Best Long-Term Dividend Growth Investments (DGI) for August 2024: Fair Value and Growth!

Alright folks, it’s been a hectic few weeks over here as I’ve been busy teaching at the Otago Business School at the University of Otago. With the second semester just kicking off, my schedule has been packed. But today, I want to take a break from the academic hustle and discuss some of my favorite long-term dividend growth investments.

When it comes to dividend growth investing, I don’t always go for companies that are deep value plays. Sometimes, it’s about finding companies with robust long-term growth prospects. Today, I’ll be diving into some great companies that offer both fair value and substantial growth potential.

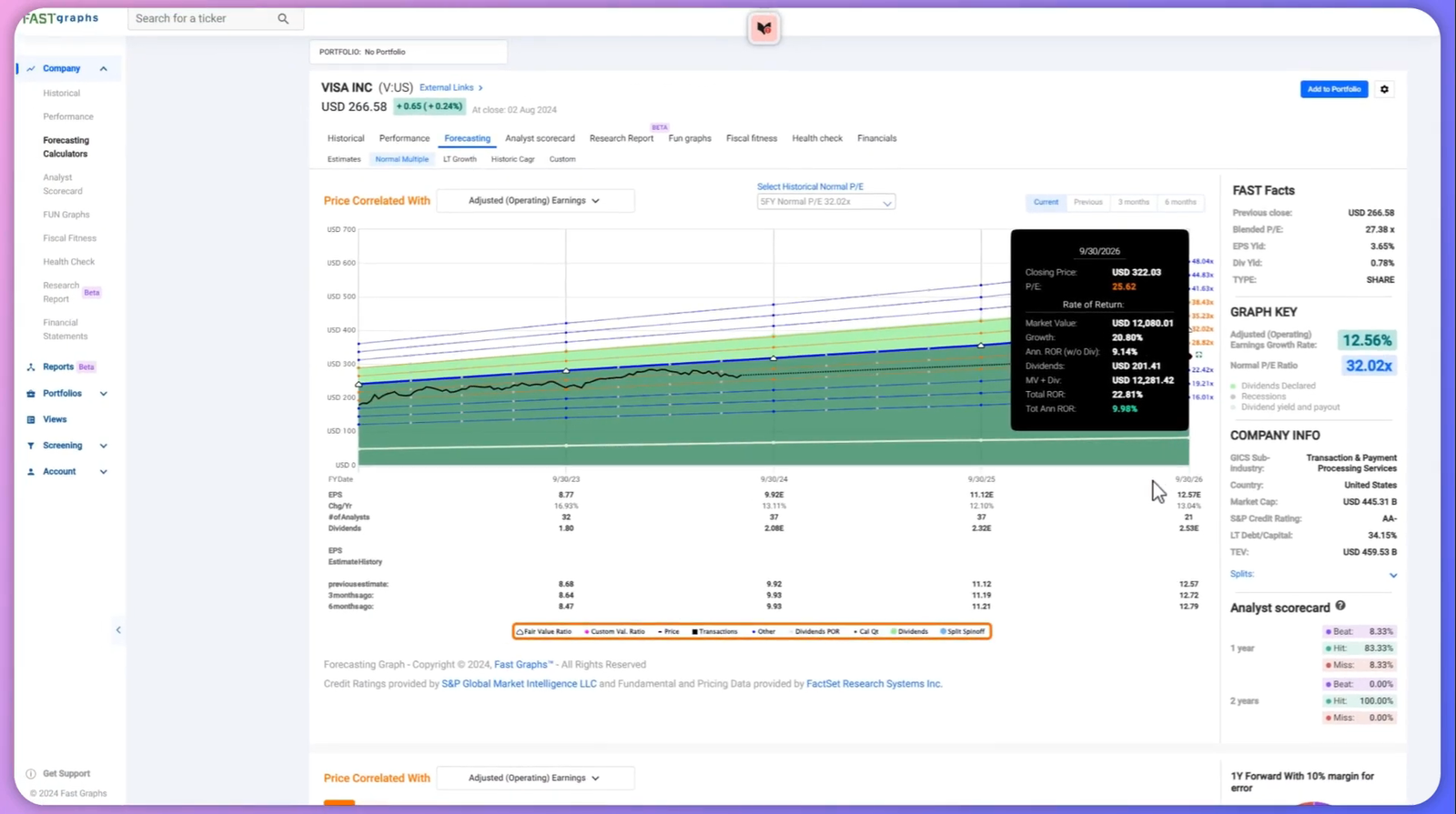

Visa (V)

One company I particularly like is Visa. Visa has shown a powerful long-term increase in earnings, even with the slight dip during COVID-19.

