount.

Advantages of Discounts

Discounts in closed-end funds are common occurrences that provide investors with a unique opportunity to generate returns. The discount represents the difference between the market price of the fund and its net asset value (NAV).

While discounts may seem like an unfavorable trend, they can be advantageous for investors who implement appropriate discount strategies. Potential capital appreciation is one advantage of investing in a closed-end fund at a discount. When purchasing shares below their NAV, investors have greater upside potential if the share price rises to meet or exceed the NAV.

Additionally, buying at a discount provides an inherent margin of safety since the investor’s downside risk is theoretically limited by the underlying assets’ value. This benefit is particularly relevant when considering volatile markets where undervalued securities present attractive opportunities.

Investors seeking income-generating investments also find discounted closed-end funds appealing. A lower purchase price results in a higher yield on investment when compared to buying at premium prices or directly holding individual stocks. Since many closed-end funds pay distributions from income and capital gains, any increase in share price will also result in compounded growth over time.

Discount strategies implemented during bearish market trends can prove profitable for long-term investors. By strategically timing purchases during periods of high discounts or taking advantage of temporary market downturns, investors can maximize their total return while minimizing risk exposure through diversification across sectors and geographies.

In conclusion, despite popular belief that discounts reflect poor performance or lackluster management, savvy investors recognize these trends as potential opportunities rather than hindrances to successful investing. As always though it’s important for those interested to conduct thorough research before making any decisions about specific investments under consideration.

Causes of the Closed End Fund Discount

Discounts in closed-end funds occur for various reasons, and investors must understand the underlying factors to make informed investment decisions. One significant cause of discounts is market impact, where external forces such as economic downturns or political instability affect the fund’s performance.

For instance, a decline in the stock market may trigger a discount for equity-focused closed-end funds since their underlying assets’ value decreases. Similarly, changes in interest rates can also affect bond-oriented closed-end funds by altering the value of fixed-income securities.

Another cause of discounts is the supply and demand dynamics within the market. Closed-end funds have a finite number of shares available that do not fluctuate based on investor demand. Therefore, when there are more sellers than buyers interested in purchasing shares at the current price level, it results in lower prices leading to discounts.

This scenario often occurs during bearish market trends or when investors shift towards other asset classes. Furthermore, management fees and expenses associated with running a closed-end fund can contribute to its discounted status. High expense ratios will reduce net returns and create less attractive investment opportunities resulting in increased selling pressure from existing shareholders causing share prices to drop thus creating discounts.

Lastly, poor investor sentiment regarding specific sectors or geographies can lead to discounts across related closed-end funds even if there has been no fundamental change in their NAV values. When investors perceive an industry negatively due to global events such as trade tensions or geopolitical risks they tend to sell off holdings putting downward pressure on affected markets which trickles down into individual investments.

In conclusion, understanding why discounts occur is critical before investing in any closed-end fund; this analysis enables informed decision-making based on actual data points rather than speculation alone. By examining potential causes such as market impacts, supply and demand dynamics, high expense ratios and negative sentiments surrounding particular industries one can better navigate these situations while avoiding costly mistakes – allowing them greater freedom over their financial future.

Managing Closed End Fund Discount

Understanding why discounts occur in closed-end funds is crucial for investors seeking to maximize their returns. Once the underlying causes of a discount have been identified, it is possible to make informed decisions about whether to invest in that fund or not. However, simply knowing why discounts occur is not enough; investors must also know how to manage them effectively.

One way to manage discounts is through portfolio diversification. By investing in a range of closed-end funds across various sectors and geographies, investors can reduce their exposure to any specific area where a discount may be present. This approach can help mitigate losses while still allowing investors to benefit from potential gains elsewhere.

Another strategy for managing discounts involves valuation strategies. Investors can carefully analyze individual closed-end funds’ NAVs (Net Asset Values) and compare them with market prices to identify discrepancies that might indicate an undervalued investment opportunity. By purchasing shares at a discounted price, investors stand to gain when the fund eventually rebounds.

Additionally, some closed-end fund managers employ tactics such as share buybacks or tender offers to try and eliminate or reduce discounts by reducing the supply of outstanding shares available on the market. These efforts can sometimes result in immediate short-term benefits for existing shareholders but should only be considered within the context of broader investment goals and long-term outlooks.

