Capital Southwest vs. The Competition

Capital Southwest Corporation (Nasdaq: CSWC) is a Dallas-based investment company that specializes in providing growth capital to middle-market businesses. For years, Capital Southwest has played an active role in the development of some of the most successful businesses in a wide range of industries. Now it is also able to provide income to investors with a healthy CSWC dividend.

Capital Southwest’s focus on dividend growth and its commitment to paying dividends consistently has resulted in the company being one of the best performers in its peer group. Capital Southwest has a long history of paying dividends and has increased its dividend payments for 10 consecutive years.

The company’s dividend yield is currently higher than the average dividend yield for companies in the S&P 500 Index. This is a great Business Development Company (BDC) to buy for a dividend today.

The company’s strong performance is due to its diversified portfolio, which includes investments in a wide range of industries. Capital Southwest’s portfolio companies have a proven track record of success and are well-positioned for continued growth. In addition, there is a current yield of nearly 11%, giving a high yield opportunity now with the potential for capital appreciation.

Capital Southwest is a great option for investors looking for a high-yield, dividend-paying stock with a long history of dividend growth. Below, we outline why we think this is a good opportunity for both current income and future capital appreciation. Investments in CSWC might form a part of a satellite portion of a core-satellite portfolio.

The following video provides a quick overview of CSWC as an investment:

When is the time to buy CSWC stock for high yield and dividends?

CSWC is a publicly traded company with a long history of paying dividends to shareholders. The dividend is a payment made by the company to shareholders out of its earnings and is typically paid quarterly. CSWC has a strong track record of increasing its dividend on an annual basis. For example, in 2018, the company increased its dividend by 15%.

The best time to buy CSWC stocks for dividends is when the company is trading at a discount on its intrinsic value. Shareholders receive the dividend on the date of record, which is typically two weeks before the payment date.

However, if you purchase shares after the ex-dividend date, you will not receive the next dividend payment. Therefore, it is important to purchase shares before the ex-dividend date in order to receive the dividend.

CSWC Dividend Growth CAGR

CSWC dividend growth has been exceptional in recent years, with a CAGR of over 20% from 2017 to 2020. This strong growth is expected to continue, with the company projecting a dividend of $0.80 per share for 2021 and $1.00 per share for 2022.

This represents an increase of 25% and 28%, respectively, from 2020 levels. CSWC is a great example of a company that has rewarded shareholders with consistently high dividend growth. This change in dividend varies more than other BDCs, like Main Street Capital, which regularly has small hikes in dividend.

CSWC Dividend Yield Over Time

The Capital Southwest dividend yield over time has been steadily increasing. Currently, the dividend yield is over 10%. This is a strong indication that the company is doing well and is able to pay its shareholders a healthy return on their investment. Capital Southwest has a long history of paying dividends, and shareholders can expect this trend to continue in the future.