“Visa’s earnings have been growing steadily with annual growth rates of 17%, 27%, and 17% over the last several years. Future estimates project continued growth at 13%, 12%, and 13% through 2026.”

Earnings and Analyst Scorecard

Visa’s strong earnings growth is supported by a solid analyst scorecard, indicating a high likelihood of meeting these projections.

Sales Growth Projections:

- 13% in 2024

- 10% in 2025

- 10% in 2026

With a 100% expectation of hitting the two-year projection, Visa’s future looks promising.

Dividend Growth

Visa isn’t just about earnings; it also boasts a strong record of dividend growth, often in double digits. This is remarkable given its low starting dividend yield of 0.78%. This makes Visa a compelling long-term compounder.

Buying Opportunities

The best times to buy Visa are during reasonable dips. I last bought it in early 2023 when the PE ratio was around 25. Currently, with a blended PE of about 20, Visa remains an attractive pick. If it returns to a PE of 32, we could expect an annualized rate of return of about 21%, though I consider a 10% return more realistic.

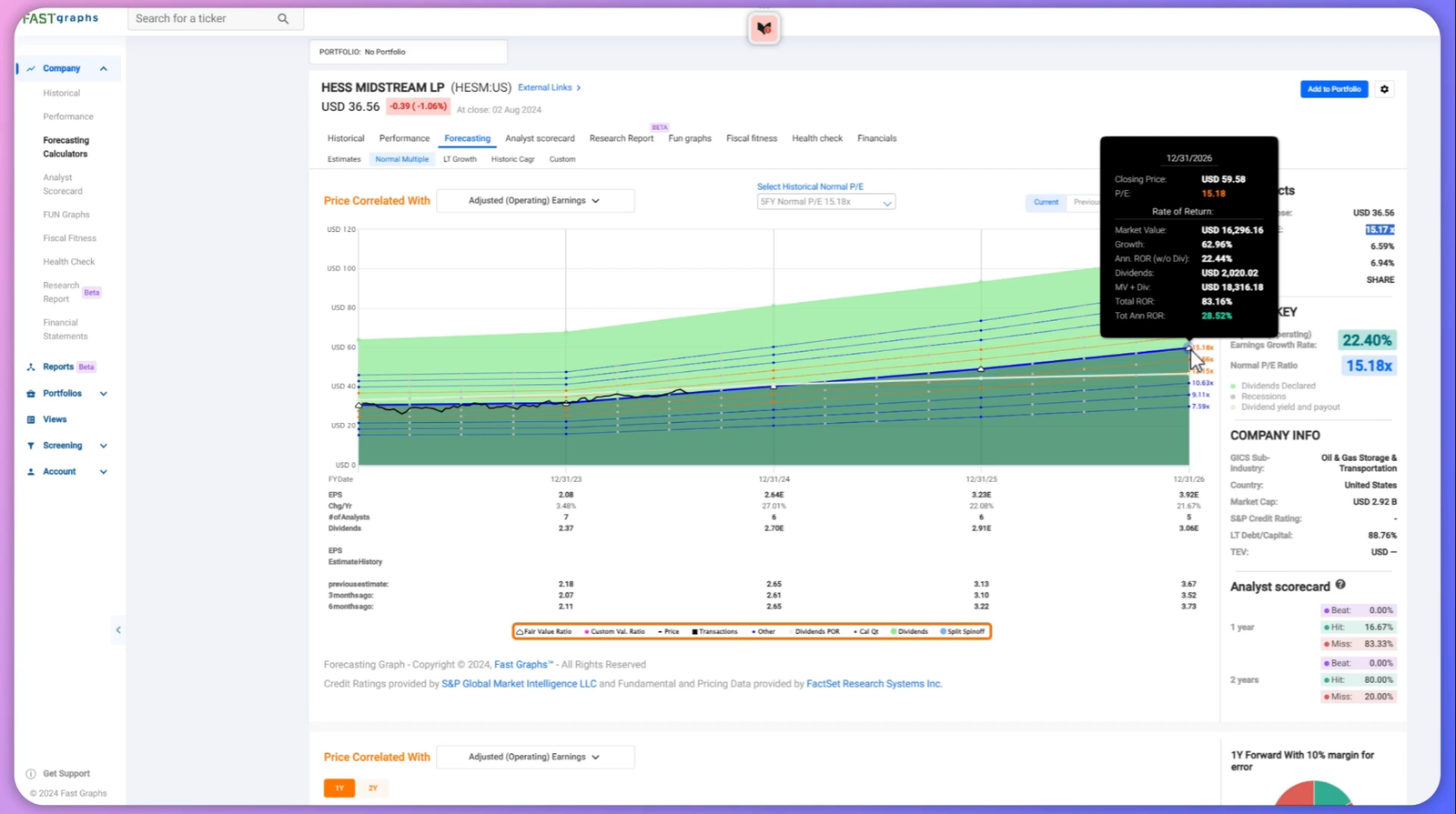

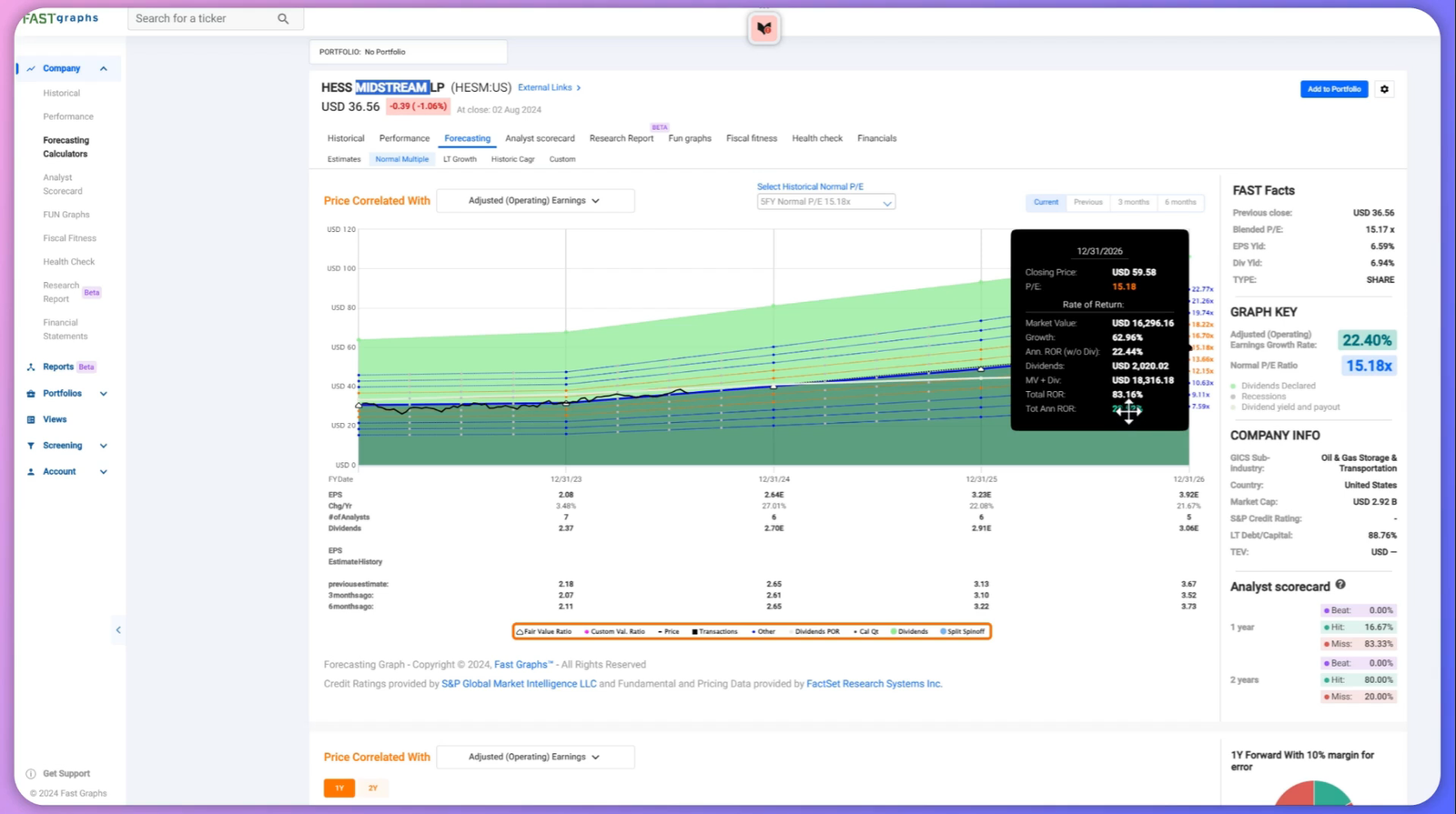

Hess Midstream (HESM)

Next, let’s talk about Hess Midstream, which offers an attractive dividend yield of 7%. Despite its limited history, the company’s earnings growth looks promising, with projections of:

- 27% in 2024

- 22% in 2025

- 21% in 2026

Stability and Growth

Midstream companies like Hess often provide relative earnings stability, making them appealing for those seeking diversification and growth.

Alternative: Enbridge (ENB)

If you prefer a company with a longer track record, consider Enbridge. With a similar dividend yield and a history of consistent dividend growth in Canadian dollars, Enbridge offers stability.

“Enbridge provides a stable alternative with an estimated annual growth rate of around 7% to 8%.”

Forecasting and Stability

While Enbridge’s growth may be slower than Hess Midstream, its consistent performance and analyst expectations make it a reliable choice.

Cigna (CI)

Switching gears to the healthcare services industry, Cigna stands out with its solid analyst scorecard. Despite a modest dividend yield of 1.6%, Cigna offers exciting long-term growth prospects.

Historical Earnings Growth

Cigna has consistently hit or exceeded analysts’ expectations, showing growth rates such as:

- 36% in 2020

- 20% in 2021

- 14% projected in 2024

Even with less impressive dividend growth, Cigna’s total return potential remains strong.