In summary, understanding why discounts occur in closed-end funds is essential for making informed investment decisions. Managing these discounts requires careful consideration of several factors including:

- Portfolio diversification

- Valuation strategies

- Potentially even shareholder activism measures like share buybacks/tender offers.

With proper management techniques in place, investors are better equipped to navigate volatile markets and achieve greater financial freedom over time.

How To Identify Discount Opportunities In Closed-End Funds

Discount opportunities in closed-end funds can be attractive for investors seeking to maximize their returns. However, identifying undervalued funds requires a thorough analysis of market trends and other indicators.

One way to do this is by comparing the fund’s net asset value (NAV) with its share price. If the share price is trading at a discount to NAV, it may indicate that the fund is undervalued. A commonly used website to check whether the NAV has diverged from the price is CEF Connect.

Another approach to identifying discount opportunities is by analyzing the fund’s historical performance. Investors can examine the fund’s past returns relative to its peers or benchmark index and any management or investment strategy changes that may have impacted its performance.

Additionally, investors should consider macroeconomic factors such as interest rates, inflation, and geopolitical risks that could affect the overall market sentiment towards certain sectors or industries.

Investors also need to be aware of potential risks when investing in discounted closed-end funds. These include liquidity risk, which refers to the difficulty in selling shares due to limited trading volume; leverage risk, which involves borrowing money to invest and amplifying losses during market downturns; and concentration risk, which occurs when a large portion of the portfolio is invested in one sector or security.

In summary, identifying undervalued funds requires a comprehensive analysis of various factors including NAV discounts, historical performance, and macroeconomic trends. While investing in discounted closed-end funds can provide higher returns than traditional mutual funds or ETFs, investors must also weigh the potential risks involved before making any investment decisions. The next section will explore these risks and rewards further.

Risks And Rewards Of Investing In Discounted Closed-End Funds

- Investing in discounted closed-end funds provides an opportunity to diversify a portfolio, which can help to reduce volatility risk.

- The potential of achieving higher returns than with traditional investments is a key reward of investing in discounted closed-end funds.

- Closed-end funds are less liquid than other investment vehicles; therefore, investing in discounted closed-end funds requires careful consideration.

- Investors should be aware that the underlying investments of discounted closed-end funds may be subject to greater volatility than other investments.

- Investing in discounted closed-end funds can provide investors with tax advantages, such as deferred taxes and lower capital gains taxes.

- Although discounted closed-end funds offer potential rewards, investors should be aware of the associated risks before investing.

Diversification Benefits

Diversification benefits are a crucial component of portfolio construction for investors seeking to manage risk. Discounted closed-end funds, despite their unique characteristics, offer diversification opportunities that can enhance the overall performance of an investor’s portfolio.

By investing in discounted closed-end funds across different asset classes and sectors, investors can achieve greater exposure to markets they might otherwise not have access to. Discounted closed-end funds provide investors with a range of investment options across various asset classes, including equities, fixed-income securities, and alternative investments such as commodities or real estate.

This diversity allows investors to customize their portfolios according to their specific needs while managing risk through broad-based market exposure. Moreover, because these funds trade at discounts to net asset value (NAV), they present attractive entry points into a wide range of markets.

Risk management is critical when investing in any financial instrument; however, discounted closed-end funds offer additional layers of protection against downside risks. For instance, many closed-end fund managers employ hedging strategies designed to mitigate volatility by using derivatives such as futures contracts or options.

These strategies help protect the value of the underlying assets held within the fund and reduce price swings during periods of market turbulence. In conclusion, discounted closed-end funds represent an excellent opportunity for investors looking for diversified exposure across multiple markets while reducing risk through professional management practices.

With careful research and due diligence on individual fund holdings and management teams’ expertise, investors can select well-managed discount CEFs that offer compelling valuations based on NAVs trading at significant discounts that could unlock potential upside over time.

Discounted CEFs enhance the breadth and depth of available investment opportunities for long-term growth-oriented portfolios aimed at providing superior returns over suitable benchmarks while effectively managing risk levels for better outcomes.

Volatility Risk

Investors who are considering investing in discounted closed-end funds should be aware of the potential volatility risk. While these funds offer diversification benefits and unique opportunities for exposure to various markets, they can also experience significant price fluctuations due to market movements or other factors.