Investment opportunity in CSWC

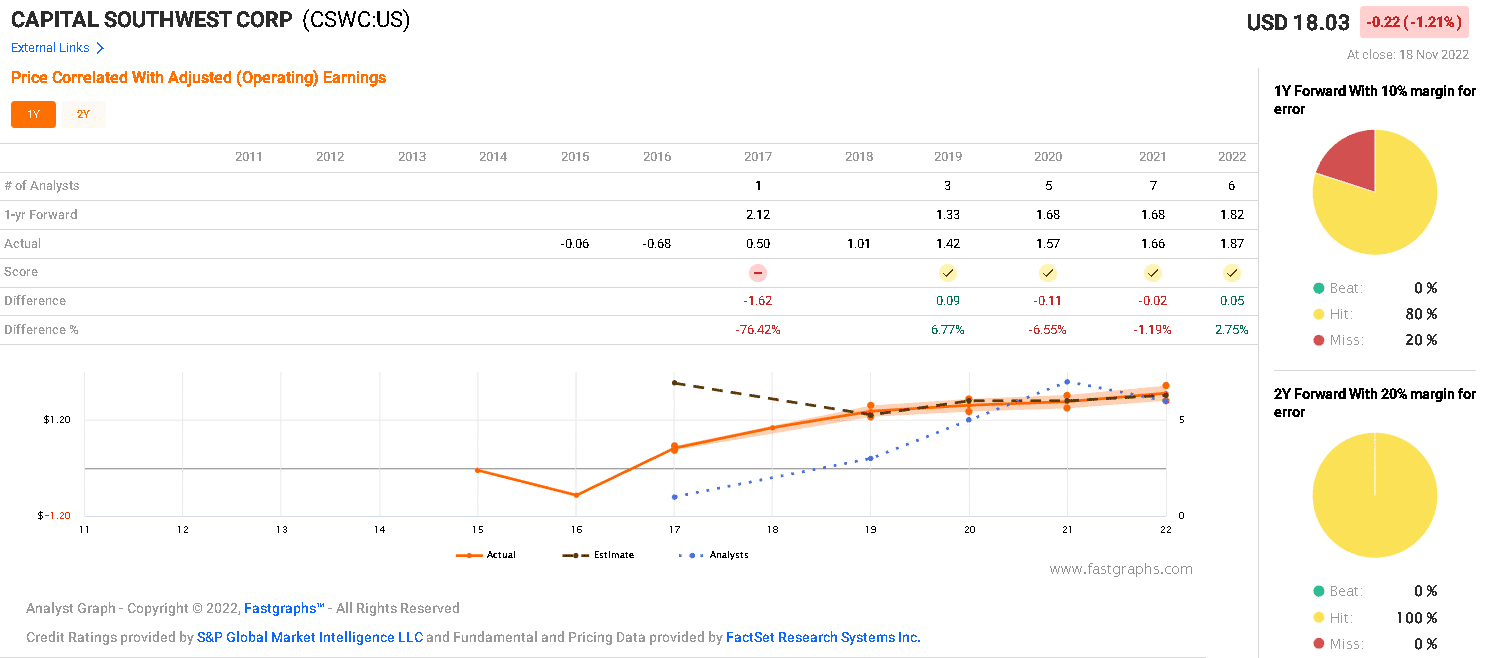

So – is now a good time to buy? The stock price seems to be lower than the earnings suggest it should be. If we can expect prices to revert to a more normal ratio, such as evidenced by the ‘normal’ P/E ratio over the last five years, the FAST Graphs forecasting calculator suggests there is some substantial upside here (Figure 1). Using this calculation, the expected total rate of return to the end of March in 2024 is over 100%, with an annualized RoR of 70%.

This is driven by the strong increase in earnings; note the change in analysts’ estimates of earnings are trending up (lower panel of Figure 1.) Check out the opportunity to lock in a strong CSWC dividend today.

How likely are the analysts to have a good forecast? That is hard to say – CSWC has not been well-followed by analysts until a couple of years ago (Figure 2). In general, the two-year forecasts are moderately accurate with estimates being right without a 20% margin of error all the time. Within a 10% margin of error in the one-year forwards, analysts are accurate about 80% of the time.

Dividend Capture Strategy for CSWC Dividend

CSWC’s dividend capture strategy is a popular way to date the dividend. The strategy involves buying shares of CSWC on the ex-dividend date and selling them on the dividend date. This allows investors to capture the dividend without having to hold the stock for the entire period.

To implement this strategy, you will need to know when CSWC is going to declare its dividend and when the ex-dividend and dividend dates are. You can find this information in the company’s historical data. Once you have this information, you can buy shares of CSWC on the ex-dividend date and sell them on the dividend date.

While this strategy can be profitable, it is important to remember that it is also risky. If the price of CSWC shares falls below the ex-dividend price, you will lose money.

Dr. Lincoln C. Wood teaches at the University of Otago in New Zealand. He is an avid investor and educator. He loves cash flow, income, and dividends when investing. He likes to buy undervalued companies with strong advantages and earnings growth.