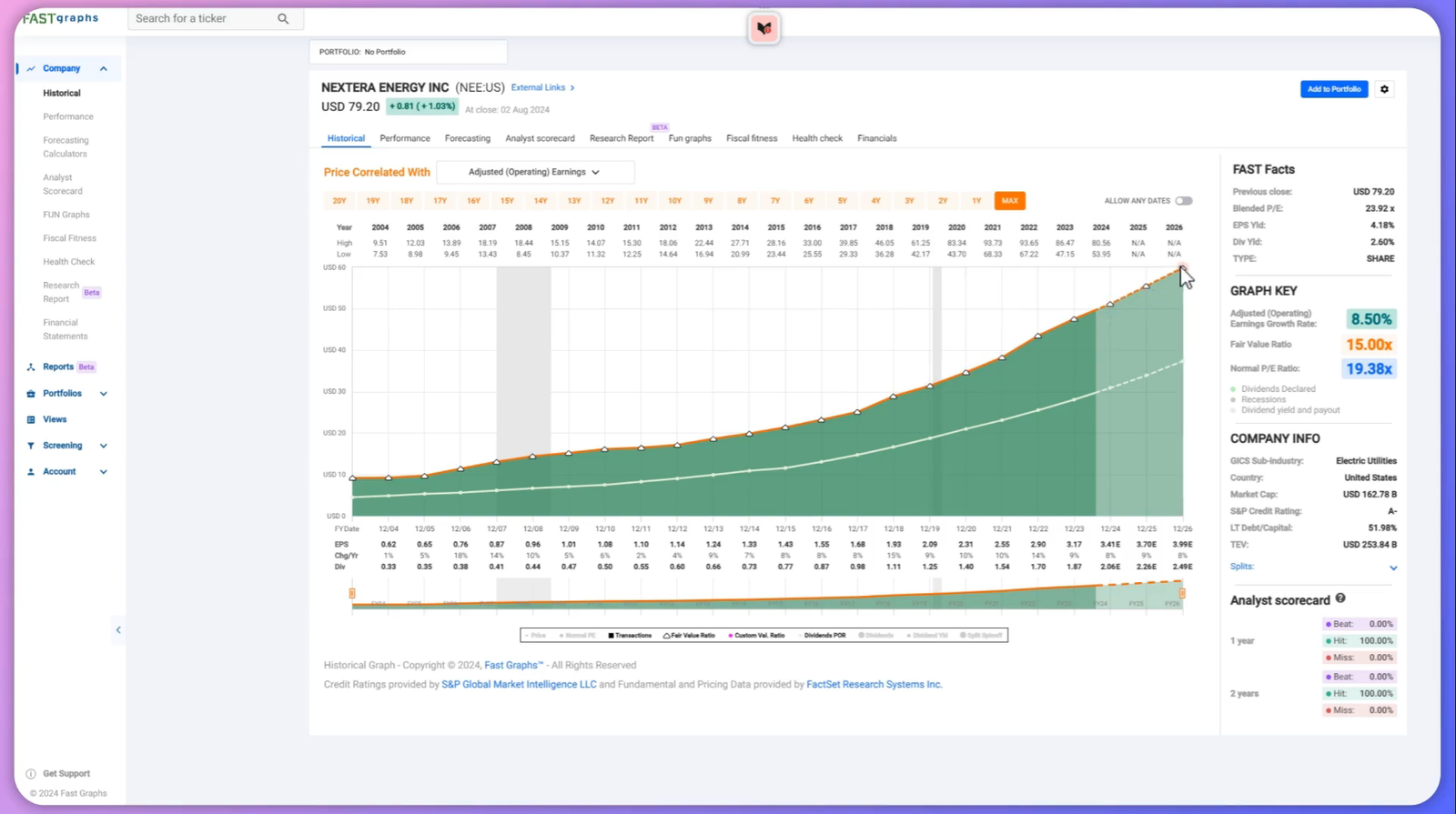

Nextera Energy (NEE)

For those looking at utilities, NEE offers a 2.6% dividend yield with a beautiful upward earnings curve.

Solid Analyst Scorecard

NEE has hit 100% of analyst expectations in both one-year and two-year forward estimates, making it a reliable pick in the utility sector.

“NEE’s performance over the last 20 years has been strong, offering consistent growth and a healthier dividend yield compared to the S&P 500.”

Earnings and Dividend Growth Projections:

NEE’s dividends have been growing at mid to low double digits in recent years, making it a solid choice for dividend growth investors.