To manage this volatility risk, many closed-end fund managers use hedging strategies that aim to mitigate downside risks by using derivatives such as futures contracts or options. These strategies help protect the value of underlying assets held within the fund and reduce price swings during periods of market turbulence. However, it is important to note that these strategies are not guaranteed to work effectively in all market conditions.

Another factor to consider when investing in discounted closed-end funds is market timing. Investors need to assess whether they are entering a position at an opportune time or if they could potentially suffer losses from poor timing decisions. It may be beneficial for investors to consult with financial advisors who have experience analyzing market trends and identifying potential entry points into various markets.

Despite these risks, investing in well-managed discount CEFs can still offer attractive rewards over the long term. By selecting funds with compelling valuations based on NAV trading at significant discounts, investors can potentially unlock upside potential while managing risk levels through professional management practices and diversified portfolios.

In summary, while volatility risk exists when investing in discounted closed-end funds, it can be managed through hedging strategies experienced fund managers employ. Additionally, careful analysis of market trends and effective timing decisions can further minimize risks associated with investment positions. Still, investors must also recognize that this type of investment carries inherent risks but offers potentially greater rewards over time compared to traditional investments.

Tax Advantages

Moving forward, investors should also consider the tax advantages of investing in discounted closed-end funds.

One significant benefit is tax loss harvesting, which involves selling losing positions to offset capital gains and reduce taxes owed. With CEFs, this strategy can be particularly effective because they often trade at discounts to their NAV, providing greater opportunities for harvesting losses.

Another advantage is estate planning, as CEFs can offer a more efficient way to transfer wealth to heirs compared to traditional investments. By gifting shares of a CEF while it is trading at a discount, investors can potentially pass on larger amounts of wealth without triggering gift taxes or reducing their lifetime exemption limit.

It’s important to note that not all CEFs are created equal when it comes to tax efficiency. Investors should look for funds with low turnover rates and long-term investment strategies, as these tend to generate fewer taxable events than actively managed funds with high turnover rates.

In conclusion, understanding the potential tax advantages associated with investing in discounted closed end funds can provide additional incentives for investors looking to diversify their portfolios while minimizing risks. By incorporating tax loss harvesting and estate planning strategies into their investment plans and selecting well-managed funds with solid track records, investors may be able to maximize returns over time while optimizing their tax liabilities.

Tips For Investing In CEFs and the Closed End Fund Discount

Investing in closed end funds can be a lucrative opportunity for investors who are willing to take risks. However, before investing, it is essential to analyze the performance of the fund and determine whether it fits your investment goals. Since closed end funds trade on exchanges like stocks, they may offer discount opportunities that could lead to higher returns.

One way to assess the performance of a closed end fund is by examining its historical net asset value (NAV) and comparing it against other similar funds. Analyzing NAV allows an investor to understand how effectively the fund’s assets have been managed over time. Additionally, diversification strategies can help minimize risk while maximizing return potential. Investing in multiple closed end funds with varying investment objectives and asset allocations enables you to spread out investments across several industries or sectors.

Another factor to consider when analyzing performance is the fund’s expense ratio. The expense ratio represents the costs associated with managing and operating the fund, which includes management fees, administrative expenses, and marketing costs. Higher expense ratios can eat into returns, making lower-cost alternatives more attractive.

In summary, investing in closed end funds requires careful analysis of their past performance and evaluation of diversified strategies that align with personal investment goals. It is crucial to keep track of relevant metrics like NAV history and expense ratios when deciding where to invest money for maximum returns while minimizing risks.

To learn more about how to buy and sell closed end funds efficiently without losing money due to transaction fees or other charges, read our subsequent section on “how-to” tips for successful trading.

How To Buy And Sell Closed End Funds

When it comes to buying and selling closed end funds, there are certain best practices that investors should be aware of.

Closed-end funds are an investment vehicle that trades on stock exchanges like regular stock but have a fixed number of outstanding shares. This means the market price may sometimes trade at a discount or premium to its net asset value (NAV).

As such, investors need to carefully consider both the pros and cons before investing in these types of funds.

One important factor to consider is the fees associated with closed-end funds. These can include management fees, administrative expenses, and other costs related to running the fund. While some funds may have lower fees than others, investors should always pay close attention to their expense ratios when evaluating potential investments.