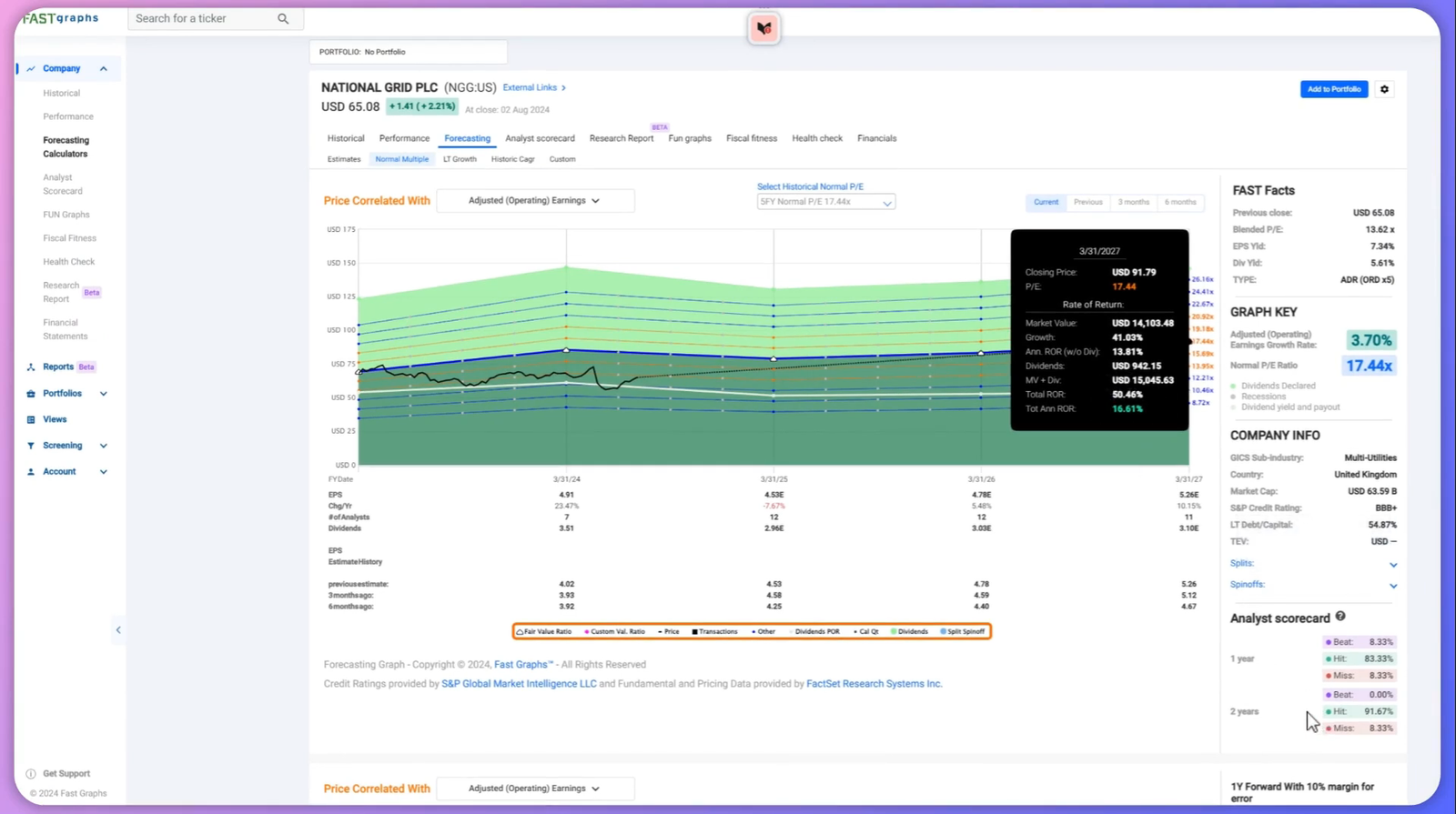

National Grid (NGG)

National Grid, an ADR from the UK, offers a dividend yield of about 5.6%. While its earnings growth is more sporadic, it’s still a reasonable pick for those seeking international diversification.

Stability and Analyst Estimates

Despite slightly weaker analyst ratings, National Grid’s dividends are expected to increase in the coming years, providing a stable income stream.

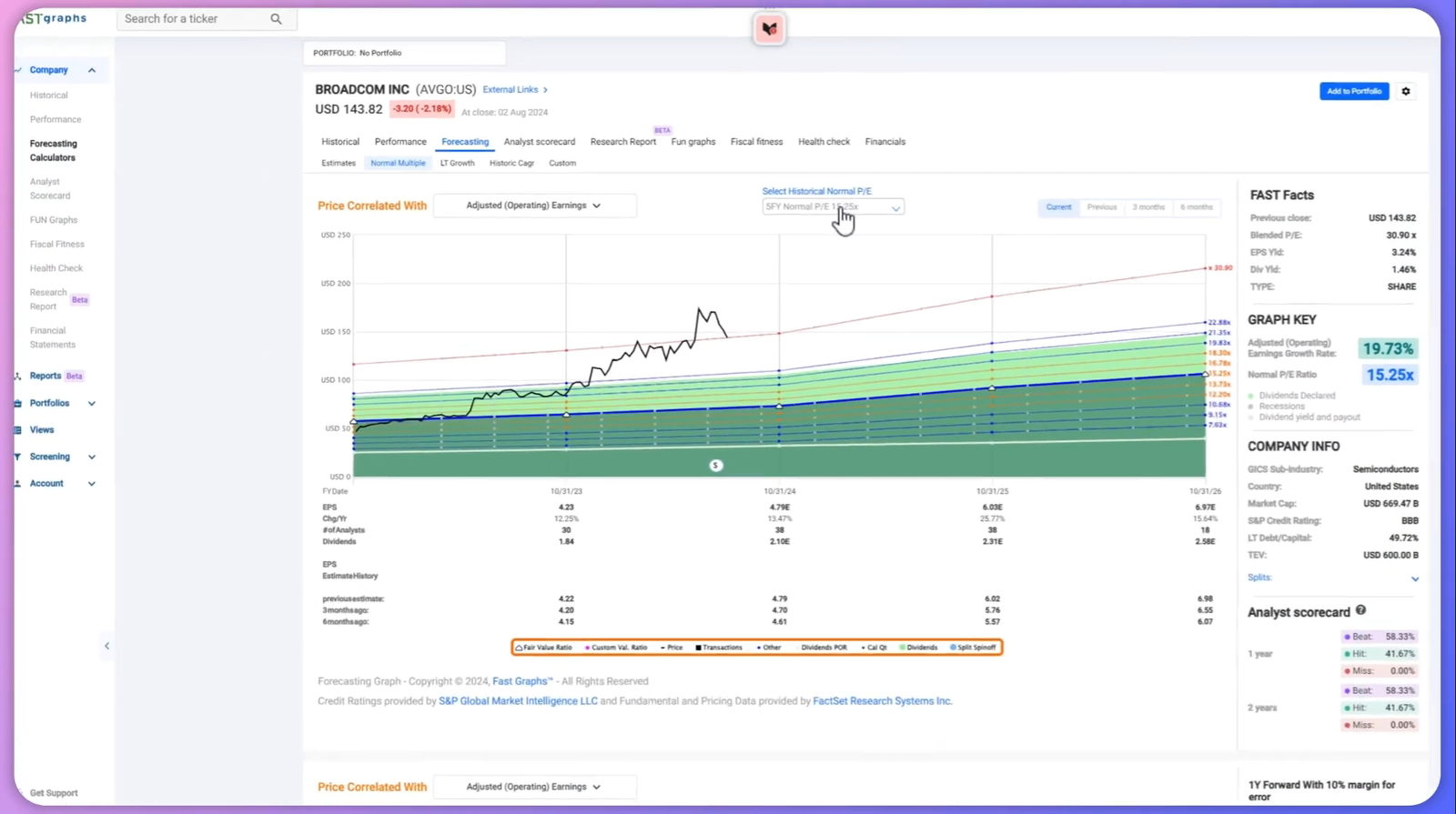

Broadcom (AVGO)

Broadcom is a standout in the semiconductor industry. Despite recent fluctuations, Broadcom’s long-term growth potential remains strong.

“Broadcom has a history of robust dividend growth, although more recent years have seen a more modest 10% annual growth rate.”

Performance and Forecasting

While the semiconductor sector is currently volatile, Broadcom’s strong financials and growth projections make it a compelling long-term hold.

Bank of Nova Scotia (BNS)

Bank of Nova Scotia offers a nearly 7% dividend yield, making it attractive for income-focused investors. Although its growth has lagged behind the S&P 500, its dividend growth rate is promising.

Forecasting and Analyst Estimates

With a reasonable long-term multiple and moderate dividend growth expectations, Bank of Nova Scotia could offer a 14%-15% annualized return.

Raymond James Financial (RJF)

Raymond James Financial provides a 1.5% dividend yield and has shown strong growth since 2015. Although not currently a strong buy for me, it remains on my radar.

Performance and Growth Projections:

Raymond James has outperformed the S&P 500 in terms of dividend growth and total returns, making it a potential future buy at the right price.