Another consideration is liquidity. Unlike open-ended mutual funds which allow for daily redemptions at NAV, closed-end funds only permit trading on an exchange during normal business hours. This lack of liquidity can make it difficult for investors looking to exit their positions quickly or easily.

Despite these potential drawbacks, there are also several advantages to investing in closed-end funds. For one thing, many of them offer high yields compared to traditional stocks or bonds due to their use of leverage and income-generating strategies. Additionally, because they trade on public exchanges just like regular stocks, investors have access to real-time pricing information and greater transparency into the fund’s performance.

Overall, when considering whether or not to invest in closed-end funds, it’s important for investors to weigh the pros and cons carefully based on their own specific financial goals and risk tolerance levels. However, with proper research and understanding of best practices for buying and selling these types of securities, there can be opportunities for profit while minimizing risk exposure.

Looking ahead to our subsequent section on closed-end vs open-end mutual funds; by comparing both options against each other we can better determine which type suits our individual needs as an investor.

Closed-End Funds Vs. Open-End Mutual Funds

In the previous section, we discussed buying and selling closed-end funds. Now let’s take a closer look at the advantages of investing in these types of funds over open-end mutual funds.

Closed-end funds often trade at discounts or premiums to their net asset value (NAV). As of January 2021, the average discount for all U.S. listed closed-end funds was approximately 7.27%. This presents an opportunity for investors to purchase assets below their intrinsic value, potentially resulting in higher returns if the fund’s underlying holdings increase in value. In contrast, open-end mutual funds are always bought and sold at NAV with no discount opportunities.

One advantage of closed-end funds is active management. Unlike passive index-tracking ETFs that simply replicate an index, closed-end fund managers have more flexibility in selecting investments based on market conditions and individual company analysis. Additionally, closed-end funds can invest in less liquid assets because they are not required to maintain daily liquidity like open-end mutual funds.

To further illustrate the differences between closed-end funds and other investment options, consider the following table:

| Investment Type | Trading Flexibility | Management Style | Liquidity |

|---|---|---|---|

| Closed-End Funds | Traded on exchange | Active | Less Liquid |

| Open-End Mutual Funds | Redeemed through issuer | Passive/Index Tracking | More Liquid |

| Exchange-Traded Funds (ETFs) | Traded on exchange | Passive/Index Tracking | More Liquid |

As an investor seeking greater freedom in your investment choices, you may find closed-end funds appealing due to their potential for discounted prices and active management style. However, it’s important to understand that there are also risks associated with these types of investments such as leverage and concentration risk. It’s crucial to do your research before making any investment decisions.

In summary, closed-end funds offer a unique investment opportunity with active management and potential discounts but also come with their own set of risks. In the next section, we will compare closed-end funds to another popular investment option: exchange-traded funds (ETFs).

Closed-End Funds Vs. Exchange-Traded Funds (ETFs)

Closed-end funds (CEFs) and exchange-traded funds (ETFs) are two types of investment vehicles that can be used by investors to generate returns on their investments. While both have similarities, the two options have some key differences.

One difference is in how they are traded. CEFs trade like stocks on an exchange, with prices determined by supply and demand. Conversely, ETFs trade throughout the day at market-determined prices based on their underlying asset values.

Another difference lies in management fees: CEFs tend to charge higher expense ratios than ETFs due to their active management style. A cost-effectiveness comparison between CEFs and ETFs reveals that while CEFs may provide more potential for income generation through dividends or capital gains distributions, this often comes at a higher cost than investing in ETFs.

However, an investor preference survey has shown that some investors prefer CEFs because of their closed nature, allowing fund managers more flexibility in making investment decisions. In summary, both CEFs and ETFs offer unique benefits and drawbacks depending on individual investor goals and preferences.

Investors should consider factors such as trading costs, management fees, dividend yields, and historical performance data before choosing one over the other. In the subsequent section about the tax implications of investing in closed-end funds, we will explore another important aspect to keep in mind when deciding whether to invest in these securities.

Tax Implications Of Investing In Closed-End Funds

While closed-end funds (CEFs) and exchange-traded funds (ETFs) share some similarities, they have distinct differences. One interesting statistic to note is that the number of CEFs has declined in recent years while ETFs continue to grow in popularity. Despite this trend, CEFs still offer unique investment opportunities for those seeking tax benefits and alternative investment strategies.

Tax benefits are a major advantage of investing in CEFs. Due to their structure as closed-end vehicles, these funds can pass through tax-free income to investors or utilize leverage without triggering taxes at the fund level. Additionally, certain types of CEF investments, such as municipal bond funds, may offer additional state-specific tax advantages.

Investment strategies also differentiate CEFs from other investment options. For example, investors can take advantage of potential discounts by purchasing shares when the market price falls below the net asset value per share (NAV). This discount provides an opportunity for investors to purchase assets below their true value and potentially reap higher returns over time.

As with any investment vehicle, it’s important to do your research before diving in. Frequently asked questions about closed-end fund discounts include inquiries about how long discounts typically last and what factors contribute to them. Investors should also consider management fees and expenses associated with owning a CEF.

By thoroughly examining all aspects of these unique investment opportunities, savvy investors can make informed decisions and potentially enjoy higher yields than traditional investment options provided.

Frequently Asked Questions About Closed-End Fund Discounts

Common Misconceptions About Closed-End Fund Discounts

Closed-end funds offer a unique investment opportunity. However, common misconceptions about closed-end fund discounts need to be addressed.

One of the most prevalent misconceptions is that all closed-end funds trade at a discount. This is not true as many closed-end funds actually trade at premiums.

Another misconception is that investors should always buy when the discount widens and sell when it narrows. Although this may seem like a good strategy, it may not always result in favorable returns for the investor.

The best practice is to analyze each individual fund’s historical discount range, as well as its current market conditions and other relevant factors before making any investment decisions.

Some investors also believe that buying at a wider-than-average discount guarantees profits due to mean reversion. However, just because a fund has traded at certain levels in the past does not necessarily mean it will revert back to those levels in the future.

Investors must take into account broader economic trends and changes within the specific industry or sector before investing based solely on historical data.

Finally, some investors assume that high discounts simply indicate an undervalued asset. While this may sometimes be true, it’s important to consider why a particular fund might be trading at such a significant discount relative to its net asset value (NAV).

It could signal deeper issues with management or underlying assets that could affect long-term performance.

Best Practices for Investing in Closed-End Fund Discounts

To avoid these misconceptions and make informed investment decisions regarding closed-end fund discounts, here are some best practices:

- Conduct thorough research on each individual fund

- Analyze both historical and current market trends

- Consider macroeconomic factors affecting industries/sectors

- Diversify your portfolio by investing across multiple sectors and industries

By following these best practices you can maximize potential returns while minimizing risk associated with closed-end fund investments without falling prey to common misconceptions.

Conclusion

The closed end fund discount present unique investment opportunities that differ from traditional stocks or bonds. These funds are traded on exchanges, allowing investors to buy and sell at a market-determined price. However, the value of closed end funds can trade either at a premium or discount to their net asset value (NAV).

Investors must understand the factors influencing this discount value to make informed decisions. Several common factors influence the discount value of closed end funds, including market sentiment, supply, and demand dynamics, fund performance, management fees, and investor sentiment toward particular sectors.

Despite these potential risks associated with investing in discounted closed end funds, there are ways that investors can mitigate such risks through careful diversification and analysis of portfolio holdings. It is crucial for investors to differentiate between temporary discounts and long-term investments as they evaluate closed end fund opportunities.

In essence, investing in discounted closed end funds requires strategic thinking and sound decision-making skills. An allegory depicts it well; imagine an adventurer crossing a river using stones from previous explorers. Each stone represents a different aspect of your investment strategy – analyzing NAV trends before buying or selling shares could be one stone while evaluating historical performance data might be another.

Without carefully considering each step along the way, you may find yourself lost amid the current’s rapids instead of safely making it across the river to reach your destination. As an investor looking for opportunities within discounted closed end funds, understanding each stepping stone will enable you to navigate financial waters effectively and emerge victorious in reaching your desired outcome.

What Is The Difference Between a Closed-End Fund and an Exchange-Traded Fund (ETF)?

How Do Closed-End Funds Generate Income For Investors?

How Are Closed-End Funds Managed and Who Makes Investment Decisions?

Is it Possible For a Closed-End Fund to Eliminate a Discount or Premium on its Own?

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.