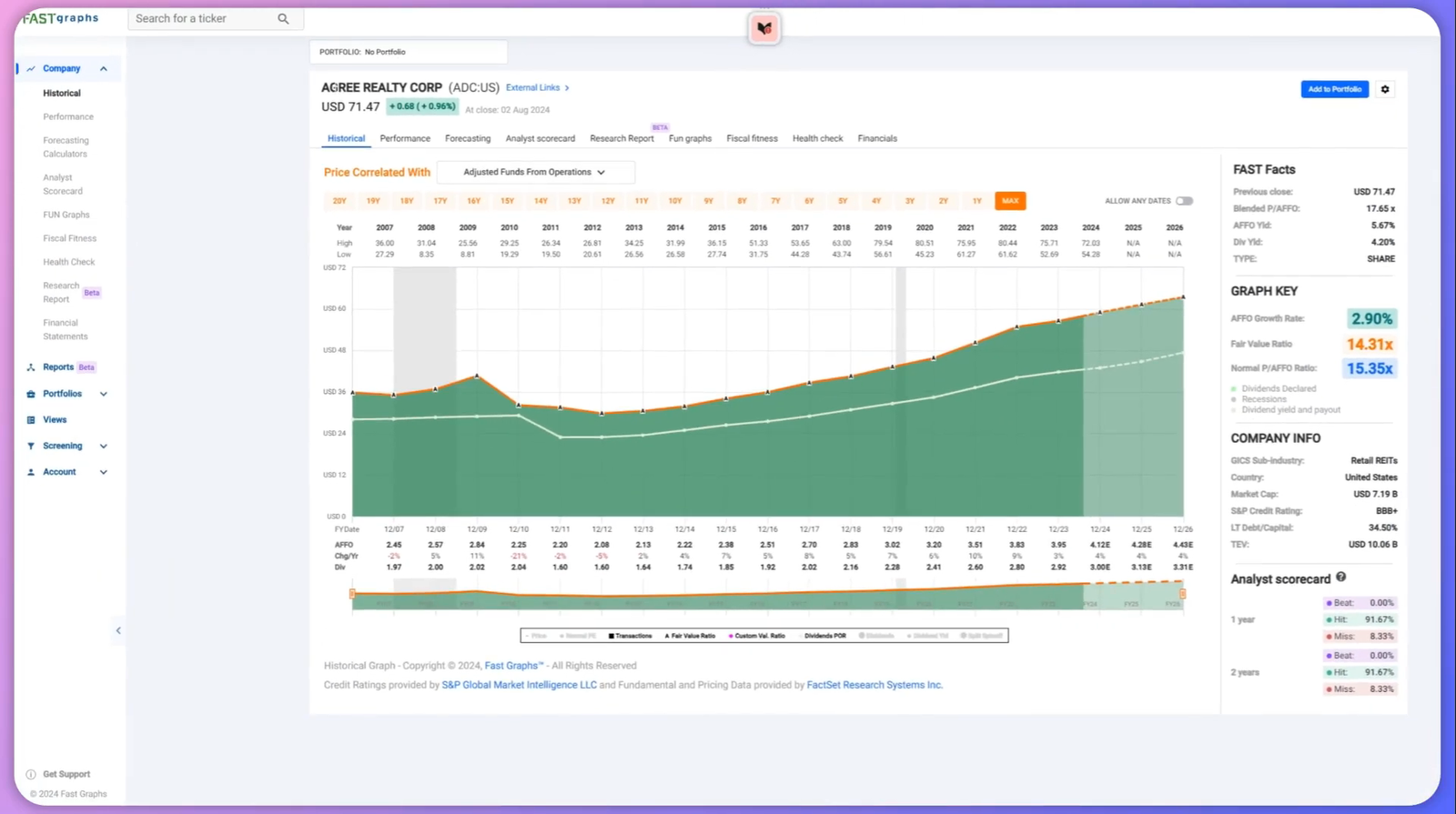

Agree Realty Corporation (ADC)

Lastly, in the REIT world, Agree Realty Corporation is a solid pick. With a BBB+ credit rating and a strong history of growing adjusted funds from operations, Agree Realty offers stability and growth.

Dividend and Performance

Agree Realty’s dividend has grown steadily at around 5% per year, offering a balanced mix of income and growth.

“Agree Realty represents a quality pick in the REIT sector with reliable performance and growth.”

In conclusion, these companies offer a range of dividend yields, growth prospects, and stability, making them suitable for a diverse long-term dividend growth investment portfolio. Let me know your thoughts and which companies you prefer in the comments below!

I hope this post provided valuable insights into some of the best long-term dividend growth investments for August 2024. Until next time, happy investing!

Let me know which companies you like down in the comments below, and feel free to share your own deep value stock picks!

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.